$20 Down Payment Car Insurance

Find the best low-deposit plans starting at just $20 down. Compare the cheapest $20 deposit car insurance quotes!

FREE Auto Insurance Comparison

Compare Quotes and Save!

Secured with SHA-256 Encryption

- The down payment is a requirement for most auto insurance providers.

- Paying part of your premium to make your insurance policy effective could be challenging for some cash-strapped drivers, even paying a $40 down payment.

- Some insurers offer $20 down payment auto insurance plans, which is an amount that fits almost anyone's budget.

- Not every carrier will sell a $20 dollars down car insurance policy, and it’s not allowed in most states.

- Using comparison websites specializing in low-cost direct insurance rates may be the right choice for anyone needing to get their vehicle covered with the least out-of-pocket expense.

Do you need to buy a cheap car insurance policy with a $20 down payment but don’t know exactly how or where to find these deals? Several insurers offer very low deposits that help cash-strapped drivers get legal coverage. Not every driver will qualify for $20 down coverage, and not every carrier offers these types of deals. Motorists with a lower risk profile will qualify for twenty dollars down auto insurance. A larger deposit will be required for those considered higher-risk drivers.

You can find detailed info in this article on low-deposit insurance plans and compare side-by-side quotes in about five minutes. With our help, you could find the best $20 down payment car insurance plans, along with other low deposit plans from $50 down.

The insurance companies we work with and profile are very reliable and have the highest financial rating from A.M. Best. They all have had a solid reputation in the insurance market for decades and offer their clients a wide variety of coverage options.

You could benefit from our free online specialized services, including multiple quotes for low deposit policies. We can help you find the most suitable provider that meets all your coverage requirements, with low deposits from $20 down in less than five minutes. There is no obligation to buy a policy when obtaining a quote. To get started, enter your zip code.

ARTICLE GUIDE

$20 Down Payment Car Insurance Policies

Almost all companies require you to pay part of your premium before the insurance policy takes effect, called the deposit or down payment. It could be difficult for drivers short on cash to fork over even a $40 down payment. It could be because they have a limited insurance budget or because they have no savings of any kind. Typical situations are students or people who are unemployed or have recently lost their job.

Other examples include someone who has spent all their available savings on buying a new car, leaving little money for car insurance. Whatever the situation is, auto insurance is mandatory. If a person operates a motorized vehicle, it needs to be covered.

Many people experience short-term financial challenges that lead a person to search for the cheapest possible auto insurance policy with the lowest deposit required. The good news for cash-strapped drivers is that some insurers offer $20 down payment car insurance plans. This amount fits into almost anyone’s budget and is cheaper than a tank of gas.

It’s also important to know that some companies promote no-down payment auto insurance policies. The reality is that free car insurance does not exist, and you must put down a deposit before your policy becomes active. You might see offers like “first month free car insurance” and think it’s real. The truth is, no insurer offers free car insurance for a day, a week, or a month. You must make a payment before your policy becomes active. To compare quotes where you live, enter your zip code and fill out an application.

Getting a $20 Down Auto Insurance Policy Online

Low down payment auto insurance plans are becoming a popular option. The main reason for the increased popularity is it allows people with cash problems to get covered with a small $20 deposit and not tie up their cash.

Plus, even drivers with a low credit score could get car coverage with a low deposit from select providers.

You could review and compare the cheapest $20 deposit car insurance quotes in a few short minutes. We can help you obtain highly personalized quotes for a policy that offers the right coverage at an affordable price, with the lowest deposit requirements, from $20 down.

The insurance companies we work with will require some basic information about you to provide a quick and accurate insurance quote. Let’s look at the data you should have ready prior to requesting quotes:

- About the driver: Name, age, gender, marital status, address, driver’s license number

- Vehicle to be insured: Make, model, date of manufacture, license plate number

- Current Coverage: All the details about your current car insurance provider

We can help you find the right policy options for your particular financial situation by allowing you to compare the lowest free rates. Apply right now by entering your zip code to start comparing quotes online.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

Applying for a Low Down Payment Auto Insurance Policy

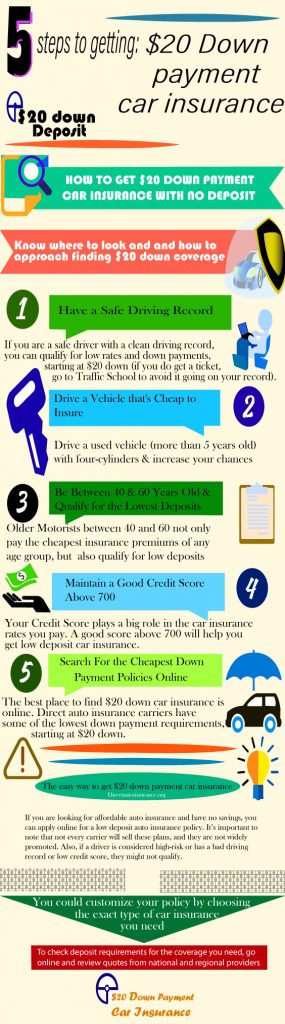

If you are looking for affordable auto insurance and have no savings, you can apply online for a low deposit auto insurance policy. It’s important to note that not every carrier will sell these plans, and they are not widely promoted. Also, if a driver is considered high-risk or has a bad driving record or low credit score, they might not qualify.

The best way to get a low down payment car insurance is to apply for quotes from major providers online. You can even use your smartphone to fill out applications and buy your policy.

Many top direct insurers like Progressive Insurance offer very low down payment plans and $20 down car insurance policies for qualified drivers.

You can easily find the right policy and a deposit that fits your budget using the specialized services of a trusted national auto insurance provider online. It could also help you save valuable time and a lot of money. You should compare at least ten quotes from both national and regional carriers.

Let the companies fight for you. Get a Quote!

Just enter your zip below

Compare Free Car Insurance Quotes and Down Payment Options

Comparing quotes online has many benefits you can take advantage of. You can customize your policy by choosing the exact type of car insurance you need. This includes your coverage limits and the best payment and deposit options, including a $20 down payment car insurance policy.

If you are experiencing a temporary bad financial situation, using websites specializing in cheap direct rates might be the right choice. You could be eligible for a no-down payment auto insurance policy, which could be helpful if you’re low on funds.

Instant $20 Down Payment Car Insurance

To check deposit requirements for the coverage you need, go online and review quotes. If you don’t qualify for a $20 down policy, you can see what insurer has the lowest deposit requirement for the coverage you are looking for. All you need to do is apply online with any device connected to the internet. A typical quote takes about five minutes, and you can then buy a policy almost instantly online.

During your hunt for the cheapest car insurance quotes with a low deposit, you could review several options that meet your particular coverage needs.

Almost all auto insurance companies offer affordable monthly payment options. Getting cheaper auto insurance can reduce your budget, which will free up more money for other things, like gas and a car wash. Finding the right payment option for your financial conditions is hassle-free when you compare quotes online. Start your free quote by entering your zip code.

Free Auto Insurance Policy Is Not Real

Unfortunately, the down payment is a requirement from all insurance providers. A free car insurance policy is a pipe dream, and it just doesn’t exist. If someone tells you so, they are lying to you. Even if you live in a state where a $0 down payment car insurance policy is legal, you still have to pay an amount before the policy takes effect.

Insurers won’t assume the risks of providing car coverage before receiving any type of payment. With a zero deposit auto insurance policy, your first-month premium payment will act as the down payment.

Consumers love the idea of free auto insurance policies, which is not a real option. Carriers want long-lasting customers who can pay for ongoing car insurance coverage.

When looking for free auto insurance coverage, potential clients are likely to stick around for a short time with a specific company and are thus not ideal customers. They are often more inclined to cancel the policy, miss a payment, or file a false claim in the worst case.

Your best bet is to search for low-down payment options from reputable companies. Start by doing some extensive research to find the most affordable coverage in your area. You might get offered an excellent deal with $20 down payment options and low monthly payments.

Don’t Stop Looking for a Cheap Car Insurance Policy

All this shouldn’t be a reason to stop looking for the cheapest down payment auto insurance possible. Many top-notch providers offer no-deposit auto insurance. This option is not available to everyone. Let’s look at some things that insurers require to be eligible for such a deal:

- Have a clean driving record

- Be 25 or older

- Search for basic car coverage

- Have a good credit score

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

Deposit Amounts Depend on Various Factors

There could be a solution so that drivers who cannot pay a big deposit upfront could still have car insurance coverage. First, they should try to find providers that specialize in low down payment insurance, such as $20 deposits.

The less likely a driver is to have an accident, the more likely the provider will offer a low deposit requirement that is under $50. The greater the risk a driver represents for an insurance company, the higher the deposit amount.

Keep a High Credit Score above 650

For many, a credit score is a factor that significantly influences your ability to obtain auto insurance with low monthly premiums. Almost all providers consider a responsible person to have good credit ratings. People who manage their money responsibly tend to behave responsibly in other aspects of their lives, such as driving.

To be eligible for a $20 down payment car insurance policy, you probably need a 650 or higher credit score.

If that’s not the case, you should immediately fix this issue as soon as possible. A good credit rating helps you get $20 deposit coverage and other helpful things like an automobile loan with a low-interest rate.

The Type of Vehicle Insured plays a Big Role in Rates

The make, model, year, and type of vehicle to be insured are other factors that influence the down payment amount. If you get insurance for an expensive car, the deposit to pay in advance will be high.

Let’s say you want to insure a Corvette sports car with a no deposit policy. Insurance companies know that the incredible speed and force of high-performance vehicles make them prone to accidents with grave injuries. Nevertheless, you might be able to secure low deposit coverage if you drive a used Toyota Corolla and drive 800 miles or less per month.

Also, there is little chance that $20 dollar down car insurance policies will cover new expensive vehicles. In short, if you are looking for $20 down car insurance, buy a used vehicle that is at least five years old.

Car Insurance No Money Down Is not only for Rich People

When insurers sell a policy, they are betting on whether the policyholder will have an accident. Providers calculate all the potential risks involved, such as the costs of repairing or replacing a vehicle. Owners of a new $60,000 BMV would not look for a $20 down payment car insurance policy, and this is smart because they are unlikely to find cheap coverage for that type of vehicle.

Providers Don’t Offer Cheap Down Payments to Risky Drivers

Insurance companies will require a higher amount of the premium in advance for drivers who need to file an SR-22, have reckless driving tickets on their record, or have any past DUI convictions.

You might qualify for car insurance with a cheap down payment if you have had coverage without any gaps for a few years in a row.

$20 Down Payment Auto Insurance: Get the Best and Cheapest Rates

If you need to spend the minimum amount on coverage, you could start looking for cheap insurance policies online, regardless of what state you live in. The internet allows you to quickly and easily compare prices from regional and national providers.

Online comparison shopping helps you determine who offers the lowest rate for the coverage you need, in addition to helping you find low deposit plans from $20 down. Still, there are things you could personally do to obtain lower rates.

- Increase the amount of your deductible ($1000.00 or higher)

- Discard overlapping coverage (Ex: rental car insurance)

- Check your coverage limits

- Park your vehicle in a garage at night

- Maintain a credit score of 650 or higher

- Make the most of available discounts (Ex: Good student, Military, Senior, Safe driver, and others)

There are areas in the U.S. where cheap low deposit car insurance is easier to get. In Florida, for example, you could be eligible for low down payment auto insurance if you:

- Drive a used vehicle that is at least eight years old

- Have maintained uninterrupted coverage during the past three years or more

- Keep a good credit score

- Have an excellent driving record

- Buy state minimum liability coverage

Convenient Automatic Payment Schedules

If you are looking for the lowest deposit policy available, you will likely end up paying monthly installments.

Almost all auto insurance carriers offer policies with the option of paying once a month. These policies often come with automatic payment programs.

Your premium amount could be automatically deducted from your bank account or charged to your credit or debit card on a specific day each month. You can choose the type of coverage you need and customize your payment options to ultimately purchase the most suitable auto insurance policy that meets your needs.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

Available Car Insurance Payment Options

Drivers who cannot pay the total premium in a lump sum in advance might benefit from installment plans. You should make these payments once a month and on time to maintain good credit.

You will have to pay these monthly installments plus your initial deposit, either nothing down or a very low down payment. Companies make available several payment terms for your plan:

- Pay the full premium in a single installment.

- Make payments twice a year or every six months.

- Payments should be made quarterly (available for both 6 and 12-month policies).

- Make the payments once a month (preferred for most policyholders).

Customers should generally pay a down payment for the policy to take effect if they have chosen an installment plan. Most insurance providers require the first-month payment to start your car coverage.

Online payments are one of the advantages of purchasing a direct car insurance policy. You could select from several forms of payment. Let’s see some of the payment methods most commonly used:

- Checks

- Money orders

- Wire transfers

- Cards (debit or credit)

- PayPal

States Where No Deposit Car Insurance Is Legal

Auto insurance with no down payment required is available only in select states across the country. You could buy a zero-down car insurance policy if you live in one of these states:

- California

- Washington

- Arizona

- Oklahoma

- Georgia

- New York

- Florida

Let the companies fight for you. Get a Quote!

Just enter your zip below

Low Down Payment Car Insurance Companies

There are not a lot of insurance companies that offer low down payments for car insurance plans. These types of deals are provided because of a variety of reasons. A few auto insurance companies that offer cheap down payment auto insurance plans from $20 are:

- Progressive

- Allstate

- Safe Auto

- Kemper

- State Farm

- Esurance

- 21st Century

$20 Down Payment Car Insurance: Advantages and Disadvantages

You should be aware that this low deposit coverage could end up being more expensive in the long run. Purchasing a “bare bones” policy with a low down payment might seem like the best deal. Let’s see in the following example if this really works better:

You buy a no-deposit policy, and you’ll pay eleven monthly premiums of $150.00, which works out to $1,650 per year. You might find a policy with another carrier that requires a deposit of $200.00 for the first month. However, it only charges $110.00 for the rest of the eleven months, for a total of $1410.00. As you can see, the no-deposit policy is $240.00 more expensive than the other one.

Those drivers in a bad financial situation might need a $20 down payment auto insurance policy when they get covered. So, they could agree to spend a higher amount of money to get low-deposit car insurance.

It is a wise decision to pay the full premium in advance, if possible. This could save you some money and eliminate the anxiety associated with making a payment every month.

Let the companies fight for you. Get a Quote!

Just enter your zip below

Options to Get the Best Minimum Coverage with a Low Down Payment

You could find cheap $20 car insurance quotes by contacting agents over the phone or in person, but it’s much easier to do so online. Shopping online leads to faster quotes from more insurers and helps you spend less time, energy, and even money. You should visit several websites and get important information about the $20 deposit auto insurance coverage options offered by different providers in just a few minutes.

State Minimum Coverage and Low Deposit Plans

The deposit amount will also depend on the type of coverage the client wants. If you’re going to buy a policy that only has liability coverage, for instance, you have a better chance of getting a $20 down payment car insurance policy.

Depending on your state and insurance provider, you could buy the state minimum coverage for just $29 per month and qualify for a low $20 down payment.

To legally drive on public roads, it is mandatory to have liability insurance at the minimum, and Liability-only is limited in its coverage scope. However, for those cashed-strapped drivers, it legally gets them on the road.

Let the companies fight for you. Get a Quote!

Just enter your zip below

Coverage Basics

Knowing the bare minimum coverage established by your state’s laws is essential before choosing your auto insurance policy.

Familiarize yourself with the types of coverage you could get

- Liability Coverage: If you are at fault in an accident, this type of insurance covers the costs of repairing the vehicle or any other damaged property for the other drivers involved.

- Personal Injury Protection (PIP): Also known as Medical Payment coverage, this type of insurance covers the medical expenses of the driver, passengers, and any other people involved in the accident.

- Collision coverage: This type of insurance covers damage to your vehicle due to a collision.

- Comprehensive coverage: This type of insurance protects you from damage that occurs to your vehicle for a reason other than a collision, for example, theft and vandalism, riot, fire, lightning, falling objects, natural disasters, and more.

- Uninsured motorist coverage: This type of insurance covers injuries and other damages you and your passengers suffered in an accident caused by a motorist driving without car insurance.

- Underinsured motorist coverage: This type of insurance pays for medical and other expenses you and your passengers incurred during an accident with a driver with insufficient car insurance to cover the damages.

You could visit Wikipedia for more information on low-deposit auto insurance. Get a free quote and compare direct rates with just a few clicks. Enter your ZIP code and start saving now.

Low Deposit Auto Insurance for Young Drivers

Drivers under 25 frequently have to deal with a particular problem. They are charged higher amounts for loans and car insurance coverage, although they generally don’t have that much money.

It happens because, according to statistics, younger drivers are the age group that is more often involved in traffic accidents.

Younger motorists typically have bad behaviors, such as texting while driving. They also take more risks behind the wheel. Could young drivers still be able to get low-deposit coverage? The odds are not in their favor, but it doesn’t hurt to try.

The first step is to compare various plans from direct providers like Progressive and Esurance. These large carriers frequently offer less stringent programs with lower deposits than most competitors.

The down payment is usually $100 or more for young drivers under 25 years of age. After comparison shopping a few plans, drivers might consider buying a basic insurance policy. It could be the minimum liability coverage allowed in the state, which could help them save money on the premium.

In general, the lower the premium, the cheaper the down payment. For example, a 6-month liability auto insurance policy that costs $370.00 could be sold with a $45.00 deposit, and you could get low deposit coverage using this.

Another way is to drive a vehicle that’s cheaper to insure. You would have to pay a larger deposit to buy coverage for a new Corvette than for a Ford Focus that is ten years old. The lowest deposits are offered to owners of older used vehicles.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

No Down Payment Car Insurance Coverage for Seniors

Drivers 55 and older are considered the safest age group of any motorists; thus, they are generally rewarded with lower rates. According to statistics, people aged 55 to 65 are the most responsible drivers and are less involved in traffic accidents than younger drivers. They rarely use mobile phones to send text messages while driving or getting into road races with other motorists.

Older drivers also don’t drive too much, and they generally travel less than 800 miles per month. Insurers are also inclined to sell coverage to seniors because they tend to stay loyal to the same company for years and pay their bills on time. All of these reasons help them get cheap $20 deposit auto insurance.

Senior drivers are often eligible for $20 down payment car insurance in particular areas and get the lowest down payments among drivers of all ages. For example, cheap auto insurance in PA policy with a low down payment can help seniors save hundreds. Compare senior auto insurance with low-down payment quotes online. Enter your zip code to get started.

Cheap Full Coverage Car Insurance with No Down Payment

Getting collision or comprehensive auto insurance coverage with no down payment can be a difficult challenge. You might wonder why. These policies are more expensive and cover more things like total loss or vehicle theft.

In essence, insurers are taking a more implicit risk with full coverage policies, which is why they cost so much more than basic liability coverage. If you are a safe driver, you might find full coverage insurance with a $20 down payment if you search multiple carriers.

Finding the Lowest Down Payment Car Insurance Policies Online

The best and most effective method of obtaining low down payment auto insurance policies is going online and comparing plans from ten or more providers. First-time buyers could find carriers on the internet that offer coverage for very low deposits, from $20 to $50.

If you are a higher-risk driver, you might be required to make a down payment of $100 or more. This includes any driver with multiple tickets or a DUI (driving under the influence) on their record. For drivers under twenty-five, it isn’t easy to get a policy with a $20 deposit. The good news is direct providers like Progressive Insurance have low deposit plans for young drivers, as low as $100 down.

You could also customize your policy to suit your particular requirements. You could add coverage, change its limits, select your payment schedule according to your budget, and choose different payment options.

Using our assistance, you could get thorough information about affordable $20 down payment car insurance plans. We could also help you arrange free first-time consultation with a qualified local agent or service.

It’s pretty quick and easy to know which companies sell the best auto insurance policies with low down payments. You should first complete an online application with your ZIP code and personal requirements, then submit it. Just some clicks and a few minutes, and the response could lead you to the right coverage for your vehicle.

Internet methods for comparing auto insurance are very convenient. You could benefit from this and save time and money in the process.

Study cheap low deposit auto insurance options available from the comfort of your home. You just need a connection and a computer or even a phone. Use our assistance to arrange a free online consultation with an experienced agent.

Compare Quotes Online and Save Time and Money

Visiting agent offices or communicating with them by phone could cost you precious time. You could get quotes online sitting comfortably at home in just a few minutes. You could also compare quotes using your smartphone at the beach or almost anywhere these days.

Quotes are non-binding and help you decide on what provider has the best coverage at the best rates. Get the lowest quotes from top providers across the country and compare them side by side. Save time and money by comparing direct rates online.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

Conclusion About $20 Down Car Insurance

Locating a cheap down payment on car insurance could be a daunting task. You might be eligible for a $20 down payment car insurance policy if you are considered a safe driver, own a used vehicle, and have a good credit score.

If you don’t qualify for a $20 down payment policy, you might get covered with a low deposit starting at just $40. Nevertheless, you might need expert assistance to get a policy that provides quality coverage at a price that meets your budget requirements.

Applying for quotes online allows you to get legally covered at the cheapest available rates combined with the lowest down payment possible. Also, you could highly customize your policy to meet your exact needs and save time too.

Don’t wait any longer. Start saving more money with a $20 down payment auto insurance policy while still getting the excellent coverage you need. Go online and enter your zip code to start comparing the cheapest rates from reputable providers in about five minutes.

Frequently Asked Questions (FAQ)

Here are some frequently asked questions related to $20 down payment car insurance:

Can I get full coverage with $20 down payment car insurance?

Full coverage typically includes liability, collision, and comprehensive coverage. While $20 down payment car insurance may provide liability coverage, additional coverage options may require higher premiums or a different payment structure. It’s important to discuss your coverage needs with the insurance provider to determine the available options within your budget.

What happens if I miss a payment with $20 down payment car insurance?

Missing a payment can have consequences, such as a lapse in coverage or policy cancellation. It’s crucial to understand the payment terms and consequences outlined by the insurance provider. Some companies may offer a grace period or payment extension options, while others may immediately cancel the policy for non-payment. Contact your insurance provider to discuss their specific policies regarding missed payments.

Are there any hidden fees associated with $20 down car insurance?

While $20 down payment car insurance may seem affordable, it’s essential to review the policy documents and ask the insurance provider about any additional fees. Some companies may charge administrative fees, processing fees, or installment fees that can increase the overall cost. Transparency is crucial, so ensure you have a clear understanding of all associated costs before finalizing your decision.

Remember, these FAQs provide general information, and it’s important to consult your insurance provider for specific details regarding their policies, terms, and conditions related to $20 down payment car insurance.

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption