Talro Insurance Agency Review

Talro is an insurance broker providing auto insurance in Illinois and surrounding areas. Compare prices and get the best deal available in Illinois with Talro Auto Insurance.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

Talro Insurance Agency Details

Talro Insurance has been one of Chicago’s leading auto insurance agencies for over 50 years. Their offices provide customer service every day of the week, primarily for Illinois drivers. The company’s website has English and Spanish versions, as the Hispanic community is statistically the largest minority group in Chicago, Illinois.

ARTICLE GUIDE

Talro Insurance Main Locations

For some, direct contact with Talro car insurance representatives is easier and more personal. You can get a free quote, make your premium payments, buy a new policy or renew your existing one through the friendly staff.

Talro Insurance Agency has four main locations in the state of Illinois:

Chicago, Illinois

4900 WEST BELMONT

CHICAGO, IL, 60641

773-205-8255

Chicago, Illinois

6245 S. PULASKI

CHICAGO, IL, 60629

773-582-6000

Joliet, Illinois

819 W JEFFERSON ST

JOLIET, IL, 60435

815-722-6600

Waukegan, Illinois

1055 N. GREEN BAY RD

WAUKEGAN, IL, 60085

847-244-5656

Talro Auto Insurance

Talro Insurance Agency has been a leading auto insurance agency in Chicago since 1960. Its professional agents strive to ensure that each client obtains the most suitable auto insurance policy at the best possible price. Talro’s premise is to work so that the client recovers from a disaster without stress and returns to lead a normal life in a short time.

Talro is a broker associated with the appropriate insurance companies, which allows you to compare prices and obtain the best available offer for the client. Although the best offer is not the same as getting very cheap auto insurance with no down payment, it is undeniable that the cost of your insurance is an essential factor when considering options that are right for you. That is why Talro strives to get you the best auto insurance price.

It doesn't matter if your driving record isn't perfect. Talro Insurance stands out for providing coverage to all types of drivers, including high-risk drivers who need to file an SR-22 form.

In addition to insuring drivers with good driving records, Talro insures drivers with:

- SR-22 Requirements

- Expired License

- Suspended License

- Revoked License

- Unlicensed

- Out-of-State License

- International License

- Temporary Visitor Driver’s License (TVDL)

Talro Auto Insurance Coverage

Talro offers, through its associated insurers, a range of auto insurance that meets the requirements to operate a vehicle in Chicago, IL, and its surroundings. The coverage limits that meet the minimum amount of liability insurance required in the states of Illinois and Indiana are as follows:

Insurance Requirements in Illinois

- Bodily Injury: $25,000 per person / $50,000 per accident

- Property Damage: $20,000

- Uninsured motorist: $25,000 per person/$50,000 per accident

Insurance Requirements in Indiana

- Bodily Injury: $25,000 per person / $50,000 per accident

- Property Damage: $10,000

- Uninsured motorist: $25,000 per person/$50,000 per accident

Get auto coverage with Talro with limits based on your specific needs. Just enter your ZIP code below and start comparing quotes.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Talro Insurance Agency: SR-22 Insurance

Due to driving violations, you might be required to present an SR-22 certificate of insurance coverage to legally drive in Illinois. In that case, with Talro, you can easily obtain your high-risk driver insurance.

Talro Insurance Agency will arrange to electronically file your SR-22 certificate immediately with the Office of the Secretary of State. The policyholder will also quickly and accurately obtain documentation as proof of properly filing their SR-22.

Who needs to file an SR-22 in Illinois?

Some drivers need to file an SR-22 after committing certain traffic violations. The most common reasons for needing SR22 insurance are:

- Driving without car insurance

- Having an accident while driving without insurance

- Suspended or revoked driver’s license

- Three traffic violations in a 12-month period

- Reckless driving of a motor vehicle

- Driving a car under the influence (DUI)

Talro Insurance Payments

Policyholders have several options for making their Talro auto insurance premium payments.

- Fast and easy Online Payments

- Payment centers

- Pay by Phone

Fast and Easy Online Payments

Talro’s website allows customers to make online payments the easiest way possible from the comfort of their homes. The online payment feature is only available for QPS (Quick Payment Service) monthly payments. Other types of endorsement or renewal payments are not available online.

Talro Payment Centers

Talro strives so that the car insurance premium payment does not represent another problem in the hectic life that average citizens usually lead. The company has hundreds of payment centers within its coverage area to make life easier for its customers. It is very easy to find the payment center closest to you through the Google Maps locator available on the Talro website.

Pay by Phone

Through 773-205-8255, you can easily make monthly payments, as well as any renewal or endorsement payment you cannot make through the website.

There is no need to be late on your Talro insurance payments. Remember that if you have SR22 insurance, it is essential that payments are made on time. If your policy is canceled or expires, your license may be suspended.

Reporting a Claim

Once you are involved in an accident covered by your Talro policy, you must file a claim. However, a detail that could be inconvenient for some is that to report the claim, you must call directly the company that appears on your identification card and do it or through Talro. However, if you need help filing your claim, Talro’s Customer Service Department and representatives will be there to help.

The insurers that Talro partners with and has been doing business with for years are as follows:

- American Alliance Insurance

- American Freedom Insurance

- American Heartland Insurance

- Apollo Casualty Insurance

- Dairyland Insurance

- Delphi Insurance

- Direct Auto Insurance

- Falcon Insurance Insurance

- Founders Insurance

- Foremost Insurance

- Kingsway Insurance

- Lighthouse Casualty Insurance

- Safeway Insurance

- Travelers Insurance

- United Equitable Insurance

- Unique Insurance

Talro Auto Insurance Reviews

As Talro is a regional company that offers insurance in Illinois and surrounding areas, it is not accredited by the Better Business Bureau (BBB). Also, because Talro is an insurance broker and not a carrier, there are no AM Best ratings on the company either.

However, we found that Talro has good Google reviews and a total of 4.5 stars out of 5. Like any other insurer, there are positive and negative reviews.

Additionally, on other sites like Birdeye.com and Yelp.com, you can see divided opinions about the company’s performance. Some policyholders rated their Talro agents’ customer service with 5 stars, while others were very bad, especially after having had an accident.

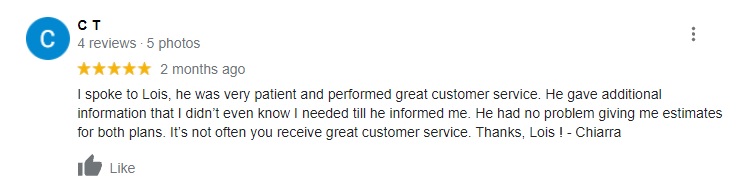

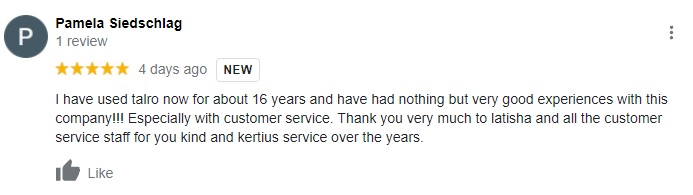

Positive Google Reviews

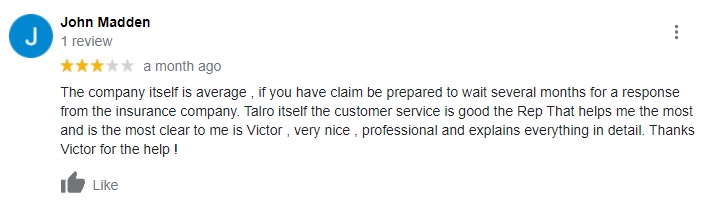

Negative Google Reviews

Talro Auto Insurance FAQs

Some of the most common questions about Talro Car Insurance that customers often ask are answered below:

Is it necessary to make my Talro insurance payment at a local office?

Although there are payment centers throughout the Chicagoland area, you can make quick and easy payments online through the website, or you can pay by phone at 773-205-8255. You can easily get the locations of the nearest payment centers by entering your ZIP code or address on the Talro website.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

How can I get an insurance policy from Talro?

You can easily obtain a Talro auto insurance policy through the website. You can apply for a car insurance quote and easily start your process of getting an insurance policy. Additionally, if you call the Talro insurance phone number (773-205-8255), you can purchase an insurance policy. Through specialized agents who will guide you properly, you will be able to obtain the policy that best suits your individual needs as a client.

Is Talro a good insurance company?

For over 50 years, Talro Insurance Agency has stood out for offering its quality services to drivers in Illinois and Indiana. Talro belongs to the small group of companies that provide SR22 coverage for high-risk drivers. They insure drivers with less than good driving records, or those who are unlicensed, out of state, international, revoked, expired, or suspended driver’s licenses. Additionally, Talro offices provide service 7 days a week, which is an advantage for both the company and the clients.