Bear River Mutual Insurance Review – 2024

For Utah residents who prefer a local insurer, it may be worth getting a quote from Bear River Mutual.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

Bear River Mutual Insurance Company Details

- Bear River Mutual offers its home and auto insurance lines to Utah residents.

- Only those drivers with excellent driving records benefit from the fairly cheap rates the company provides.

- Bear River Mutual reviews tend to be divided between customers with terrible opinions and those who intend to stick with the company for life.

Bear River Mutual is an insurance company serving Utahns for over 110 years. That’s why this company is one of the most well-known providers in the state. It sells its insurance products only in the state of Utah at its more than 125 agency offices throughout the state.

Bear River Insurance may not offer some of the advantages of the larger insurers, but it may be a good provider for specific types of Utah drivers and homeowners. Utah residents may find greater savings opportunities and better coverage options from a different carrier, but Bear River is a local carrier with state-compliant policies.

Not sure if you should buy now auto insurance with Bear River Mutual? Find out everything you need about this insurance company in our review. Explore your options, find the best rates and save money. Get started by entering your zip code below and comparing insurance quotes for yourself.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

ARTICLE GUIDE

Bear River Mutual Overview

Bear River Mutual Insurance has been providing insurance services to Utahns since 1909. Headquartered in Murray, the company is today one of the oldest local property and casualty insurers in the state.

The company only insures Utah residents but provides the advantage that insured drivers are automatically covered if they drive outside the state or even in Canada.

Bear River Mutual is owned by the policyholders, just like other mutual insurance companies. To cover claims, the company draws money from a common fund that all policyholders contribute to. Policyholders can then expect lower rates compared to other insurers. Today many insurers have moved away from that model, but Bear River Mutual continues to operate as a mutual insurance company.

Another feature of the company is that you can only get a quote through an agent, as it does not offer the option of getting direct online quotes. Additionally, because the company only accepts customers with exceptional driving records, it may be difficult for some drivers to obtain Bear River auto insurance. Unfortunately, this excludes many potential customers, but it also keeps the average insurance price low. Affordable and accessible insurance is the main objective of the company.

Bear River has historically been able to meet its financial obligations to its policyholders, which is why it has an AM Best A- (Excellent) rating for financial strength. However, Bear River is not rated by Standard & Poor’s (S&P) or J.D. Power, and this may be due to the fact that it operates in only one state.

| Perks | Drawbacks |

|---|---|

| Over 100 years of local experience in the insurance business and customer service | Only available to Utah policyholders |

| Excellent rating for its financial strength | Online quotes are not available |

| Policyholders own the company | Limited range of insurance products |

Bear River Mutual Insurance Products

Bear River Mutual primarily sells car insurance policies but also a line of home insurance and other insurance products. Among the insurances it sells are:

- Car Insurance: With Bear River Mutual, you can get everything from minimal liability insurance to comprehensive coverage, depending on your individual needs. Among the different auto coverages that a Bear River policy can include exclusively for customers in Utah are liability, uninsured motorist coverage, comprehensive and collision coverage, and roadside assistance.

- Home & Condo Insurance: Bear River Mutual does not offer special coverage for extreme weather conditions, such as tornadoes, hurricanes, and other natural disasters that do not typically occur in the state of Utah. That’s why the cost of homeowners and condo insurance is kept low. These policies can cover primary or secondary residences, equipment breakdown, earthquakes, as well as personal and condominium liabilities.

- Renters Insurance: If you rent a home in Utah, you can protect the contents of your rental property with Bear River Mutual. Renters insurance is sometimes required and covers personal property, loss of use, and certain renters perils, in the event the home you rent is damaged.

- Umbrella Insurance: This covers those assets that you consider worth protecting. Umbrella insurance can cover not only damages but helps cover the legal costs of lawsuits and other items for which you are responsible. Bear River Mutual Umbrella Insurance sells general insurance with liability limits of $1 million to $2 million.

- Dwelling Insurance: Although similar to homeowners insurance, homeowners often use Dwelling insurance to cover their rental properties. Bear River Mutual sells dwelling insurance on personally owned buildings, homes, duplexes, and fourplexes.

Bear River Mutual also offers RVs, mobile homes, and trailers special coverages.

Bear River Car Insurance Coverages

Bear River Mutual offers a variety of auto insurance coverages that you can customize your policy with. Bear River Mutual offers relatively standard coverages, including:

- Liability Coverage: Utah, like the vast majority of states, requires a minimum amount of liability insurance to protect you financially after an at-fault accident. With Bear River Mutual, you can get the amount of coverage you need, whether it meets or exceeds the state minimum limits. Liability coverage helps pay for expenses arising from an accident that resulted in bodily or third-party property damage.

- Comprehensive Coverage: The comprehensive coverage offered by Bear River covers the cost of damage to your vehicle from an incident not related to a collision. This includes damage from fires, storms, hail, etc. In addition, it covers damage due to vandalism and theft of the vehicle.

- Collision Coverage: Bear River Mutual’s collision coverage will cover the cost of repairs to your own vehicle after a collision with another car or object.

- Uninsured/Underinsured Motorist Coverage: In Utah, drivers are required to have between $20,000 to $65,000 of uninsured or underinsured motorist coverage. Bear River Mutual insurance allows drivers to meet or even exceed the minimum limits set by the state.

- Personal Injury Protection: Utah also requires drivers to have personal injury protection coverage. If the driver is injured in an accident, this coverage helps pay for medical bills and lost wages. The minimum coverage for this state is $3,000 PIP. With Bear River Mutual, drivers can match and even exceed the amount of insurance required by the state.

- Roadside Assistance: Like many other insurance companies, Bear River Mutual offers 24/7 roadside assistance. With this service that can be included in Bear River policies at an additional cost, towing services, gasoline delivery, and lockouts, among others, are covered in the event of a vehicle breakdown on the road.

- Rental Car Reimbursement: When your car needs repairs after a covered accident, your Bear River Mutual auto insurance policy covers the cost of a rental car until your vehicle leaves the repair shop.

Bear River Mutual Car Insurance Rates

Bear River has maintained its traditional business approach, where policyholders pay into a pool from which claims are paid. The company’s principle is to keep rates low for its policyholders, and it sticks to this by only accepting clients with excellent driving records.

Estimating Bear River Mutual quotes before starting the online process is difficult. However, their clients claim that with this company, they get 15% cheaper rates than with the larger companies that insure the state.

Below are the average annual rates for Utah from some of the largest companies in the insurance market, highlighting Bear River Mutual’s average rates.

The company maintains more than 125 offices throughout Utah and has a network of agents to sell its insurance products. To find an agent near you or request a quote, you can visit BearRiverMutual.com. Simply enter the basic information requested, and we’ll contact you for an estimate of the cost of your Bear River Mutual insurance policy.

Bear River Mutual Auto Insurance Discounts

Not a few insurance companies post their full list of discounts on their website. However, in the case of Bear River Mutual, you will need to speak with a company agent to find out what discounts are available to you based on your individual characteristics.

The company offers a standard range of discounts to help further reduce the cost of your policy:

- Multi-Policy Discount: If you bundle multiple insurance products Bear River Mutual offers, you’ll get a discount on your annual premium. You can bundle your auto insurance with a variety of insurance types like dwelling insurance, renters or homeowners insurance, condo insurance, or RV insurance.

- Multi-Vehicle Discount: If you insure multiple vehicles owned by you or someone in your household through Bear River Mutual, then you may qualify for discounted rates.

- Higher Deductible Discount: Fortunately, Bear River allows customers to choose the size of their deductible. One of the ways to get cheaper premiums and low down payments with this company is to raise your deductible above $1,000 and qualify for a discount.

- Bear Care Direct Repair Program (DRP): Bear River Mutual’s Bear Care Direct Repair Program (DRP) covers the repair of your vehicle if it is done at a body shop that is part of Bear Care DRP. This eliminates the uncertainty and stress associated with auto repair costs sin the company guarantees the work performed.

- Safe Driving Discounts: With a clean driving record for the past 3-7 years you may qualify for a discount from Bear River Mutual. However, keep in mind that if you have a DUI on your record, it will remain on the record for 10 years per Utah state regulations.

Bear River Mutual Ratings and Reviews

Bear River Mutual has received great reviews from clients throughout Utah. In fact, the company has one of the best online presences according to its average ratings among the insurance companies we have reviewed. The average Google review rating is one of the highest we’ve seen among insurers, and its rating of 4.7 stars out of 5 is comparable to that of major insurance companies.

The Better Business Bureau gives Bear River Mutual an A-, but like most insurance companies, it has only 1.1 stars out of 5 with only 10 customer reviews. It is often the case that policyholders review the company only if they are dissatisfied with a recent claim. So it’s not surprising that even good insurance companies have low average ratings.

Bear River Mutual’s financial rating from A.M. Best is also excellent, although the A- rating isn’t as strong as some of its larger competitors. Other review websites like Clearsurance, Finder, WalletHub, and Yelp have very high ratings for Bear River.

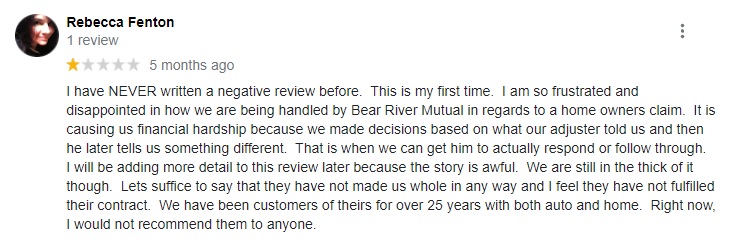

As is common for any insurer, the source of most complaints is often based on the claims process. This is due to things like rude interactions with the insurance agent, mix-ups in the claim process, and policies being canceled without warning, especially after a customer’s first claim.

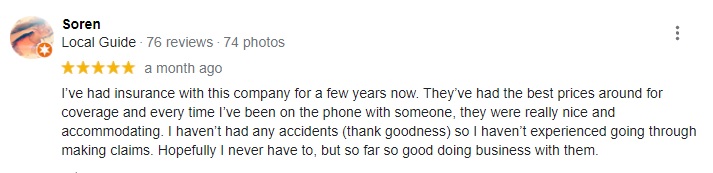

Just as some customers are less satisfied with Bear River Mutual’s customer service, others stay with the company for life. Here are two examples of Google reviews with completely opposite opinions regarding the company’s performance:

However, the largest companies usually have the best overall ratings. So if you are looking for a great national company with the most excellent ratings and reviews, Bear River may not be the option for you. Compare auto insurance quotes and make an informed decision about the company that will best meet your insurance needs.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

Our Take On Bear River Mutual

Bear River Mutual is today the oldest and largest insurance company in the state of Utah. It already has more than 110 years of experience in the insurance market, and as with wine, age gives value to the product. As such, it remains one of the most popular options in the state, but sadly it doesn’t insure residents outside of Utah.

Bear River is an insurance company highly rated by financial strength and customer service rating organizations. If you live in Utah, this could be your best auto insurance option. Unfortunately, it is highly likely that you will not qualify for a Bear River Insurance policy if you do not have a clean driving record.

Bear River prices may be a little higher than some of the larger national and regional insurers, but reputation precedes this company. With its commitment to keeping insurance rates low and meeting the unique needs of Utahns, Bear River Mutual has many customers who stay for life.

If you’re considering Bear River Mutual’s affordability and coverage options, don’t forget to compare them with other regional or national companies. Do not wait more; enter your zip code into our free tool below and see what the quotes would look like for you right now.