Pronto Insurance Review – 2024

Get a quote from Pronto Insurance and start saving today! If you need high-value insurance at favorable prices, Pronto may be the right option.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

Pronto Insurance Company Details

Based in Brownsville, Texas, Pronto Insurance is a company that focuses on offering high-value insurance at favorable prices with excellent claims management. Pronto’s auto and home insurance are by far the most popular, but the company provides many other advantageous insurance products. A notable insurance product is its Mexico Insurance, which makes the company popular with US residents who frequently travel south of the border.

However, what really makes Pronto relevant is its focus on Spanish-speaking communities. Latino customers can access the website in Spanish or call a separate number with service in Spanish.

The company is not rated by organizations such as AM Best, J.D. Power, or Standard and Poor’s (S&P). This is why it isn’t easy to have an accurate idea about the company’s financial stability and customer service.

Find out everything you need to know about Pronto Insurance in our review. If you’re looking for the best auto insurance rates in your state, get auto insurance quotes from multiple insurance companies in less than 10 minutes below!

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

- The support provided by bilingual agents makes Pronto Insurance a good option for the Latino community.

- Pronto insurance agents are available at drive-thru windows at 300 locations, by phone, and online.

- Several lines of insurance products are available.

- Convenient Pronto auto insurance packages for high-risk drivers.

- Not rated by J.D. Power or AM Best for customer service or financial strength.

- Standard auto insurance premiums are more expensive than competitors

- Customer service during limited hours.

- Limited coverage area.

ARTICLE GUIDE

Pronto Insurance Overview

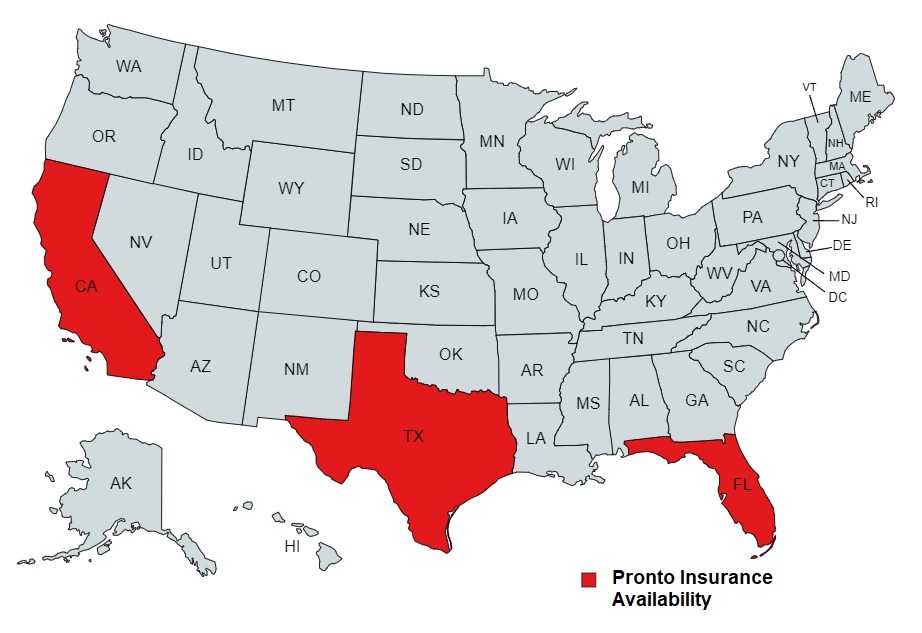

Pronto Insurance is a company based in Brownsville, Texas, founded in 1997. Its high-value insurance products and financial services are offered at competitive prices, in addition to its superior claims handling. The company serves customers in only three states: Texas, California, and Florida. However, not all lines of insurance are available in all three states; rather, policy availability varies from state to state.

Pronto’s car insurance packages are largely geared towards high-risk drivers, although they also offer standard insurance plans. Pronto coverages include auto insurance, home insurance, renters insurance, health, commercial, etc.

Among Pronto's featured products is Mexico Car Insurance, which is an advantage for those who frequently travel from the United States.

Their service is also focused on Latino communities. Many Pronto Insurance agents speak English and Spanish and provide assistance in both languages, either in person or over the phone. Pronto’s website also has a Spanish version that favors Spanish speakers. Even though Pronto is not the only insurer to offer bilingual insurance services in California, this feature undoubtedly makes it popular with Spanish-speaking customers.

Pronto Insurance Availability

Pronto strives to provide affordable plans to its consumers, but unfortunately, so far, it only operates in Texas, Florida, and California.

Pronto Insurance Products

Below we list the lines of insurance that Pronto clients can benefit from:

Vehicle Insurance

- Auto: Pronto Insurance knows that, for most drivers, insuring their vehicle is more than a state requirement. This is why it offers personalized insurance policies and packages from which you can choose, with variable terms from 1 to 12 months. The coverages they offer include SR22, Roadside Assistance, and basic coverages such as Civil Liability and Physical Damage.

- Motorcycle: If you ride a motorcycle in Texas or California and are involved in a collision with another vehicle, Pronto’s motorcycle collision insurance covers any damage that may occur. These policies generally cover the cost of injuries to others and property damage if you are at fault for the accident.

- RVs: Pronto’s RV Insurance is solid yet flexible. As an RV owner in Texas or California, you can enjoy your vacation knowing you won’t have to pay excessive out-of-pocket costs in the event of a loss or an at-fault accident causing bodily injury or property damage to others.

- Boat: If you cause injury or property damage while boating, Pronto’s boat insurance protects you financially, but you can only get this coverage if you live in California or Texas.

- Watercraft: Costs associated with a collision, theft, storm damage, or towing damage to your watercraft are covered by Pronto’s 12-month Watercraft Insurance policies. This coverage is only available in Texas and California.

Mexico Insurance

- Mexico Insurance: Pronto helps you get the best price, coverage, and services for your trip to Mexico if you are a driver from Texas and California. If you frequently travel to Mexico, remember that drivers are required to have at least a minimum level of coverage in the event of an accident.

Property Insurance

- Homeowners: As misfortunes and accidents are going to happen regardless of our will, it is best to prepare for when they happen. Through Pronto Home Insurance (only available in Texas and California), you can rest easy knowing that you will be protected in case of accidents that damage your home.

- Renters: Homeowners insurance does not cover renters’ personal property or furniture. That’s why you need Renters Insurance if you can’t afford to replace all of your home’s assets due to total or partial loss from an accident or casualty. Pronto Renters Insurance is available to customers in California and Texas.

- Condominium: For protection against loss and repair costs due to theft, fire damage, vandalism, and water damage to a condominium unit, Pronto Insurance provides condominium insurance.

- Mobile Home: If you own a manufactured home in Texas, you can take advantage of Pronto Mobile Home Insurance. This type of coverage protects you against physical damage from perils such as fire, hail, water, and losses from theft or vandalism to your mobile home.

Business

- Commercial: To financially protect your business, commercial insurance or business insurance is the coverage you need. With Pronto’s commercial insurance, you’ll be protected against theft and property damage, customer lawsuits, employee or customer injuries, and several types of unexpected events.

Customer Service

The fact that Pronto Insurance offers customer service over the phone in Spanish and English is noteworthy. Additionally, customers can choose whether to visit the website in English or Spanish, which is an advantage for Spanish-speaking customers.

Furthermore, the company offers convenient hours at its 300 drive-thru windows for Pronto Insurance payment delivery and quick responses. Customer service by phone has convenient but different hours in each state, although this service is not available 24 hours a day. You can contact customer service through the following Pronto Insurance phone numbers:

- Florida: 1-844-776-4361

- California: 1-800-949-3274

- Texas: 1-855-200-4567

To access the Roadside Assistance service, you can call 1-888-649-8029.

In the event of an accident, you can access the website and submit and track your claim online. You can also choose to chat with a claims agent or call an adjuster through the following numbers based on your state:

- Florida: 1-844-776-4361

- California: 1-800-272-3922

- Texas: 1-888-224-7740

You can find information about office hours in each state where Pronto operates on the website. Just visit www.prontoinsurance.com for more details.

Pronto Car Insurance

Pronto’s auto coverage is primarily focused on high-risk drivers, including cheap non-owners insurance and SR-22 coverage. However, the company also offers standard coverage packages and other additional coverages.

Among the additional coverage plans, Mexico Insurance stands out, as advantageous for drivers who usually travel to or from Mexico. Another complementary coverage is Roadside Assistance, with considerable advantages that include 24/7 service, personalized trip routing, and valuable discounts on car rentals and hotels throughout the country.

Without question, Pronto could be a good auto insurance option if you're a high-risk driver. However, you must live in Texas, California, or Florida to get a policy.

Pronto Auto Insurance Coverages

The company offers three auto insurance coverage packages: Essential, Comprehensive, and Alternative. Each of these packages offers different levels of coverage. Drivers can choose from these Pronto Auto Insurance plans the coverage that best suits their needs. Below we list the characteristics of these plans.

- Essential package: With this basic package of Pronto, customers get limited coverage. State minimum liability coverage levels are insured and combined with Uninsured/Underinsured Motorist Coverage (UM/UIM), Personal Injury Protection (PIP), and Roadside Assistance for 6-month policies.

- Comprehensive Package: In addition to collision and comprehensive coverage that cover damage to your own vehicle, this package includes Towing Coverage, Rental Coverage, and Custom Equipment. You can purchase the Comprehensive Package along with the Essential Package to get Full Coverage.

- Alternative Package: This insurance package is designed and targeted to cover high-risk drivers who need specialized coverage. This option offers non-standard coverage for non-owners driving a vehicle owned by someone else and SR-22 insurance for high-risk drivers on six-month policies only.

Pronto strives to ensure that its policyholders can find policies tailored to their individual characteristics. The company has a variety of coverage options and promotes flexible and affordable Pronto Insurance payment plans. Not all insurance companies offer short-term payment plans; however, you can choose Pronto policies for 1, 2, 3, 6, and 12 months.

If you are in need of short-term temporary insurance with flexible and specialized coverage, Pronto Insurance may be the option you are looking for.

Pronto Auto Insurance Discounts

Pronto’s overall rates may be cheaper than many of the largest and most well-known insurance companies in the US. However, it doesn’t offer as many and varied discounts as larger insurance providers. This is one of the drawbacks of Pronto auto insurance for those looking to save money on their insurance premium. Below we list discounts that the company offers:

- Multiple Car Discount: If you insure multiple vehicles with Pronto Car Insurance, you may qualify for a discount on your insurance premium.

- Renewal Discount: Drivers who renew their Pronto policies can receive a discount each year they stay with the company.

Insurance Ratings, Customer Satisfaction, and Complaints

It is not very easy to find reviews of Pronto Insurance online. None of the major customer service rating agencies offer ratings for Pronto Insurance. The company is not rated by J.D. Power, for example. This is because Pronto is not big enough to be rated on a national level or a specific region. Nor has Consumer Reports rated Pronto.

Regarding the Better Business Bureau (BBB), although Pronto is not technically rated, some customer reviews offer an average rating of 1.2/5 stars. However, keep in mind that people rate their insurers mostly when they are dissatisfied with their service. For this reason, many of the leading and most recognized insurance agencies have low online ratings on many occasions.

Pronto Insurance is more popular on other websites, including Trustpilot. On this website, the average rating of Pronto is Excellent with 4/5 stars, based on more than 800 customer reviews.

When it comes to financial strength, ability to cover pending claims, and other metrics, there aren’t many ratings for Pronto Insurance either. A.M. Best, Moody’s, or Standard & Poor’s, which are the most important rating agencies for financial strength, do not offer ratings on Pronto Insurance.

Pronto Insurance Website and App

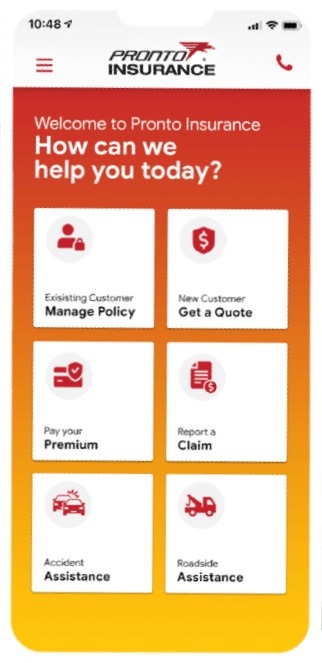

On the Pronto Insurance website, you can get the information you need about the company’s insurance products and services. You’ll be able to get Pronto Insurance quotes, make payments online, manage your policies, and more. However, you may find it very convenient to access these services using the Pronto Insurance App. To get a quote, you just need to choose the insurance product you need and enter your zip code.

Pronto Insurance App

The Pronto Insurance mobile app is only available to Texas customers. Through it, you will be able to obtain a car policy in minutes at the best possible price. You can also get Pronto Insurance quotes, and manage your policy.

App users will receive important notifications and necessary reminders about their policy and monthly payments.

Among the administration facilities is the possibility to change your policy at any time and include additional drivers or vehicles. You can also access and manage multiple policies from your account.

Premium payments through the Pronto App are simple and with different options. In addition, the app offers the possibility of storing several Pronto Insurance payment sources or cards.

You can also easily access and print or email your ID cards or get proof of insurance at any time.

Final Takeaways on Pronto Insurance

Pronto Insurance is an insurer that strives to provide high-value insurance and financial services at convenient costs. The company promotes excellent claims handling for its auto, property, and business insurance products.

Pronto coverage options may not be very varied, and for those with significant assets may be limited. However, there are many other notable benefits of Pronto Insurance, including insurance focused on high-risk drivers who need non-standard coverage.

Drivers who value flexibility can benefit from short-term insurance plans in every state where Pronto operates.

There is one feature that makes the insurer very popular with the Latino population: Pronto Insurance’s customer service representatives can serve customers in English and Spanish. Pronto provides its policyholders with customer service over the phone or in person at any of its hundreds of locations.

However, it should be noted that Pronto’s customer service and financial strength have not been rated by the major agencies that evaluate the performance and reliability of insurance companies.

Before deciding on Pronto insurance, compare quotes from various top-rated national and regional insurers. Just enter your ZIP code below, and the rest will be a breeze!

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Frequently Asked Questions

Is Pronto Car Insurance good?

Even when the most recognized rating organizations have not rated Pronto, there are still online reviews and ratings given by customers. More than half of the reviewers recommend renewing the Pronto policy. The company also boasts of its superior claims handling. So, although Pronto does not provide service throughout the country, it is considered a good company in the states where it operates.

How can I get a Pronto Car Insurance Quote?

Prospective Pronto customers can call the company’s customer service or use the online quote form through the website. With the online variant, you must select the type of product you want to insure, enter your ZIP code, and click on the START button. Then the process is simple: you just have to complete the quote form with your personal data and that of the property to be insured.

How can I file a Pronto Insurance Claim?

Pronto provides many facilities for you to make and track the status of a claim. Policyholders can report a claim online or by calling the Pronto Claim Center. You can find out more about the correct numbers to make your claim on the contact page of the Pronto website. Please note that you will need to provide as much detail as you can about the incident as well as your personal information.