AMCO Auto Insurance – 2024 Review

Let’s review the coverages and rates provided by AMCO Insurance.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

- AMCO Insurance Company primarily provides property and casualty insurance.

- Best Insurance Reports rated AMCO with an A+.

- AMCO has only authorized agents to sell its insurance products.

- AMCO's annual revenues amount to more than $ 4 billion.

- Jerry Jurgensen is the CEO of the company, and its president is Kirt Walker.

AMCO Insurance Company Details

If you want to know all about AMCO auto insurance, its product offerings, and how to contact the company, we can help. You can take a closer look at AMCO insurance and the car coverages they offer. Let’s review the history of the insurer and its current policy sales service.

ARTICLE GUIDE

AMCO Insurance Overview

AMCO is a company that primarily underwrites property and casualty insurance lines. It was founded in Iowa in 1959, and today the company is based in Des Moines city, IA. AMCO is currently a subsidiary of Allied Group Inc., a Nationwide Mutual Insurance Company division.

As part of the Allied Group, this company is one of the largest businesses in that region. There are more than 2,500 AMCO employees in Des Moines alone.

Under the guidance of Allied Insurance Group, AMCO aims to provide quality insurance coverage at affordable prices. The insurer offers dedicated customer service, honoring its slogan “On your side.”

AMCO Insurance Availability

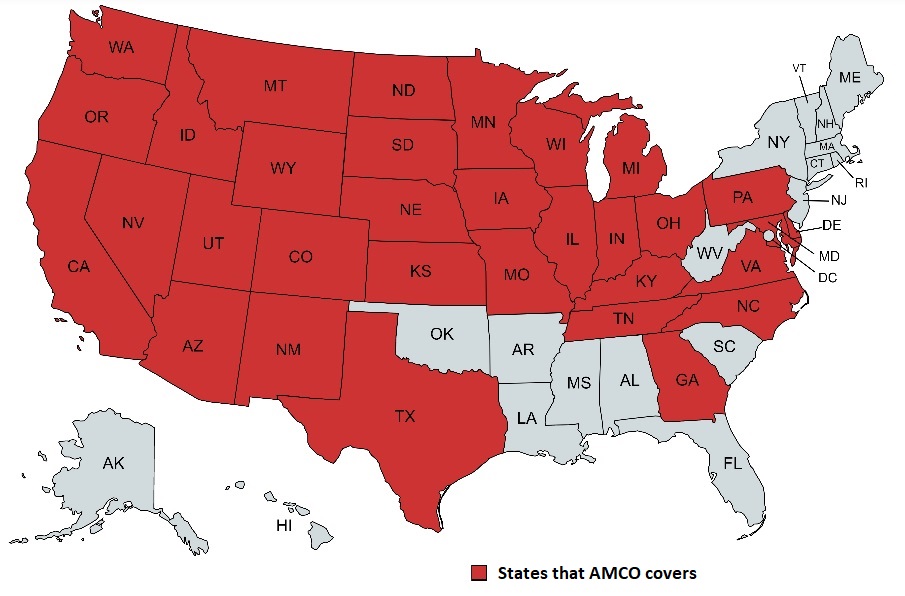

California and Texas, with their large populations, are just part of the 32 states in the United States where AMCO Insurance is licensed to sell insurance policies. The map below highlights the states where AMCO operates:

In order to find the best car insurance rates, compare auto insurance rates from multiple companies like AMCO. You can get your free online quote starting right now. Just enter your code in our instant quote tool and fill out an application.

Let the companies fight for you. Get a Quote!

Just enter your zip below

AMCO Auto Insurance Coverage

It is appropriate to remember that in the United States, auto insurance is mandatory in all 50 states. Therefore, if you drive a vehicle, you must get insurance to cover it. A key aspect of buying auto insurance is knowing your policy limits and the types of situations in which you are actually covered. Most states have minimum coverage requirements that drivers must carry. Taking Texas car insurance as an example, the following minimum liability coverage amounts are set to cover situations where you are responsible for an accident.

- $30,000 for bodily injury per person

- $60,000 total for bodily injury in the accident

- $25,000 for property damage

However, it is recommended that you have more than the minimum required, and that’s where AMCO comes into play. You can purchase AMCO coverage that is both good and affordable. You can get very low monthly rates, as much as $45 per month. If you finance a car or drive a leased vehicle, you will need to get comprehensive coverage. Fortunately, AMCO provides excellent comprehensive coverage with rates below the national average.

Regardless of the type of car insurance you need, you can get it through a licensed AMCO agent. You can also get a free online quote today and start evaluating AMCO’s costs and coverage.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

Optional AMCO Coverage

AMCO also has optional coverage in addition to offering liability, comprehensive, and collision coverage. Optional coverage includes:

- Uninsured Motorist Coverage

- Personal Injury Protection (PIP)

- Medical payment coverage

An additional and very convenient feature for AMCO customers is that the company offers many insurance plans that include roadside assistance.

Always put the protection of your assets in the foreground, and protect yourself against an accident with severe consequences. Decide carefully on the type of coverage you need and the limits on your policy.

AMCO Car Insurance Costs

When looking for insurance options, many people are only interested in those that have a low price. An advantage of AMCO coverage is that its rates are often below the national average. However, AMCO’s reputation has been based not only on affordable auto insurance but also on the solid coverage behind this price, plus excellent customer service. We researched AMCO’s rates for different types of coverage for a Toyota Camry with a four-cylinder engine, and the results were as follows:

| TYPES OF CAR INSURANCE COVERAGE | AVERAGE ANNUAL AMCO CAR INSURANCE RATES |

|---|---|

| Full Coverage | $938.27 |

| Liability Coverage | $501.41 |

| Collision Coverage | $274.58 |

| Comprehensive Coverage | $147.23 |

You should note that these are only AMCO national averages. However, your premiums will be affected by many factors, including:

- Age

- Driving Record

- Type of vehicle

- ZIP Code

- Status as Homeowner or Renter

- Type of coverage you need

Comparing side-by-side auto insurance rates has never been easier. Enter your zip code to start comparing direct auto insurance rates in about 5 minutes. Let the companies fight for you. Get a Quote! Just enter your zip below

List of Insurance Discounts

Although AMCO may not offer as many discounts as some larger competitors, there is a notably large list of them that are worth using. Among the main discounts that can be mentioned are the following:

- Good Student Discount

- Safe Driver Discount

- Senior Citizen

- Accident-Free Discount

- Military and Veteran Discount

- Low Mileage

AMCO Auto Insurance Payment Options

The options that AMCO customers can use to make their payments include:

- Debit and Credit Card

- Wire Transfers

- Electronic Check

- Checks by Mail

AMCO Insurance Website and Customer Service

On AMCO.net, the company’s main website, you can:

- Make monthly payments

- Print out ID cards

- Check your policy

- Get car insurance quotes

Additionally, the website has a blog where you can read numerous posts offering tips on how to get the best auto coverage while saving money on your auto insurance.

Fortunately, the site has a Spanish version that is very convenient for the many Spanish-speaking customers that abound in many states where the company operates.

In addition, you can reach a company agent by calling the customer service phone number from 9 am to 6 pm Central Time.

Don’t think twice, and get a direct car insurance quote now. Compare the company’s rates and select the coverage that best suits your insurance needs.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

AMCO Company Reviews

Among many online surveys, AMCO has been rated approximately 4.8 stars out of 5. The company has thousands of customers nationwide, so this is an excellent overall rating.

Among the many excellent reviews that the company has, stand out those that refer to the dedicated service of the company staff. Clients highly value the time that staff dedicates to each client to develop an appropriate and individualized insurance plan.

Also noteworthy are the excellent reviews about the company’s good claims payment history and, above all, payments made on time and in full.

Perhaps because not many policyholders have filed complaints with the BBB, we cannot find many reviews of AMCO on this agency’s website.

Our Take on AMCO Auto Insurance

AMCO is an excellent insurer. Although it is a medium-sized insurer, it has an extensive network of authorized agents who offer its low-deposit insurance products at low costs. According to our study, the cost of AMCO auto insurance in almost every state is below the national average cost of insurance.

If you think you already know enough about AMCO Insurance and live in one of the states where the company operates, it may be an excellent time to read the full review of the AMCO insurance quote online. Just enter your zip code in our FREE online quote tool and start your quote application. Compare rates from Direct Insurance and other top rated car insurance companies and choose the insurance plan that will save you the most.

Just enter your ZIP code and start saving right now!