Amigo Insurance Review 2024

Get an Amigo Auto Insurance quote if you need coverage for high-risk drivers. Find affordable and thorough insurance that’s hard to get with larger providers.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

Amigo Insurance Contact Details

Amigo Insurance is not one of the best-known insurers in the US market. There are not as many reviews for Amigo Auto Insurance as for its bigger competitors. This is primarily due to the fact that their market niche is limited to a few states and Mexico. Based on the limited information obtained about the company, it appears that it is designed to offer insurance to high-risk drivers and is notable for its Mexico travel insurance.

But can we say that Amigo is a reliable insurer that offers good car insurance? Read on and discover everything you need to know about Amigo’s insurance products and services.

ARTICLE GUIDE

Amigo Auto Insurance Overview

Amigo Insurance is an independent insurance agency based in the Prairie State. The company offers auto, home, and other insurance products in a small number of states, as well as Mexico.

Although there is not much information available about Amigo Auto Insurance, it is easy to see that it is geared towards providing insurance to Latino residents. However, they seem to be primarily targeting those customers who visit their offices in person.

Amigo Insurance is known for its Mexico travel insurance. The company can help keep drivers covered, whether they’re taking a short trip or an extended stay in Mexico. Additionally, the company offers homeowners insurance, renters insurance, commercial insurance, motorcycle insurance, SR-22 coverage, and rideshare insurance coverage, in addition to auto insurance.

According to the insurer’s official website, the company’s mission is to save its customers the hassle of searching for the right insurance company. It also seeks to provide quality, honest service while helping clients prepare for the unfortunate events that are everyday risks.

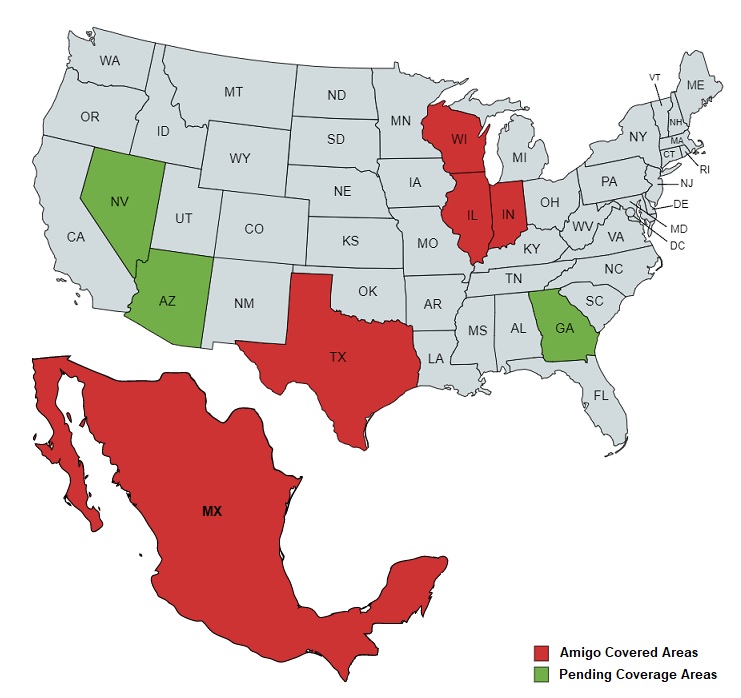

Amigo Insurance Availability

Amigo Insurance is best known in the state of Illinois, where it has its headquarters. However, the company also provides insurance in Indiana, Wisconsin, Texas, and Mexico, with plans to expand to Arizona, Nevada, and Georgia in the near future.

Amigo Insurance Products

Amigo Insurance offers a range of insurance products, including:

Auto Insurance

Amigo auto insurance policies are well known, especially in Illinois. The company offers standard coverage types, including liability, collision, and comprehensive coverage, as well as uninsured/underinsured motorist coverage. You can choose from affordable Amigo car insurance options that meet minimum state requirements to full coverage plans with higher limits. You can get and compare quotes and choose the amount of coverage that best suits your insurance needs through the company’s website.

Let the companies fight for you. Get a Quote!

Just enter your zip below

Motorcycle Insurance

Amigo’s motorcycle insurance works similarly to car insurance. Motorcycle riders can protect the value of their motorcycle with a full coverage insurance policy or just get minimal liability coverage for basic protection.

Commercial Insurance

Businesses may also need liability coverage and additional protections, just like vehicles. This is why Amigo offers workers’ compensation insurance, general liability insurance, and other insurance services and products to business owners as part of its commercial insurance.

Uber/Lyft Driver Coverage

Although Lyft and Uber provide a basic level of auto insurance, there are gaps where rideshare drivers are unprotected in the event of an accident. This includes times the driver is not yet transporting passengers, but the app is on. If the driver were to have an accident, the basic rideshare liability coverage might not be enough to cover the cost of damages and medical bills, and regular insurance coverage will not apply. To fill those gaps, Amigo Insurance provides rideshare coverage.

Uber and Lyft drivers can protect their liability with a policy that goes beyond the rideshare company's minimum requirements.

SR-22 Insurance

If you are considered a high-risk driver, have many violations on your driving record, or have had lapses in your insurance history, the DMV may require you to submit an SR-22 certificate. If you need SR-22 coverage, you can get it with Amigo Insurance.

Mexico Travel Insurance

Auto insurance policies issued in the United States typically do not cover travel to Mexico. If you are at fault for an accident while in Mexico and do not have the minimum liability coverage required, you will face a high expense to cover the damages. Thus, if you plan to travel to Mexico by driving your car or renting a vehicle during your stay there, you will need special auto insurance coverage. Fortunately, Amigo Insurance is one of the few insurance companies registered in Mexico to provide auto insurance. Its Mexico Travel Insurance provides at least the minimum liability insurance for adequately covered driving on your trip.

Homeowners Insurance

Amigo’s homeowners insurance covers damage to your property, as well as your legal liability for injuries or property damage caused to others. Protect both your home and your personal belongings. Please note that although most damage is covered, there are exceptions. This is the case for damage caused by floods, earthquakes, and poor maintenance.

Renters Insurance

Renters insurance is a cost-effective and affordable way to pay for repairing or replacing items damaged by a covered event. This includes theft, fire, smoke, and more. If you don’t own the home you live in, Amigo renters insurance can cover your personal property and additional living expenses like food and a temporary place to live if a covered incident leaves you without a place to stay. The insurance also includes liability protection for damage to third parties within your home.

How Does Amigo Auto Insurance Work?

Amigo auto insurance is primarily known in Illinois and the other states where it operates for its competitive prices. Like other major insurers, Amigo auto insurance will cover you against financial loss if you have an accident.

Amigo auto insurance policies can be made up of six different types of coverage, although not all policyholders need the same amount of coverage. Some of these coverages are required by the state and others by the lender in case the vehicle is financed or leased.

You can compare Amigo car insurance quotes online in minutes. Get started by entering your ZIP code below and get a quote.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

Amigo Auto Insurance Coverage Options

Some of the coverage options available include:

Liability coverage: In accidents where you are found to be at fault, your liability insurance covers expenses for bodily injury and property damage to third parties, meeting state minimum requirements.

Collision Coverage: In the event of a collision involving another vehicle, Amigo’s collision coverage will cover the cost of replacing or repairing your vehicle. Although not generally required, this coverage is still highly recommended for all drivers.

Comprehensive Coverage: With this add-on to your policy, you can protect your vehicle from non-collision-related damage such as fire, theft, vandalism, or some natural disasters.

Collision and comprehensive coverage are generally optional unless required by the lender if you have a financed or leased car. However, in many cases where your vehicle has a high value, it is advisable to add this coverage to your policy due to the high costs involved in the repair.

Uninsured/Underinsured Motorist Coverage: By adding this coverage to your Amigo auto insurance policy, you can protect your vehicle in the event of an accident involving a poorly insured driver.

Medical coverage: The medical coverage requirement is different in each state. Some states require drivers to have personal injury protection (PIP) coverage, medical payments coverage, or other medical coverage options. Amigo’s Medical Coverage seeks to cover the cost of rehabilitation, treating injuries, loss of wages, and even funeral expenses in the event of an accident.

Keep in mind that each state requires a specific amount of coverage. However, you can purchase additional coverage for added protection, customizing your policy to meet your particular auto insurance needs. You can get an Amigo Insurance policy for six months or one year.

Additionally, you can obtain other types of optional coverage, including:

- Gap Coverage

- Towing and Labor

- Rental Reimbursement

Amigo Auto Insurance Discounts

Like many other insurers, Amigo offers a variety of car insurance discounts, such as:

Good Driver Discounts: Safe drivers who have a history of good driving behavior, do not have citations, or meet specific standards can get a discount on their Amigos insurance premiums.

Multi-Policy Discounts: If you have several assets to protect, you can choose to insure them all with the same insurer. If you have multiple Amigo insurance policies, such as home, auto, or renters insurance, you may qualify for the company’s multi-policy discounts.

Safety & Security Feature Discounts: If you have a safer vehicle for both drivers and passengers, you will get lower auto insurance rates. You may qualify for an insurance discount if your vehicle has additional safety and security features.

Good Student Discounts: You may qualify for a discount on your Amigo auto insurance policy if you are a student with good grades.

Pros of Amigo Auto Insurance Policies

If you subscribe to an Amigo Auto Insurance policy, you can take advantage of some benefits that the company offers. Below we list some of them.

Affordable Options

Based on the information the company provides, they offer insurance packages that can match and compete with the options of the best providers. If we take into account the SR-22 insurance costs or other specialized policies they offer, it is clear that Amigo Insurance is certainly cheaper. These policies are usually more expensive in most of the competing companies.

Multiple Insurance Options

Amigo Insurance offers multiple insurance policies, including auto, business, home, motorcycle, and travel insurance. High-risk drivers with irregular driving histories can get coverage with Amigo that may be difficult to obtain with other companies, including SR-22 insurance.

You may benefit from coverage that extends to Mexico if you are a driver who frequently travels from the United States.

As an added benefit, if you take out more than one policy with the company, you’ll get additional discounts on your insurance premiums.

Bilingual Services

For Spanish-speaking residents who need insurance from a local provider, one of the best options to choose from is Amigo Insurance. The company’s name is the word “friend” in Spanish, and it is no coincidence. In the company, you will be able to create a highly personalized plan through personal insurance agents who speak both English and Spanish fluently.

Online Resources

Without a doubt, managing your insurance online is much more helpful and convenient. You can take advantage of essential online resources when purchasing insurance with Amigo Insurance. As part of these resources is their online quoting system to estimate the cost of your coverage. Once customers submit information through the Amigo’s website, an agent will contact them and build a policy that fits their particular needs. Additionally, customers will be able to make Amigo insurance payments online instead of in person or by checks to the main office.

Cons of Amigo Auto Insurance Policies

Although we have listed many advantages of Amigo Auto Insurance above, they also have some disadvantages, as we will see below:

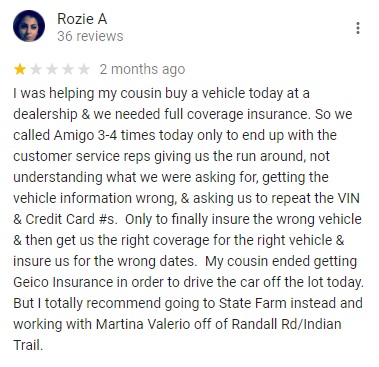

Poor Customer Service

If there’s one thing that makes an accident even more difficult to handle, it’s poor customer service when you’re trying to file a claim. The most frequent complaint from policyholders about Amigo Insurance is precisely its lousy customer service. Many claimants comment that they have found it very difficult to contact an Amigo insurance representative, only to deal with rude and impatient agents.

Available in a Small Number of States

Although Amigo car insurance is available in Mexico, in the United States it is only available in 4 states, including Illinois, where it is headquartered. However, they plan to expand their operations to Arizona, Georgia, and Nevada.

Incorrect Charges and Unlikely Refunds

Another type of complaint about Amigo Auto Insurance is related to overcharged policies. Added to this is the difficulty for clients to receive reimbursements for amounts charged in excess.

Although particular circumstances could justify this procedure, the mere fact that the complaints are recurrent gives food for thought. If this is combined with the poor customer service that many complain about, getting a refund can be definitely a long and tiring process.

Amigo Insurance Ratings & Reviews

Amigo is a small insurer popular with Hispanic drivers in Illinois. However, it is not as well known as its larger competitors. Consequently, it has very few online reviews from major online rating agencies, reviewing organizations, and significant websites. Thus, the insurer is not rated by J.D. Power, A.M. Best, nor is it listed with the Better Business Bureau (BBB).

We were able to find a few Amigo customer reviews, but most are Google reviews. As you can see from the examples below, some customers are satisfied with the service and scope of their policy. In contrast, others are genuinely disappointed with billing and customer service issues.

Additionally, on the company’s website, in the Amigo Insurance Testimonials section, many positive customer reviews are reflected.

Our Take On Amigo Auto Insurance

Amigo Insurance is a company well known for its auto insurance products and services, primarily in Illinois, where it is headquartered. However, it also operates in three other states in the US and stands out for offering car insurance in Mexico.

According to most reviews from Amigo Auto Insurance policyholders, their high-risk driver policies are substantially cheaper than what you might get from larger providers.

With Amigo, you can get affordable coverage that protects you while traveling to Mexico. However, you can likely find better personal insurance deals from larger insurance providers.

Unfortunately, poor customer service can hinder the claims process and any other operation with the company. This is why we recommend that you choose a different insurance provider unless you are a driver who needs specialized insurance.

When shopping for different auto insurance quotes, you will find several options. To start requesting a quote, you can enter your ZIP code below. If you are trying to find “Amigo Insurance near me” or need more information on Amigo Insurance, visit AmigoInsurance.com today.