Empower Insurance Review – 2024

Millions of Texans have obtained affordable auto insurance from Empower Insurance since 2003. Find the plans and coverages that best fit your specific needs, today!

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

- The Better Business Bureau rated Empower Insurance an A+.

- Customers can report claims online 24/7 or through the Empower Insurance helpline.

- Policyholders can have complete control over their policy from the Empower online portal.

- The company provides different levels of coverage to suit any client's budget and insurance needs.

- Empower is proud to be the only insurance company to win the Company of the Year Award from the Professional Insurance Agents of Texas (PIATX) four times.

Empower Insurance Company Details

Millions of Texans have chosen Empower to insure their vehicles because of its wide range of coverages, discounts, and an A+ rating with the Better Business Bureau (BBB). Sure enough, Empower Insurance will offer a car program specially designed for you regardless of your credit score, the type of driver you are, your age, and any type of risk you represent for the company.

ARTICLE GUIDE

Empower Insurance Overview

Empower Insurance Group’s beginnings date back to 1972 when it began as an independent agency. It was in 2003 when the agency expanded to create Empower. Compared to large national conglomerates, Empower Insurance is a small company based in Fort Worth, Texas. The company was founded in 2003 and has since provided insurance policies to millions of people in Texas.

More recently, the company partnered with Alinsco Insurance Company. Alinsco and Empower are basically the same.

Today it is one of the largest MGAs in the state and is represented by more than 2,000 independent agents throughout Texas who sell Empower insurance policies.

Empower Locations

Empower Insurance only writes auto insurance policies in the state of Texas. The company understands the particular insurance needs of Texans, which is why it specializes in affordable auto insurance in Texas. For this reason, more than 200,000 Texans have insured their vehicles with Empower Insurance Group through a policy with quality coverage and low cost.

Empower Car Insurance

Many of the company’s coverage plans don’t take your credit score into account when calculating the cost of your premium. This is ideal for many drivers who don’t have a good credit score but still need to drive insured.

Whether drivers looking for coverage that covers only the minimum limits required by the state or those who need cheap comprehensive coverage, they will find the right policy at Empower Insurance.

Additionally, Empower Insurance offers a variety of auto insurance programs that are beneficial for those who need to stick to a limited budget. These programs provide different levels of coverage, so you can get one that suits your particular coverage needs.

You can choose the most suitable period for your policy, which can be six or twelve months, depending on your needs.

Empower Insurance Programs

- Empower Priority provides one month of liability-only coverage. The only requirement to obtain this plan is to provide an ID, which may even be expired, as long as it has a photo. IDs include your driver’s license or a foreign ID.

- Empower Enhanced provides extended coverage for all household members on listed cars, except for borrowed or rented vehicles. The program provides semi-annual liability, collision, and comprehensive coverage policies. The only requirement to qualify is to have a photo ID, even if it is expired. This includes driver’s license and foreign IDs.

- Empower Annual Savings Program provides coverage for all household members listed in the policy. The program also includes liability coverage for permissive use for non-household members. This is the best way to get the lowest 12-month rates and excellent monthly payment auto insurance plans.

- Empower Bravo is a credit-based product. Drivers with good credit ratings get the best rates for collision, comprehensive, uninsured/underinsured motorist coverage. The program includes coverage for borrowed or rented vehicles. The only requirement to qualify is to have a valid US driver’s license.

- Empower Select is the program with the most extensive coverage among all the plans Empower Insurance Group offers. This plan provides 6-month of liability insurance to a rented or borrowed vehicle the insured might drive. The program includes collision and comprehensive coverage. The only requirement to qualify is to have a valid US driver’s license.

Auto Insurance Coverages

- Bodily Injury Liability covers the costs of medical expenses for third-party injuries due to an at-fault accident.

- Property Damage Liability covers expenses for damage caused by you to third-party properties in an at-fault accident.

- Medical Payments Coverage covers bodily injury expenses to the insured, passengers, or family members traveling in an insured vehicle at the time of the accident, regardless of who was at fault.

- Comprehensive Coverage protects the insured from damage to their vehicle caused in an accident not related to a collision. This includes damage from flooding and other natural disasters, vandalism, fire, theft, etc.

- Collision Coverage protects the insured vehicle from damage caused in an accident.

- Uninsured/Underinsured Motorist Coverage protects the policyholder in the event of an accident where the at-fault driver is a hit-and-run or has little or no insurance.

- Personal Injury Protection covers the medical expenses of the driver and his passengers in the event of an accident. It might cover funeral costs, living expenses, lost wages, depending on the state.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Empower Car Insurance Discounts

Surely you will be able to take advantage of some of the discounts that Empower Insurance offers that will help you reduce your insurance premium rates. Some of the discounts Empower offers are:

- Multi-Car Discount: Policyholders who insure more than one vehicle with an Empower policy can save by obtaining this discount.

- Safe Driver Discount: Those drivers who have no violations or accidents on their record during a certain period of time can qualify for this discount with Empower Insurance.

- EFT Discount: You may be eligible for this discount if you use an Electronic Funds Transfer (EFT) to pay your monthly premium online with your checking account or credit card.

- Proof of Prior Insurance Discount: To qualify for this discount you must have had continuous coverage with no gaps.

Filing a Claim with Empower Insurance Group

Filing a claim with Empower Insurance is easy. You can fill out a simple online form on the company website or call the Empower Insurance phone number [1-877-437-5007] 24 hours a day. You can also download the Alinsco Mobile App for faster service at the touch of a button.

Empower Insurance Ratings and Complaints

BBB rated Empower an A+, but the company only got 1.5 stars based on customer ratings. Consumer complaints are mainly related to the claims payment process, highlighting the following:

- Empower’s “Resolution Department” tendency to offer low claim payouts.

- Unnecessary process delay by company adjusters by requesting a lot of details, mainly when there is disagreement about the amount to be settled.

- Agents usually record conversations with clients when filing their claims and thoroughly search for any details that cause the denial of the claim or at least a reduction in the compensation amount.

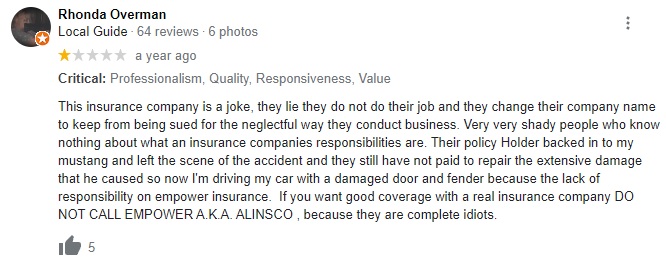

In any case, Empower claims to be highly rated by its consumers, but the truth is that many complain about the company’s performance. The following Google review reflects this kind of stance:

Empower Insurance Pros and Cons

| Pros | Cons |

|---|---|

| *More than 2,000 independent agents sell the company’s insurance products and provide tailored coverage. | *Provides its insurance products only to Texas residents |

| *Wide variety of car insurance programs. | *Lots of complaints about their claims payment process |

| *Awarded 4 times by the Professional Insurance Agents of Texas (PIATX) as Company of the Year. |

Our Take on Empower Insurance

If you live in the state of Texas, then you are eligible for Empower Insurance’s variety of insurance programs. Empower Insurance may be a great option if you need coverage that fits your particular coverage needs in Texas. By combining the company’s insurance programs with the discounts they offer, you can get rates that fit your budget. Find affordable auto insurance in Texas and quality coverage with Empower Insurance Group.

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption