Very Cheap Car Insurance No Deposit

Find out how to Get Very Cheap Car Insurance No Deposit today and what tips to follow.

FREE Auto Insurance Comparison

Compare Quotes and Save!

Secured with SHA-256 Encryption

- The vast majority of drivers see coverage as a way to be protected. Some of them, though, just want to abide by the law. These drivers shop for the lowest rates.

- The premium is nothing more than the total amount that the insured driver must pay for the policy. However, there is an amount that the insured driver must pay in the event of an accident: the deductible.

- Many insurers allow you to make premium payments in installments, generally monthly.

- Most insurance companies will request a deposit from the insured driver. The reason is that they don't want insured drivers to be covered in case of an accident without paying.

If you’re shopping for new auto insurance and are low on cash, a very cheap car insurance no deposit policy can help you get covered without a significant down payment. While a bit more expensive than other coverage types, this type of plan is ideal for those that need to get legally insured with the lowest out-of-pocket cost possible.

ARTICLE GUIDE

What is No Deposit Auto Insurance?

Many drivers think that no deposit auto insurance means getting the first month of coverage for free. This is not the case. There are no carriers in the U.S. that offer auto insurance coverage without receiving a payment upfront.

In some states and with select insurers, a dirt cheap auto insurance plan with no down payment waives the deposit. However, you still need to make the first installment payment. To illustrate this, let’s say you had a policy that cost $1,200 per year. You qualified for a zero-down plan. So, for your policy to become active, you just need to make the first of 12 installment payments, which in this example is $100.

For those very low on funds that need to get covered with the minimum amount paid to the insurer, this $0 deposit plan can help a lot.

Get a quote today and compare multiple plans and rates in about five minutes. Get started by entering your zip code.

How to Qualify for No Deposit or Low Down Payment Auto Insurance

In short, the safer a motorist you are and the less of a risk you pose to a provider, the more likely you will qualify for one of these low deposits or even zero down payment deals. To qualify, you should:

- Drive safe: A clean driving record is essential and demonstrates you are a responsible motorist

- Drive less: It’s not always possible to lower the miles you drive, but fewer miles mean a cheaper premium. Try carpooling or use public transportation when possible

- Drive an Automobile that is cheap to insure

- Maintain a credit score of 700 at least

- Michigan

- Massachusetts

- North Carolina

- Montana

- Hawaii

- Pennsylvania

- Liability

- Comprehensive and collision

- Underinsured or uninsured driver

- Protection for personal injury or medical payment

- Some factors, like your age and years of driving experience, are out of your control.

- Keeping a clean driving record and having a good credit score mostly depend on you.

- Buy a car that is cheap to insure.

- Choose the right coverage for your needs.

- Each insurance company calculates premiums differently.

- Your rating factors won’t always be perfect, but that doesn’t mean you can’t get better rates.

- You are not compelled to stay with the same insurance company forever, so make sure you shop around at least twice a year.

- Find the insurer whose price is the most competitive for the coverage you are looking for.

- The less risk you pose to a car insurance company, the better chance you have of qualifying for no down payment auto insurance and low monthly payments.

- Progressive

- USAA Insurance

- Farmers

- State Farm

- Allstate

- Nationwide

- Travelers

- Farm Bureau

- Kemper

- Auto-Owners

- Your monthly payments will be lower, as the deposit will cover part of the premium.

- The insurance company will see you as a trusted customer, as you will have shown responsibility.

- Cost of your down payment

- Cost of your monthly payments

- Total price if you pay in full

- Raise your deductible: The deductible is the money you will be required to pay if you get into an accident. By raising it to $1,000 or higher, you can save 15% or more. This can result in a strain, assuming that your finances aren’t substantial. However, if you want to be covered just to obey the law, increasing your deductible can significantly reduce your premium. On the downside, if you are involved in an accident, you will be forced to pay for most of your repairs.

- Possible discounts: Extra discounts can be available like multi-car insurance, firefighters, military, students, nurses. Get all the discounts you can to save the most on your policy. Ask your insurance carrier what discounts do you qualify for.

- Talk to your employer: Some companies offer group auto insurance deals. Find out with your employer if there are deals available to you. This type of discount can save you 10% or more.

- Agree to automated payments: Paying your premium in installments will probably cost you more than if you paid in full upfront. In this case, asking your insurer to arrange for automatic payments every month can help bring your premium cost down.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Factors that Influence Very Cheap Car Insurance No Deposit Rates

Insurance premiums calculate the risk you pose as a driver. The less risky you are, the lower rates you will pay. Conversely, the riskier you are, the higher you will pay for coverage.

Driving Record, Driving Experience, and Claims History

These three factors account for 35% of your Insurance Premium.

Driving Record

Among the most critical risk factors to an insurer is how safe you drive. Your behavior behind the wheel affects your risk of getting into an accident. That’s why auto insurance companies, first of all, take a look at your driving record. Drivers with a good record commonly qualify for very cheap car insurance with no deposit and are also eligible for other discounts.

Driving records reflect if a driver has been involved in accidents or has tickets on their record. Collisions and moving violations such as a DUI, speeding tickets, and others on the driver’s record mean more risk in the eyes of auto insurers. This results in higher premiums.

Even a minor moving violation, resulting in a ticket, can sometimes increase your insurance rates up to 40 percent. A first ticket will not increase your rates with some insurers, but any ticket on your driving record will imply losing your discount for being a good driver, which is estimated to be as high as 30 percent.

Major moving violations like a DUI can double your rate or more due to a mix of lost discounts and higher rates.

Some car insurance companies refuse to insure drivers with multiple accidents or moving violations. If this is the case, you will still be able to find insurance, though most likely with a nonstandard insurance company, and at a very high cost until your record is clean.

Typically, a moving violation will impact your car insurance rate. Parking tickets, however, are not considered moving violations because you were not operating your car.

Driving Experience

Insurance companies know it: inexperienced drivers are a more significant risk. Experience is a notable factor insurance companies use to calculate rates, whether you are 16 or 50 years old. Drivers with little or no driving experience at all are at a higher risk of getting into a collision and filing claims.

Teenagers are the largest class of drivers with low experience, and they also pay more for their auto insurance than any other group of drivers. They won't qualify for very cheap car insurance no deposit because of their age and inexperience.

A middle-aged person who is a new driver will usually get a lower rate because he tends to be a more responsible and safer driver. The more years of experience, the better.

Combining having a license for a long time and having a good driving record is even better and will help you drive down your pay rates.

Claims History

Insurance companies not only examine your driving record and experience, but they also review information about your claims history. Your claims record includes previous claims you’ve made, not only to them but also to other auto insurance companies.

Not-at-fault accidents and comprehensive claims won’t cause your rates to go up. However, at-fault collisions will lead to rate increases. They will also analyze how much you’ve received for your demands, as claims under $1,500 may not result in higher rates.

Another important consideration when analyzing your claims history is the number of filed claims. Three or more claims in a three-year term will make car insurance companies see you as a risky person to insure. Consequently, they will either raise your rates or choose not to extend your policy.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Age, Marital Status, and Gender

These are also crucial factors. A quarter or 25% of your insurance premium is based on these three components.

Age

The slogan of car insurance companies could be: “The less experienced the driver, the higher the auto insurance cost.” Statistics show that young drivers are the riskiest category of drivers to insure. They are more reckless behind the wheel and are involved in more accidents than older ones. They are also more distracted drivers. In such a way, you will hardly get cheap car insurance for young drivers low deposit.

Rates decrease as you age with several insurers. After you turn 25, you’ll start paying much less for coverage. A study carried out by the IIHS states that drivers between 30 to 69 years of age are a lot less likely to have an automobile accident.

If their driving record is clean, car insurance rates generally don't vary for drivers from their thirties until they become seniors.

Marital Status

Studies show that married drivers are a lower risk to insurance companies than single ones; this includes divorced and widowed drivers. Married drivers are less active and drive safer. The result is fewer accidents and fewer claims. The NIH conducted a study that found the number of collisions with single drivers involved was twice as much as those with married drivers.

Overall coverage prices can be up to 15 percent cheaper for married people. Married couples can also have additional deductions or multi-car discounts by combining their auto insurance policies. They can save even more with a multi-policy that bundles home and car insurance coverage with the same insurer.

Of all fifty states, Massachusetts is the only one that doesn’t allow car insurance companies to consider marital status as a factor for rating.

Gender

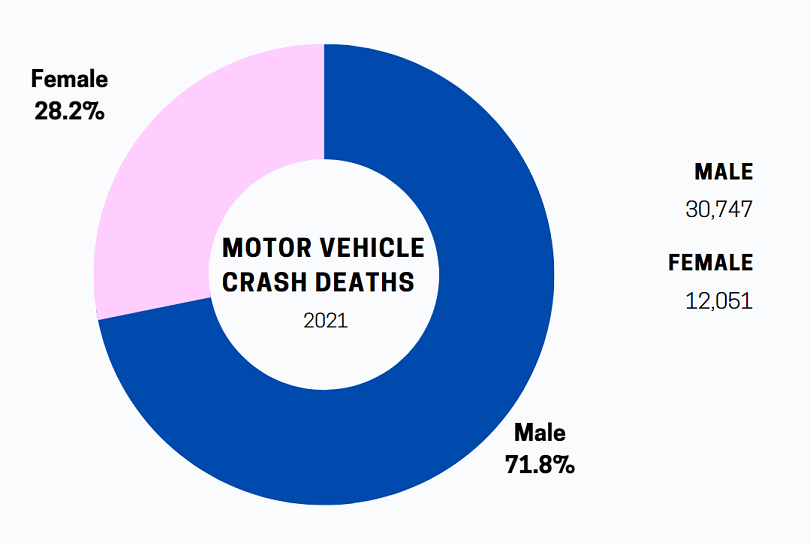

Accident statistics are not the same for men and women. This is why most states allow insurers to look at the driver’s gender when calculating the premium.

Stats prove men are more likely to get involved in an accident, especially young drivers, who are often more aggressive. Fatal accidents involving males are more than double those compared to females.

The IIHS indicates that males drive more often than female motorists. Their driving performance is also more dangerous. This includes driving under the influence, speeding, and not wearing a seat belt. The IIHS asserts that men mainly cause severe crashes.

The following chart, based on IIHS data on Fatality Facts 2022, clearly shows that difference:

Insurers apply this data to rates they charge to male drivers. So, it can be easier for a female to qualify for cheap auto insurance with nothing down.

Six states do not allow insurance rates to be affected by gender. These states are:

Let the companies fight for you. Get a Quote!

Just enter your zip below

Car Type, Make, Model and Use

Around 20% of your insurance premium is based on these factors.

Vehicle Type

Your rates also depend on the type of car you’re insuring. Studies and insurer’s data show which are the vehicles that get into the most accidents. This is why some cars cost so much more to insure than others.

The car’s price, theft rate, the cost of the parts and repairs, accident rate, and the safety tests are all critical factors taken into consideration by the insurance companies before they are ready to send you a quote. Based on these elements, different models from the same make have different insurance rates.

Use of the Car

Insurance companies also want to find out what’s the personal use of your automobile. A vehicle you drive to go to work is more at risk than a car you use only on weekends. Personal use of a vehicle is less expensive since the risk of having an accident is lower.

If the use of your vehicle is for business, you’ll likely pay much higher premiums. If you use your car for ridesharing, buy a policy specifically for this type of insurance.

Mileage

The more you drive, the higher the risk of having a collision. The insurance company will always try to know how much you drive. Your insurer can also try to find out where you go.

Check the miles you drive. If you see you’re driving fewer miles, tell your insurer and ask to adjust your premium.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Policy Type and Options

These are other factors that account for around 9% of the amount you’ll have to pay for your car insurance.

Past Insurance Coverage

Studies have found that drivers with continuous car insurance history are more responsible. Insurance companies know this. If this is your case, you’ll be able to get a better rate.

The insurance company would look at your previous car insurance regardless of whether it was with your current insurer or another provider. However, keeping your insurance policy with the same insurer for a few years may help you get a loyalty discount.

Insurance Deductible

The deductible is the amount you pay before the insurance kicks in. The higher you set the deductible, the lower your rates will be. Conversely, the lower your deductible is, the more you will pay.

Types of Auto Insurance Coverage

Choosing the lowest price is not always the best route to take. It’s not just the price but also what insurer you chose that’s important.

Not all insurance companies are competent. You should avoid insurance companies with terrible customer service or an inadequate response after a claim is filed.

Where you Live

Eight percent of your premium depends on where you live. Do you know why insurance companies ask for your ZIP code before they give you an estimate? That’s because your address is an important factor used to calculate the premium amount. If you live in a low-crime area (like out in the country), you can get cheaper auto insurance rates.

Let the companies fight for you. Get a Quote!

Just enter your zip below

Credit History

Around 3% of your rate is based on your credit history. Studies show that drivers with lower credit scores (600 or less) are more prone to file claims, including inflated or fake ones. If your credit score is low, you could expect a rise in your premium from your insurance company. Some states, though, don’t admit credit history to be used as a factor. States like California and Massachusetts prohibit insurance companies from using credit history as a factor used to calculate rates charged to customers.

Summary of Factors Influencing Very Cheap No Deposit Auto Insurance

You need to know the risk factors you can control that lead to obtaining very cheap car insurance with no deposit and those you cannot control.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Companies that Sell Instant Auto Insurance with No Deposit

Instant Car Insurance With No Deposit is not a particular product suggested by most insurers. When you buy car insurance, you can divide the premium in your policy evenly in monthly payments.

For most people, the initial deposit will be higher than the following ones. As stated earlier, the first payment represents the down payment.

People with good driving records and excellent credit scores qualify more easily for no deposit or low down payment auto insurance.

There are only a small number of major carriers that sell zero deposit auto insurance. These include:

Very Cheap Car Insurance No Deposit Doesn’t Mean It’s Free Coverage

Since auto insurance with no deposit is not a commonly used term by most insurers, the name is more frequently used by smaller companies in often inaccurate ways. One possible wrong conclusion is that you can get covered before paying your insurance company at least some money. Many drivers think this is what cheap no deposit car insurance is about. However, this is not true. As stated repeatedly, you can’t get covered until you make a payment.

To put it another way, auto insurers won’t cover you or your car if you don’t pay something upfront. This is because, once your policy is effective, you can submit a claim at any time.

If auto insurance was free for a month and the driver made a claim, your insurer may be forced to pay out before receiving any money from you. This is the main reason why carriers require initial payment upfront.

The good news is that very cheap auto insurance with nothing down lets you get insured with the smallest out-of-pocket cost. It also allows you to pay your premium in affordable monthly payments. Start a quote today by entering your zip code.

You Don’t Need to Make a Deposit to Get a Quote

You can always get cheap car insurance quotes no deposit from many insurers. No reputable auto insurance company will ask you for an upfront payment or charge you to send you a quote.

If a company tells you it’s a common practice to charge for a quote, this should be a warning signal about that insurer’s reputation.

A Down Payment Could Be Your First Month’s Installment

The payment for the first month of coverage can be considered as the down payment. It gives the appearance that there is no money down. An insurer that waives the deposit reduces the initial expenses you must pay to activate the policy.

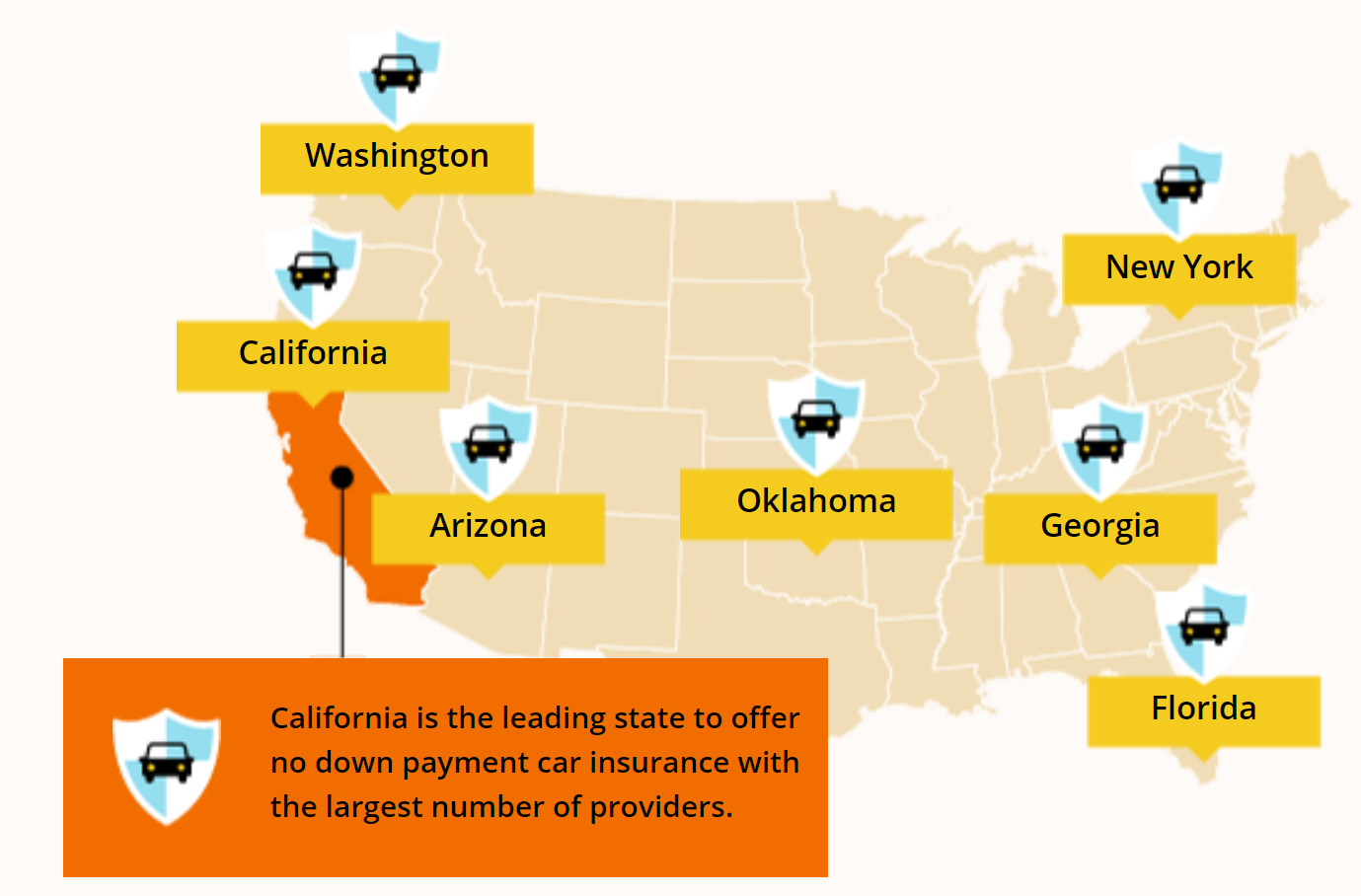

A car insurance company may offer no deposit insurance by only requiring the driver to make the first installment payment. Not all insurers provide this type of coverage, and it’s not allowed in all states.

Let’s look at an example. Your insurance company may charge you $900 for your premium if you pay it in full upfront. If you get a zero-down policy, you might pay $966 for the policy in 12 equal payments of $80.50.

For the policy to become effective, the first installment payment of $80.50 would need to be paid. Again, this helps those drivers low on cash who need auto insurance as soon as possible.

Let the companies fight for you. Get a Quote!

Just enter your zip below

Is it Smart Getting a Very Cheap Car Insurance No Deposit Policy?

The main advantages of making a down payment are:

There’s not an established sum or percentage of the premium for your down payment. Usually, the rates for the deposit and the premium are lower for safe drivers. The factors considered by the insurance company to set your deposit are similar to those studied to determine your rates.

Getting very cheap car insurance with no deposit depends on several factors. Your address, age, and type of car, as well as your credit and driving records, are essential aspects. The last two factors are especially relevant as they are less difficult to control.

Very cheap car insurance no deposit is not possible for every driver. Insurance companies will always request a higher deposit from a driver who has been involved in collisions, has a bad driving record, a bad credit rating, or is a new motorist.

Your deposit may be a small amount or an essential portion of the total you will have to pay. It depends on your insurance company’s policies. A usual deposit could correspond to two months of a monthly premium.

These deposits often range from 20 to 33% of the premium for a six-month coverage. The percentage depends on the insurer’s policy and the state. If your driving record is good, you could pay a lower deposit for your first month than on the following months of coverage.

Auto Insurance Payments

If you cannot pay your premium all at once upfront, you can choose to pay for your auto insurance in monthly installments. Doing so can create a situation where you are stuck between a rock and a hard place if your insurance company asks you to come up with a 30 % deposit.

No Deposit Plan – Monthly Payments vs. 12 Month Policy Paid Upfront

| DIFFERENCE IN COST | NO DOWN PAYMENT | FULL PAYMENT |

|---|---|---|

| First Payment | $140 | $1,596 |

| Remaining Monthly Payments | $1,540 | $0 |

| Cost Savings | $0 | $84 |

In some states and with some providers, you’ll be able to cut out an upfront payment by purchasing a no down payment auto insurance plan.

Once your driving history and your car information are submitted, you’ll get a quote. You will then receive the following information:

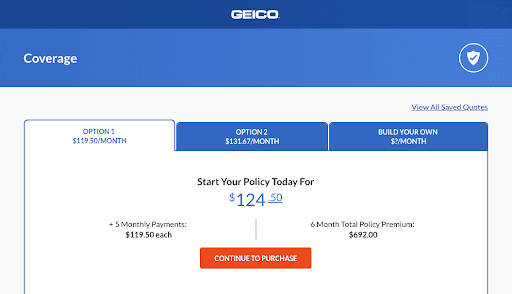

Here you can see the Geico Insurance Company quote page displaying the payment options for an auto insurance policy:

In the example, after an initial deposit of $124.50, the monthly payment is set to $119.50, meaning that the deposit is very low, only $5.00. If you pay your premium in full, Geico offers a discount. Your premium is $722.00 in monthly installments, but you’ll get a $30.00 discount if you pay upfront and in full.

Typically, you can buy your auto insurance right away after receiving the quote, despite the amount of the down payment. Compare plans and rates today. Enter your zip code to get started.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Affordable Auto Insurance Without a Deposit

You can indeed almost always find a way to get cheap auto insurance without making a significant deposit. Counting on your driving record and address, separate auto insurers may ask for different down payment amounts.

Here you’ll see some sample quotes from State Farm, Progressive, and Geico, which are among the best insurers. The common factor for a person with an exceptional driving record is a very low required deposit. Even more, Progressive asked for a lower payment for the initial month than the ensuing months:

| Company | Deposit | Monthly Premium | 6-Month Premium | First-month cost compared to a typical month (%) |

|---|---|---|---|---|

| GEICO | $62.30 | $61.30 | $368.80 | 102% |

| Progressive | $29.28 | $74.15 | $400.03 | 39% |

| State Farm | $99.32 | $99.32 | $595.92 | 100% |

Two of these insurance companies, Geico and Progressive, gave our sample driver a small discount for paying the entire premium upfront. Still, State Farm kept the same amount for the premium regardless of an advanced payment in full or in installments.

Shopping for cheap auto insurance without a deposit requires getting quotes from many insurance companies and comparing the best plans. Some insurance companies will require deposits either smaller or larger. Your job is to find which company has the best deal for the coverage you need.

How to Find Very Cheap Car Insurance No Deposit?

It’s true, No Deposit Auto Insurance is not the most common type of insurance, but that doesn’t mean that there aren’t many companies that offer this type of coverage. You can also buy this type of insurance online, either directly with the insurer or through a third party’s website.

There’s no difference in how to get a good deal on auto insurance coverage with no upfront cost to you or any other policy. Your very cheap car insurance no deposit quote will be impacted by the same price components and type of policy you choose. This includes liability, collision, comprehensive, and uninsured motorists’ insurance. In all 50 states, the mandatory coverage is liability insurance. Your base premium will be further increased if you include other coverage benefits and add-ons like increased limits.

Tips for Getting Cheaper Auto Insurance Rates

Shop Online for No Very Cheap No Deposit Auto Insurance

The best way to find insurers that offer very cheap car insurance with nothing down is online. You can compare the lowest rates from multiple regional and national insurers at sites like this in just a few minutes.

Start a free online quote application and instantly compare up to ten quotes. Enter your zip to get started. Get the cheapest auto insurance with nothing down online.

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption