Cheap Car Insurance in Georgia with Low Down Payment

Cheap Car Insurance in Georgia with Low Down Payment. Lowest Rates From Just $18 a Month.

FREE Auto Insurance Comparison

Compare Quotes and Save!

Secured with SHA-256 Encryption

If you’re a resident of Georgia in need of car insurance coverage but have limited financial resources, you’ve come to the right place. In this comprehensive guide on finding cheap car insurance in Georgia with low down payment, you can get valuable insights and tips to help you navigate the process of obtaining dirt cheap car insurance in Georgia.

Georgia is known for its bustling cities, picturesque landscapes, and diverse communities. Regardless of your location, having car insurance is a legal requirement to protect yourself, your vehicle, and others on the road. However, we understand that finding affordable coverage can be challenging, especially if you have budget constraints. So, let’s dive in and discover how you can obtain cheap car insurance in Georgia without compromising on quality or protection.

ARTICLE GUIDE

What Exactly is Cheap Car Insurance with Low or No Down Payment?

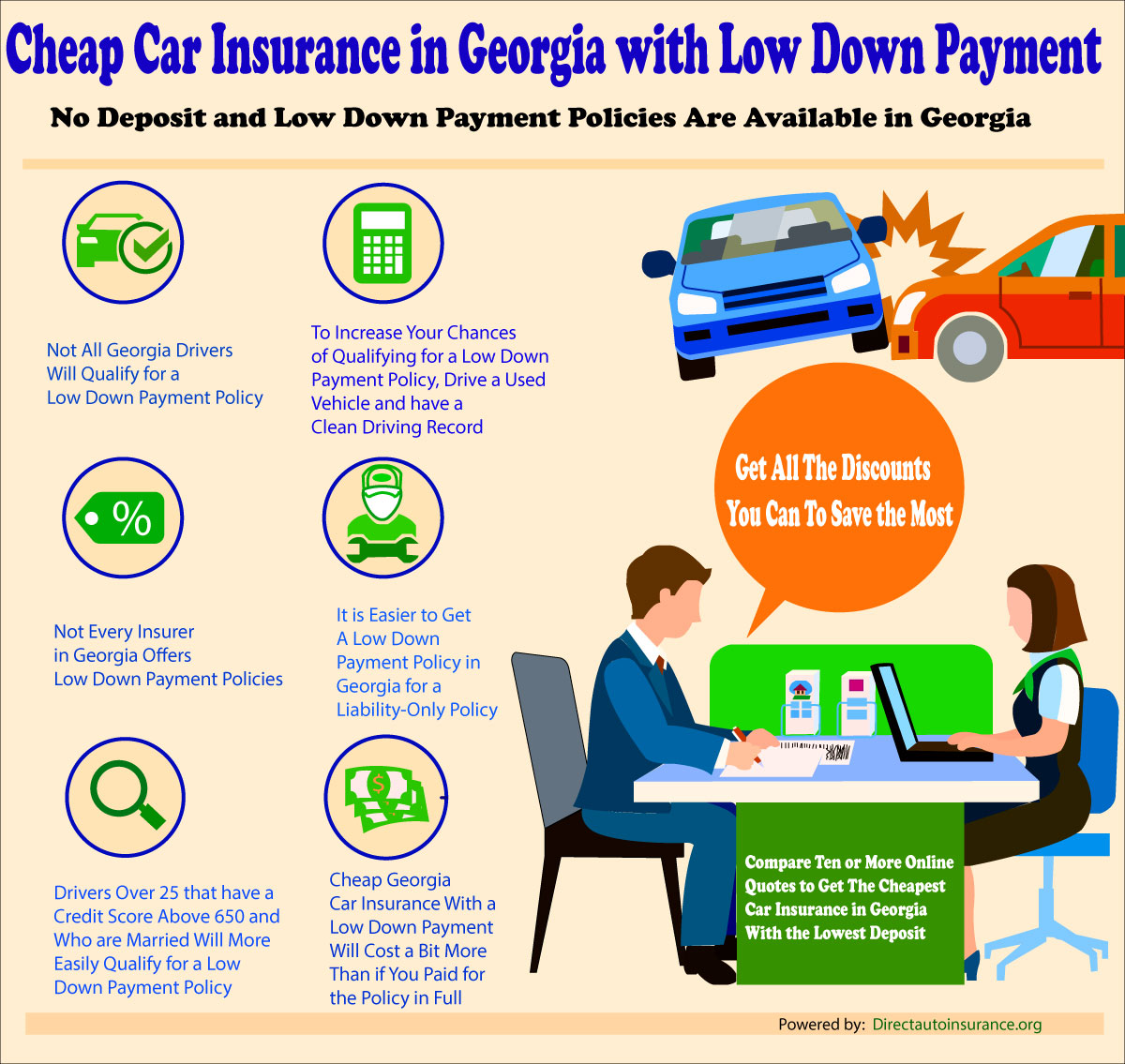

Low down payment car insurance refers to insurance plans that allow policyholders to start their coverage just by making a small initial down payment like $20 down payment car insurance. Even better are cheap car insurance in GA with no down payment plans which means getting coverage without making any down payment at all. Instead of requiring a lump sum upfront, these plans distribute the cost of the insurance premium over the course of the policy term, typically through monthly payments.

This can be particularly beneficial for those on a tight budget or facing immediate financial constraints. With cheap car insurance in GA with no down payment, individuals can obtain the necessary coverage without having to provide a significant amount of money upfront.

It’s important to note that while these plans offer convenience in terms of no down payment, the total cost of the premium may be slightly higher compared to policies that require an upfront payment. Insurance companies may adjust the monthly premium to account for the absence of a down payment. However, this trade-off allows drivers to spread the cost of their insurance over time, making it more manageable and accessible.

Cost of Car Insurance in GA with Low Down Payment

There is good news for those looking for cheap car insurance in Georgia with low down payment. This is because Georgia is one of several select states that allow these policies. As you may already know, insurance premiums and the deposit you will be required to pay are based on multiple factors. Your insurance rates may be influenced apart from the national average.

Georgia has one of the higher average car insurance rates in the country compared to the other 49 states in the U.S. According to a recent study, the national average for yearly auto insurance in the state is between $1,250 and $1,450 for adults over the age of 25. However, there are several considerations to take into account as listed below.

Factors Affecting Georgia Car Insurance Costs

- Age – Drivers under 25, or drivers over 65, will be charged more for their insurance only due to being a higher risk. Especially male drivers under the age of 25 are considered the riskiest and therefore face the highest premium payments.

- Gender – Some people may be faced with larger premiums based on their gender and the perception of their gender.

- Vehicle Type – Your vehicle’s make, model, year, and overall classification significantly influence how much you pay for your cheap auto insurance GA. For example, a red sports car or German luxury vehicle will automatically raise your premiums higher than someone who drives a Toyota Corolla.

- History of Claims – Insurance companies consider this history as an indication of increased risk, resulting in adjusted premiums to account for potential future claims. If you have a record of previous claims or accidents, your premiums are likely to be higher.

- Marital Status – Did you know that the state of Georgia sees single drivers as a bigger risk than married drivers? Because of this, your premiums will change depending on your marital status.

- Number of Drivers on the Policy – Are you letting multiple drivers use your vehicle? If so, this will impact the cost of your insurance.

- Driving Behaviors -Reckless driving, traffic violations, and accidents caused by the driver can lead to higher premiums. Conversely, maintaining a clean driving record and practicing safe habits can help lower insurance costs.

Georgia Low Down Payment Auto Insurance Providers

Georgia is one of several states that also offer no down payment policies. This can help those drivers on a tight budget that need to secure buy now pay later car insurance. Several companies provide cheap car insurance in GA with no down payment, including the following:

- Progressive

- Kemper

- Allstate

- Farmers

- Alliance

- Nationwide

- Safe Auto

Remember that it is crucial to compare multiple auto insurance quotes to find the best coverage at the most competitive price, tailoring your insurance to your needs, and making an informed decision. To start comparing quotes, just enter your ZIP code below.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Minimum Auto Insurance Requirements and Additional Coverage in Georgia

Each state has minimum requirements for car insurance. For Georgia, the Motor Vehicle Division requires you must have at least the following coverages:

- $25,000 property damage coverage

- $50,000 bodily injury coverage per accident

- $25,000 bodily injury coverage per person

Additionally, while not legally required, it is advisable to consider additional auto insurance coverage options in Georgia, such as:

- Uninsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who doesn’t have insurance.

- Underinsured Motorist Coverage: This coverage comes into play if you are in an accident with a driver who has insurance, but their coverage is insufficient to cover your expenses.

- Comprehensive Coverage: This coverage helps pay for damages to your vehicle caused by incidents other than collisions, such as theft, vandalism, or severe weather. If you need full coverage car insurance in GA, you need to get comprehensive insurance.

- Collision Coverage: If your vehicle is damaged in a collision with an object or another vehicle, this type of coverage covers repairs or replacement of your car.

- Medical Payments Coverage: This coverage assists in covering medical expenses incurred as a result of an accident, no matter who is at fault.

Georgia Facts and Auto Insurance Laws

In Georgia, you are required to carry your insurance policy with you in the car every time you drive. You also must have electronic proof of insurance if you need to prove that you are covered and don’t have your I.D. card on hand.

Not having the right insurance or not having enough insurance can result in heavy fines. This can ultimately lead to a suspension of your license, so make sure you know your facts before you shop for cheap car insurance in Georgia with low down payment.

Make sure you familiarize yourself with Georgia’s car insurance laws to find a policy that works best for you. Compare quotes by entering your ZIP code in our form below.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

How to Find Cheap Car Insurance in Georgia with Low Down Payment

Finding cheap car insurance in Georgia with a low down payment requires careful research and comparison. To help you navigate the process and secure the best possible coverage, consider the following steps:

Comparing the Cheapest Georgia Auto Insurance Quotes

One of the most effective ways to find cheap car insurance with a low down payment is to compare quotes from multiple insurance providers. Whether you need instant car insurance with no deposit or comprehensive coverage, you must compare as many quotes as possible from direct providers and agent-based carriers. Utilize online comparison tools or reach out to insurance agents to gather quotes based on your specific requirements. Compare the coverage options, premiums, deductibles, and down payment amounts to identify the most affordable and suitable insurance plans for your needs.

Find cheap car insurance in Georgia with low down payment in less than 5 minutes. Enter your zip code and get matched with the best online rates instantly. Save hundreds by buying direct.

Let the companies fight for you. Get a Quote!

Just enter your zip below

Discounts and Special Offers

Insurance companies often offer various discounts and special offers that can help lower your insurance costs. Inquire about available discounts such as safe driver discounts, multi-policy discounts (bundling car insurance with other types of insurance), or discounts for completing defensive driving courses. Taking advantage of these discounts can significantly reduce your premiums and make cheap car insurance more accessible.

Choosing the Right Coverage

Selecting the appropriate coverage levels is essential for obtaining cheap car insurance in Georgia under $50. While it may be tempting to opt for the minimum required coverage, carefully assess your needs and potential risks. Balancing affordability with adequate protection is crucial. Consider factors such as your vehicle’s value, your driving habits, and your personal financial situation when deciding on the coverage levels that suit you best.

Considerations for Young Drivers

If you’re a young driver seeking cheap car insurance in Georgia, there are additional considerations to keep in mind. Young drivers often face higher insurance rates due to their limited driving experience. However, some insurance companies offer discounts and specialized programs for young drivers, such as good student discounts or telematics-based insurance plans. Explore these options to find affordable coverage that caters specifically to young drivers.

Frequently Asked Questions (FAQs)

A: Yes, it is possible to find cheap car insurance in GA with no down payment. Many insurance providers offering this type of plan, also known as no down payment car insurance companies, offer flexible payment options to accommodate different budgets. By comparing quotes from multiple insurers and exploring their payment plans, you can find affordable car insurance options that require minimal upfront payments.

A: To find affordable car insurance in Georgia, it is advisable to shop around and compare quotes from multiple insurance providers. Each company sets its own rates, so obtaining several quotes allows you to identify the most cost-effective options. Additionally, consider factors such as your driving record, the type of car you drive, and any available discounts that can help lower your premiums.

A: There are several ways to lower car insurance costs in Georgia. Maintaining a clean driving record, taking defensive driving courses, and installing safety features in your vehicle can help qualify you for discounts. Additionally, choosing a higher deductible and opting for only the necessary coverage can reduce your premiums. It’s also worth exploring any special discounts offered by insurers, such as multi-policy discounts or good student discounts.

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption