No Deposit Car Insurance

Find the most suitable no deposit car insurance policy that fits your budget. Get fast, free quotes. Lowest Rates from $29 a month. Find & Compare the Best Insurance!

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

- Due to a shortage of cash and financial resources, most drivers cannot pay even a small amount of down payment.

- No Deposit Car Insurance can help those struggling financially, get legally insured, and allow them to make low monthly installments.

- These policies cost a bit more, but they can be essential for those low on cash and who need immediate coverage.

- People with a bad driving record might face obstacles in qualifying for car insurance with nothing down.

- Commonly, the first month’s premium will be regarded and considered as the down payment.

Nowadays, people are always searching for a car insurance policy that is not only cheap but also doesn’t have any down payments. Such insurance deals are very hard to find in today’s time. But if you’re looking for one, we will help you by giving you the most detailed information about the topic. We will show you the best Deposit Car Insurance options that you can opt for. Here you will find the most suitable no deposit auto insurance policy that fits your budget.

We don’t just work with any insurance companies. The companies that we are partnered with are some of the most reliable and dominant carriers in the market.

Each insurer has been operating for decades and offers a wide range of products and the lowest rates possible. To get started, enter your zip code and compare side-by-said car insurance rates to save the most efficiently.

Find the best auto insurance providers with no down payment policies. Get low deposit plans from just $20 down. Use our free online services.

ARTICLE GUIDE

Why Choose a No Deposit Car Insurance Plan?

Due to a shortage of cash and financial resources, most drivers are unable to pay even a tiny amount of down payment for the insurance they want to get.

A lot of the companies require people to pay some part of their premium before they can put the insurance policy into effect. Such people need very cheap insurance with no down payment to get on the road.

A majority of people in today’s time do not have enough savings to spend on expensive insurance deposits. In terms of car insurance, people want cheap car insurance with the lowest down payment possible. The good news is there are insurance providers that offer car insurance with no deposit required.

This can help those struggling financially, get legally insured, and allow them to make low monthly installments. While these policies cost a bit more, they can be essential for those low on cash and who need immediate coverage.

Getting Cheap Car Insurance Online with No Deposit

We will help you compare, then choose the right and the cheapest insurance policy. That will be best for you and your budget. We will help you compare all the no deposit auto insurance plans available where you live.

According to your needs and requirements, insurance companies always require some basic information to provide you with the best solution and response. Before you request any quotes, be sure to collect the following info:

- Personal information about the driver, such as gender, address, driver’s license number, marital status, and age

- Information about the car that is to be insured: model, license plate number, make, and the manufacturing date

- All the information about your current car insurance provider

Compare the lowest rates available; we will help you find the best and cheapest policy with a low-down payment.

Let the companies fight for you. Get a Quote!

Just enter your zip below

Cheap Automobile Insurance Coverage with No Deposit

Did you know that if you don’t have any savings and want cheap and affordable car insurance, you can go for a no deposit auto insurance plan? Not all insurance providers will offer this, but some do. Also, people with a bad driving record might face obstacles in qualifying for car insurance with nothing down.

Get covered with the lowest deposit possible. The best way to do that is to apply for quotes from all the leading providers online. Also, you have the option to fill out an online application at once and purchase your policy.

You can even get insured using your smartphone in minutes. Many top insurance providers offer 0 down car insurance policies online, but not all. Use the specialized services that connect you with direct providers. You’ll be able to save time and get the best policy that fits your budget.

Comparing No Deposit Car Insurance Quotes Online

If you compare car insurance quotes online, you’ll get many benefits. This includes finding out what carriers have low deposit auto insurance deals near you.

- Search for the best policy according to your coverage limits

- Get also suitable payment options and the type of car insurance you want

- You can compare side-by-side rates in only five minutes and often save hundreds with direct rates

- Compare rates from both national and regional carriers

Get auto insurance online with no deposit needed and low deposit plans from about $20 down. Most people will face financial troubles from time to time.

Are you facing some financial difficulties right now? You can use the websites here to help you in getting cheap direct rates. You can get legally covered with no deposit and a small first-time installment payment. Enter your zip code to get started.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Instant Auto Insurance with No deposit

Getting a no deposit or no down payment car insurance quote from good providers is very easy. All that is required is that you apply online. Search for the cheapest quotes. Compare the alternatives that might meet your requirements for car insurance. Every insurance provider offers affordable payment plans. When comparing quotes online, you can find the right policy that matches your budget.

The issue is that most car insurance providers require a certain amount as a down payment. There are no free car insurance policies.

Even if you are being offered a $0 down payment car insurance, it won’t take any effect until you pay some certain amount as required, often the first installment payment. In this scenario, the first month’s premium will be regarded as the down payment.

But this doesn’t mean that you should not look for the best cheap car insurance policy with the best rates for you. Some of the top insurance providers offer no deposit insurance. The following are some of the critical requirements for being eligible for a no deposit car insurance policy:

- Clean driving record

- Age of 25 or older

- Good credit score

- A search for basic car coverage

Various Factors Determine the Deposit Amount Required

There might be a solution for drivers who cannot pay a deposit to get car coverage. First, they should be looking for insurance providers that offer no down payment car insurance or insurance policies that require a minor amount as a deposit.

The better the driver’s profile looks, the more incentives the insurance company will offer. And the worse the profile is, the higher the amount of deposit required to be paid.

For most companies, your credit score significantly influences your overall ability to get car insurance with low monthly payments. All insurance providers prefer a person with a good credit rating. To become eligible for cheap $20 down payment car insurance, you must have a credit score of 650 or more. A good credit rating will help you get other incentives as well.

The other factors that affect the down payment amount are the vehicle details. The insurance providers assume all the costs they will incur before offering you a cheap rate. The insurance for a car that is cheap will have a low deposit. An expensive car will have a high deposit rate. No deposit car insurance coverage will be easily offered for a vehicle that isn’t very expensive. And the expensive cars are also not insured with the $20 down payment policies.

If an expensive car is involved in an accident, the cost for the insurance company will be very high. So, they calculate every aspect before they quote you. The deposit amount also depends on the type of coverage that you want. The more coverage you want, the higher the deposit amount needed.

Let the companies fight for you. Get a Quote!

Just enter your zip below

Qualify for Cheap Down Payment Car Insurance

You can get cheap car insurance policies online if you want to spend a small amount on car coverage. The internet will allow you to compare the prices of national and regional insurance providers. In this way, you will be able to see the lowest rate that you can get. Here are some things that you can do to get lower rates:

- Have a Good Credit Score of 650 or Higher

- Use Garages to Store your Vehicle

- Getting rid of Overlapping Coverage

- Increasing the amount of deductibles

There are certain places where you can easily get very cheap low deposit car insurance. In Florida, you can be eligible for zero down payments if you meet the following requirements:

- You have a Good Credit Score

- A Good Driving Record

- You have a used Vehicle

- Want Minimum Liability Coverage

Payment Options for Car Insurance

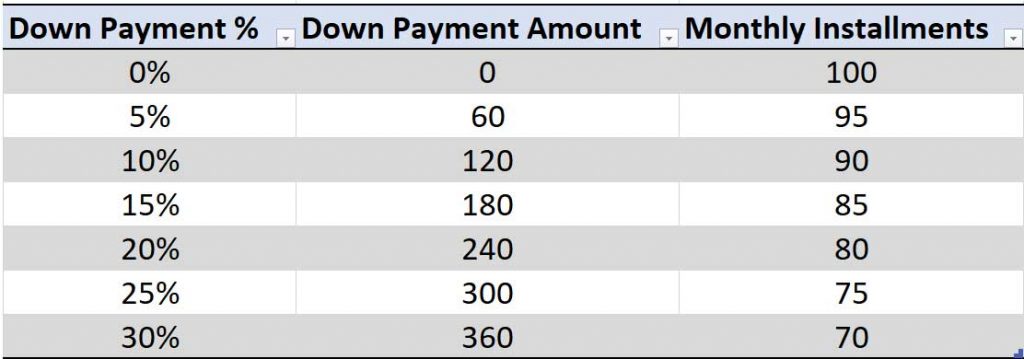

Not all drivers are able to pay in a lump sum. They might find it advantageous to use installment options for insurance payments. Before you get a car insurance policy, the insurance provider will offer you all the methods and choices of payment. Along with the initial deposit, you’ll need to pay monthly installments. Payment plans that most insurance companies offer include:

- Once-a-month payments

- Twice-a-year payments

- Payment every six months

- Full premium in a single premium payment

The clients also pay a certain down payment for making the insurance take effect. There are several options for making the payment, such as;

- Money orders

- Credit or debit cards

- Checks or Cashier’s Checks

- Wire transfers

- PayPal

Automatically Schedule Your Payment

Most insurance policies also come with an automatically scheduled payment system. The premium you must pay will automatically be deducted from your bank account or charged to your credit card on a specified date. You will also be able to customize the payment options by most insurance providers. Before going for a policy, make sure that you get cheap auto insurance easily afforded by you.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Auto Insurance with No Down Payment: The Good & The Bad

Auto insurance has some benefits and drawbacks with no down payments. The policies with low deposit coverage can most likely become very expensive over the policy’s life.

While no money down car insurance might seem right, there are some issues too. The monthly premiums that most insurance companies charge can be more expensive.

Most people won’t find it easy to pay those amounts. People who are not financially stable might need cheap auto insurance like a $20 down payment policy. They’ll be required to pay substantial premiums on a timely basis. Paying the full premium in advance is always a good option if people can afford it. This could help in avoiding the major monthly payments.

States Where No Deposit Auto Insurance Is Considered Legal

The states where no deposit car insurance is legal are New York, Arizona, Washington, Florida, Oklahoma, California, and Georgia.

Companies That Offer No Down Payment Auto Insurance

Several major and regional top insurance companies offer no down payment auto insurance. These include:

- Allstate.

- Safe Auto.

- Kemper.

- State Farm.

- Progressive

Low Deposit Car Insurance For Younger Drivers

People under 25 will find it very hard to get a low deposit car insurance because, according to statistical reports, they are more likely to find themselves in road accidents.

Therefore, most insurance companies will avoid offering low deposit car insurance or no money down car insurance to young people.

However, some companies like Progressive might offer affordable or low deposit insurance policies under $50. So, young drivers can opt for those if they want to get auto insurance at a lower price. However, the odds are never in favor of young drivers when trying to get low deposit car insurance for themselves.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

No Money Down Car Insurance for Senior Drivers

The safest drivers are 55 years or older and mostly get the lowest rates for insurance.

The statistical reports show that senior drivers are responsible and are less likely to get into accidents, and therefore they are offered better incentives by the car insurance companies.

They might even get the no money down car insurance with ease compared to the younger drivers. And senior drivers also get a very low deposit rate, which can be as low as $20. So, according to all the odds being in their favor, the senior drivers get the best offers from the auto insurance companies.

Full Coverage Auto Insurance with No Down Payment

Because offering full coverage auto insurance with no down payment can become costly for insurance companies, it is scarce to find such offers. The auto insurers always offer low deposit auto insurance policies below $50.

So, while getting a 0 down payment full coverage car insurance might be very rare, getting a low deposit auto insurance is relatively easier.

The Best Options for Getting Minimum Car Insurance Coverage with a Low-Down Payment

Finding cheap auto insurance is easier online than getting them through agents in person. The response and efficiency of online methods are very beneficial. But before you go for coverage, try to understand the types offered to you by the insurance companies.

- Personal Injury Protection (PIP): This medical coverage covers all drivers’ medical expenses.

- Collision Coverage: This coverage will cover the damage done to the car because of a collision.

- Liability Coverage: When a driver is at fault during an accident, this insurance will cover the costs required to repair the vehicle of the other person involved in the accident.

- Underinsured Motorist Coverage: Pays for medical and all other expenses that the driver and passengers will incur in an accident with a driver who does not have sufficient insurance to cover the damage.

- Comprehensive Coverage: This insurance will cover things like theft and other major or minor damage which is not collision-related.

- Uninsured Motorist Coverage: This will cover injuries and the other damages suffered by the driver and the passengers in an accident caused by a motorist driving without auto insurance.

Let the companies fight for you. Get a Quote!

Just enter your zip below

Find Low Down Payment Auto Insurance Online

It would be best to search online for the best low-down-payment or no money down car insurance. The internet will offer many options for low deposit auto insurance ranging from $0 to $40. In about five minutes, you can also put in all your requirements and needs to find the most suitable auto insurance policy with a low down payment online.

With our assistance, you will be able to get detailed information about all the low low down ($20) insurance policies. All you need to do is complete our online application along with your zip code and other personal details, and we will help you get the best available rates. We will help you arrange a free first-time consultation with a local agent or qualified service.

The internet will help you save a lot of money and time. So, please use it and find the best policy for yourself using our assistance.

Comparing Quotes Online: Save Your Money & Valuable Time

You waste a lot of money and time when you go to an insurance agent or broker’s office. The best thing you can do to compare quotes is to go online. You will be able to get the lowest quotes from all the top insurance companies on the internet, and you will be able to compare them and find the best one for yourself. This will allow you to compare cheap car insurance with no deposit and other plans with deposits starting from $20 down. Enter your zip code to start comparing the best rates and coverage available.

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption