National Family Insurance Review – 2024

National Family, also known as Assurance, provides life, home, and auto insurance policies.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

National Family Assurance Details

ARTICLE GUIDE

National Family Assurance Overview

National Family Insurance is a company based in Seattle, Washington. It was founded in 2016 to connect consumers with a wide variety of insurance products. The company is formally known as Assurance and was acquired by Prudential Financial in October 2019, combining Assurance’s direct-to-consumer reach and Prudential’s strong brand.

National Family Assurance corporation is an option worth considering for your auto insurance. The company offers policy add-ons that set it apart from the competition and various discounts that you can take advantage of. National Family has a high customer satisfaction rate, making it an excellent option in the insurance market. However, you should be aware that not all of the company’s insurance products are available in all states.

National Family Insurance Products

With National Family, you can select the following types of insurance:

- Life Insurance

- Medicare

- Health Insurance

- Home Insurance

- Auto Insurance

Requesting a Quote with National Family

National Family Assurance quotes can be requested online or over the phone. This is why the company has experienced agents who offer services every day of the week.

The company also provides a simple online quote process that guides customers to obtain the policy with the appropriate coverage.

However, you should notice that they provide referrals, not real quotes. So, you will be able to select the insurance policy that fits your needs and saves you the most money after comparing National Family’s options to other top-rated U.S. car insurance companies.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

National Family Auto Insurance

National Family is a leading provider of auto insurance. It focuses on offering basic coverage policies for standard drivers but provides a variety of advantageous discounts.

In addition, it stands out among companies of its kind for its exclusive policy add-ons, including rideshare insurance.

National Family Auto Coverages

- Bodily Injury Liability – Covers expenses for physical damage caused to third parties in a car accident for which you are found to be at fault.

- Property Damage Liability – Pays for third-party property damage if you were at fault.

- Comprehensive Coverage – Covers the insured vehicle in case of damage due to accidents other than a collision, including vandalism, theft, natural disasters, falling tree branches, etc.

- Collision Coverage – Covers the insured vehicle for damage caused in a collision with another vehicle or object if the driver is considered at fault for the accident.

- Medical Expenses – Covers medical expenses for injuries to the insured driver or passengers.

- Uninsured or Underinsured Motorist Coverage – It covers damage due to an accident with a driver who is not insured or does not carry enough insurance to cover damages.

Additional Coverages

National Family auto insurance policies have great add-ons for those looking for broader coverage beyond the basic insurance that most insurers include.

Add-ons include:

- Gap Insurance: In the event your car is stolen or totaled, GAP insurance covers the difference between the amount owed on the auto loan and the amount covered by your standard insurance policy.

- Accidental Death and Dismemberment Coverage: Covers the costs of an auto accident resulting in certain injuries, such as catastrophic loss of sight or limb. It even pays the designated beneficiary upon the insured’s death, regardless of fault.

- Ridesharing Insurance: Customers who drive for services like Lyft or Uber likely have a full liability policy from the rideshare company that only covers you once you’ve accepted a ride. On the other hand, your personal insurance policy will not cover you as long as you are logged into the company’s application. So, there is a coverage gap while waiting for a new customer, which rideshare insurance can cover.

National Family Assurance Discounts

To ensure you pay the lowest car insurance premium possible, National Family offers several discounts for drivers, including the following:

- Good Student Discounts: Students with good grades above 3.0 may qualify for this discount.

- Good Driver Discount: Those with no recent tickets or accidents on their driving record will be considered good drivers and may receive discounted rates.

- Safety Discount: By installing safety features such as airbags, anti-lock brakes, and electronic stability control, you can benefit from this discount.

- Low Mileage Discount: You can receive discounted annual premiums if you drive less than 7,500 miles per year.

- Multi-Policy Discount: By insuring your home and vehicle under the same National Family Insurance policy, you can get lower insurance rates than insuring them separately.

- Multi-Car Discount: You will get discounted rates if you have more than one vehicle and insure them on the same insurance policy.

- Loyalty Discount: You will be able to get greater discounts on your insurance premium the longer you stay insured by National Family.

- Go Paperless: If you set up automatic payments or pay your monthly fees electronically, you may qualify for this discount.

You may qualify for some other type of discount the company offers. So don’t hesitate to talk to your National Family insurance agent about the options you can count on!

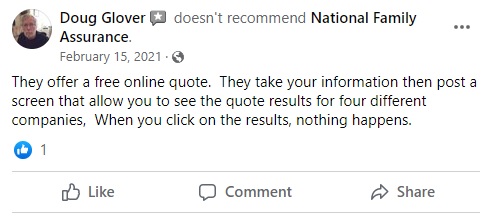

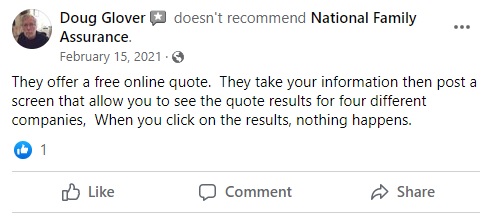

National Family Insurance Reviews and Complaints

The main complaints about National Family are based on the fact that the company’s website does not make it completely clear before the client fills out the quote form that what they offer are references and not estimates with real values. Also, after the customer fills out the form with all the personal details, it seems that they get a lot of phone calls from several agents.

Below we show two Facebook comments that reflect this type of dissatisfaction with the insurer’s service:

Final Thoughts

Standard and add-on coverage options, along with a wide variety of discounts, make National Family highly competitive in the insurance market. A large network of authorized agents offers low-deposit insurance products at affordable prices.

Still, if you’re not sure if this is the insurance company you’re looking for, don’t forget to compare several insurance quotes from regional and national providers. Select the company that offers the cheapest monthly auto insurance policy and coverage that best suits your particular coverage needs and save!

Enter your ZIP code into our FREE online quote tool to begin your quote application.