Cheapest Car Insurance in El Paso

Compare multiple quotes, and learn how to save based on your individual insurance needs.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

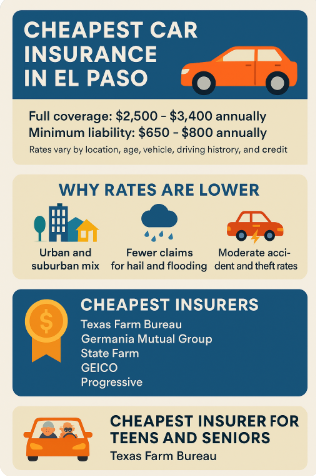

With rates increasing in recent years, many drivers are seeking the cheapest car insurance in El Paso. The good news is that drivers in El Paso, Texas, do enjoy relatively lower auto insurance rates compared to other major Texas cities. Full-coverage policies typically range between $2,500 and $3,400 annually, while minimum liability coverage averages $650 to $800 per year, depending on the insurer. Premiums vary based on location, age, vehicle, driving history, and credit profile.

Top insurers offering the best rates include Texas Farm Bureau, Germania Mutual Group, State Farm, and Progressive. For military families, USAA remains a standout. Seniors often benefit from reduced premiums due to experience and discounts, while teens face higher costs, but can still save a lot by staying on family policies, maintaining good grades, and participating in safe-driving programs.

ARTICLE GUIDE

Why Car Insurance Rates in El Paso Are What They Are

A combination of local dynamics and broader Texas insurance regulations shapes insurance rates in El Paso.

Key factors influencing pricing:

- Vehicle and road use patterns: El Paso’s mix of urban and suburban areas contributes to moderate rates compared to more congested Texas cities.

- Weather-related claims: Unlike Houston or Dallas, El Paso typically sees fewer hail and flood claims, which can lower claim-related premiums.

- Crime and theft trends: Certain ZIP codes experience higher accident or theft rates, pushing premiums upward in those neighborhoods.

- Texas liability minimums (30/60/25): These ensure a baseline level of protection but don’t significantly reduce costs.

- Driver profile factors: Age, credit, vehicle type, and driving record play significant roles in underwriting.

- Neighborhood variations: ZIPs like 79938 see higher premiums ($3,668/year) versus others, averaging $3,379.

The Cheapest Car Insurance Companies in El Paso

Texas Farm Bureau

- Tops many rankings with a median annual full-coverage rate of around $1,314 for a 35-year-old with a clean record.

- Other studies confirm $959/year for full coverage.

- Some estimates report $77/month ($924/year) for full coverage and just $27/month for liability insurance ($324/year).

Germania Mutual Group

- Germania Mutual offers the cheapest full-coverage option in El Paso at around $1,386/year or $116/month.

State Farm

- Listed at about $118/month for full coverage ($1,416/year).

- Minimum liability policies start at around $50/month.

GEICO & Progressive

- GEICO averages around $2,399/year for full coverage.

- Progressive comes in at $2,094/year.

- Some sources place GEICO at $151/month ($1,812/year); Progressive at $184/month ($2,208/year).

USAA (Military Only)

- Median full-coverage rate is about $1,683/year for eligible members.

Overall Cheapest Car Insurance Company in El Paso

For the broader population, Texas Farm Bureau offers the best combination of rates across driver profiles:

- Full coverage: $959–$1,314/year ($77–$110/month)

- Liability only: $324/year ($27/month)

These figures are about half of the El Paso average of $172/month ($2,064/year).

USAA remains the cheapest for eligible military drivers at $1,683/year for full coverage.

Cheapest Car Insurance in El Paso for Seniors

Rates drop significantly by age 60 due to driving experience:

- Texas Farm Bureau: $1,088/year for full coverage.

- State Farm: $1,666/year

- Progressive: $1,773/year

- GEICO: $1,939/year

- USAA: $1,428/year for qualified members.

Saving strategies for seniors:

- Take Texas-approved mature driver safety courses.

- Bundle auto with home or other policies.

- Monitor annual mileage for potential discounts.

Cheapest Car Insurance in El Paso for Teens

Teen drivers pay significantly higher insurance premiums, but some insurers charge lower costs. The following table compares average full coverage insurance costs for teen drivers in El Paso.

- Texas Farm Bureau (full coverage): $123/month ($1,476/year); Liability only: $51/month ($612/year)

- State Farm: $149/month full; GEICO: $153/month; both far cheaper than the city average ($528/month).

- Progressive: $252/month;

- Allstate: $251/month.

| Insurance Company | Average Monthly Cost | Average Annual Cost |

|---|---|---|

| Texas Farm Bureau | $123 | $1,476 |

| State Farm | $149 | $1,788 |

| GEICO | $153 | $1,836 |

| Progressive | $252 | $3,024 |

| Allstate | $251 | $3,012 |

| City Average | $528 | $6,336 |

* Note: Texas Farm Bureau also offers a very competitive liability-only policy at an average of $51 per month ($612 per year).

Key Takeaway: While teens pay higher premiums, choosing the right insurer is critical. Texas Farm Bureau, State Farm, and GEICO offer full coverage rates far below the El Paso city average for teen drivers.

Teen savings tips:

- Stay on a parent’s policy rather than buying separately.

- Qualify for teen insurance discounts, such as good-student or safe-driving discounts.

- Complete a driver safety course recognized by Texas.

El Paso Auto Insurance Rate Comparison

The following comparison is based on a 35-year-old driver with a clean driving record. The table shows average monthly and annual premiums from major insurers.

| Company | Full Coverage (Annual) | Minimum Liability (Annual) |

|---|---|---|

| Texas Farm Bureau | $959 to $1,314 | $324 |

| Germania Mutual | ~$1,386 | $460 |

| State Farm | ~$1,416 | $600 |

| GEICO | ~$1,812 | $705 |

| Progressive | ~$2,094 to $2,208 | $812 |

| Allstate | ~$2,196 | $912 |

| USAA* | ~$1,683 | $526 |

* USAA is available only to active military and veterans and their families.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

How to Get the Cheapest Car Insurance in El Paso

- Compare quotes annually: The market is shifting; it’s a buyer’s market right now.

- Start with top contenders: Farm Bureau, Germania Mutual, State Farm, GEICO, Progressive, plus USAA if eligible.

- Maximize discounts: Driver safety courses, bundling, good student, multi-vehicle, telematics, and autopay.

- Adjust coverage smartly: Liability only may suit older cars; raise deductibles for cost savings.

- Re-shop at life events: New car, moving, claims, or tickets can drastically shift pricing.

- Monitor macro factors: Be aware of rising costs due to inflation, auto part tariffs, and climate risk modeling.

Frequently Asked Questions (FAQ)

Texas Farm Bureau offers the lowest rates for most drivers. Germania Mutual offers competitive full-coverage prices. USAA is the cheapest if eligible.

Approximately $600 to $800/year, with Texas Farm Bureau offering as low as $324/year.

Usually between $1,476 and $3,400 per year, with many top insurers under $1,500. The average citywide is around $3,379/year.

Texas Farm Bureau and USAA (when eligible) lead in savings for senior drivers.

Teens pay steep premiums, but Texas Farm Bureau offers the most affordable: $1,476/year full or $612/year liability.

Rates rise significantly in El Paso, up to 39% after a DUI. Texas Farm Bureau and State Farm tend to offer the lowest post-DUI coverage: $142 to $124/month, respectively.

Fewer claims, less weather risk, and lower urban density help—insurers often consider it lower-risk.

The Final Word on Cheapest Car Insurance in El Paso

For El Paso drivers, Texas Farm Bureau is the go-to option for affordability across ages and coverage types.

Germania Mutual Group also shines for full-coverage rates. State Farm provides a solid blend of price and service, while GEICO and Progressive are competitive in select segments. USAA remains the best value for eligible individuals.

Seniors and teens should look closely at Farm Bureau for cheap rates. Teen drivers in El Paso can significantly lower expenses by staying on a parent’s plan. With premiums stabilizing and the market offering better deals, getting quotes now could save hundreds annually, especially when bundled with discounts and tailored to personal risk. Get the cheapest El Paso, Texas car insurance online today and save more with direct rates.

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption