Pay As You Go Car Insurance

Discover the convenience of usage-based car insurance. Flexible coverage adapted to your needs. Get started now and pay only for what you use.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

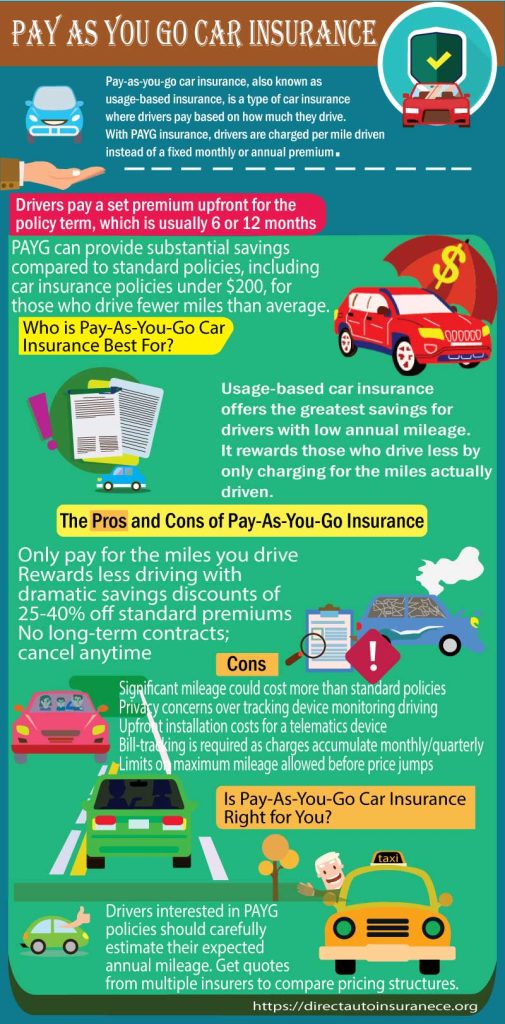

Pay-as-you-go car insurance is a flexible type of auto coverage where drivers are billed based on how much they drive. Unlike traditional plans with fixed monthly or annual premiums, PAYG car insurance calculates your rate per mile. It’s especially popular among low-mileage drivers who want to save money by only paying for the coverage they actually use.

In this article, we’ll go over pay-as-you-go car insurance, including how it works, who it’s best for, and what you might expect to pay with leading providers. We’ll also provide quotes from 10 top insurers to help you see if this model fits your needs.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

ARTICLE GUIDE

What Makes Pay-As-You-Go Car Insurance Popular Among Drivers?

With traditional car insurance policies, drivers pay a fixed premium for a 6- or 12-month term, no matter if they drive just 5 miles or 5,000. For those who don’t drive often, this can feel unfair.

Pay-as-you-go insurance changes that model. With this type of usage-based car insurance, your premium is tied to your mileage. A device installed or a mobile app tracks your driving, and you're billed accordingly for insurance coverage based on usage

Rates are very low per mile—typically just a few cents per mile. While this can add up for frequent drivers, those with lower mileage often see significant savings compared to standard policies.

Some drivers even qualify for car insurance under $200 per month simply by reducing their driving habits.

Drivers Need To Install a Telematic Device

PAYG insurance uses telematics technology to track mileage. Insurers install a small device in the vehicle or require an app that monitors your driving data. The device or app transmits data on miles driven, location, time of driving, and even behaviors like rapid acceleration or hard braking.

In some cases, insurers allow you to prepay for a set number of miles, such as 1,000- or 5,000-mile blocks. As you approach the limit, you can purchase additional miles as needed. The insurers may also cap the total mileage allowed on the policy. Going over that cap would require upgrading to a standard insurance policy or pay higher rates.

Who is Pay-As-You-Go Car Insurance Best For?

Usage-based car insurance policies offer the greatest savings for drivers with low annual mileage. It rewards those who drive less by only charging for the miles actually driven.

Here are some examples of drivers who stand to benefit the most from PAYG insurance:

- Retirees who no longer commute to work every day

- People who live in urban areas and use public transportation frequently

- Drivers who work from home and have minimal travel needs

- People who own a car for limited occasional use only

- Parents with teens who drive infrequently

Pay-as-you-go policies may work better for drivers who put a lot of miles on their vehicles. The per-mile charges can add up quickly at higher mileage and may end up costing more than standard insurance. But for those with minimal driving needs, pay as you go car insurance can save drivers hundreds per year.

Top Pay-As-You-Go Car Insurance Companies

Several major insurers now offer pay-as-you-go car insurance alongside their traditional plans. These programs often fall under the broader category of usage-based car insurance, but focus primarily on mileage to determine rates. Here are some of the top providers offering PAYG options:

- Progressive – Snapshot program offers usage-based discounts of up to 30% by tracking driving behavior and miles through a mobile app or plug-in device.

- Allstate – Drivewise program provides a plugged device that tracks mileage and driving habits, rewarding safe, low-mileage drivers with personalized discounts.

- State Farm – Drive Safe & Save uses in-car technology or a mobile app that collects data to calculate rates based on mileage and driving style.

- Liberty Mutual – RightTrack program provides customized pricing through telematics, with potential savings for low-mileage and careful drivers.

- Travelers – The IntelliDrive program gives drivers more control over their premiums by monitoring real-time data and offering discounts based on mileage and safety.

- MileMeter – Specializes in true mileage-based insurance, charging drivers strictly based on the number of miles they drive—ideal for infrequent drivers.

- Metromile – Pioneered PAYG insurance, charges a low base rate plus a per-mile fee, offering potential savings for drivers with low annual mileage.

Pay-As-You-Go Quotes from Top Insurers

To give a clearer picture of how pay-as-you-go car insurance compares to traditional coverage, here are sample monthly quotes from 10 top insurers. These estimates are based on varied driver profiles and expected annual mileage.

- Progressive Snapshot: A driver with a clean record and good credit in Houston received a quote of $115/month for driving 12,000 miles per year. This reflects a 28% discount compared to the standard premium of $160/month.

- Allstate Drivewise: In Chicago, a driver with a history of speeding tickets was quoted $135/month for 10,000 annual miles. This represents a 40% savings versus Allstate’s standard rate of $220/month.

- State Farm Drive Safe & Save: A Seattle driver with standard full coverage and 8,000 miles annually was quoted $108/month, a 40% discount from the standard premium of $180/month.

- Liberty Mutual RightTrack: Liberty Mutual quoted $94 per month for 6,000 miles annually to a single male driver with no accidents or tickets and good credit. Their standard full coverage car insurance premium was $150 per month, so this quote represented a 37% discount.

- Travelers IntelliDrive: A younger driver in Miami with a recent speeding ticket got a quote of $125/month for 10,000 miles. Compared to a standard premium of $225/month, that’s a 44% savings.

- MileMeter Quote: A higher-risk driver in Los Angeles with a recent accident and 8,000 annual miles received a usage-based insurance quote of $165/month, compared to $260/month for a standard policy—36% off.

- Metromile: An older driver in Phoenix driving 5,000 miles annually was quoted $112/month. Compared to their regular $150/month policy, that’s a 25% discount.

- Root: A teenage driver in Dallas driving around 6,000 miles per year was offered $105/month, which is a 53% reduction from the standard $225/month rate.

- ByMile: In Denver, a safe driver with excellent credit and no violations received a quote of $80/month for 4,000 miles. This is 38% less than their standard premium of $130/month.r accidents in Denver. Compared to a standard premium of $130, the ByMile PAYG insurance offered a 38% discount.

- Esurance DriveSense: A female driver in her 20s with average risk in Phoenix got a quote of $100/month for 7,500 miles annually. That’s a 29% discount compared to the $140/month traditional rate.

The Pros and Cons of Pay-As-You-Go Insurance

Like any insurance model, pay-as-you-go car insurance has its advantages and limitations. While it’s designed to reward low-mileage drivers, it may not suit everyone.

Pros

- Only pay for what you drive – No more flat fees for unused miles.

- Potential for major savings – Especially beneficial for drivers with limited travel.

- Encourages better driving habits – Some usage-based programs also track safety.

- No long-term commitment – Many PAYG policies offer flexible billing options.

Cons

- Significant mileage could cost more than standard policies

- Privacy concerns – Telematic devices track your location and behavior.

- Upfront installation costs for a telematics device – Not all drivers want to pay for a hardware in their vehicle.

- Mileage caps – Some providers impose limits that may not suit all lifestyles.

Is Pay-As-You-Go Car Insurance Right for You?

Pay-as-you-go auto insurance offers significant savings potential for lower mileage drivers and want a premium that reflects their actual usage. If you drive occasionally—whether because you work remotely, live in a walkable city, or share a household vehicle—this model could lead to meaningful savings.

However, if your driving habits vary widely, or you regularly take long trips, a traditional insurance policy might offer more stability in pricing.

A tracking device installation and monitoring may also make some hesitant about privacy. Before switching, consider:

- The potential savings versus standard rates

- Your annual mileage

- Driving consistency

- Comfort with tracking technology

Compare pay-as-you-go car insurance quotes from multiple providers to see how pricing shifts based on your estimated miles. Then, evaluate if the savings outweigh any privacy concerns in minutes. Enter your zip code and fill out an online application to get started. Save hundreds annually on the coverage you need.

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption