GEICO Car Insurance Discounts

Take advantage of GEICO’s great coverage at discounted rates right now.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

- GEICO offers 30+ discounts, including unique savings for military, federal employees, and students.

- Discounts can stack, saving drivers up to 40% on premiums (varies by state).

- Compare GEICO’s discounts vs. competitors like State Farm and Progressive to find the best deal.

Taking advantage of discounts offered by insurance companies is one of the best ways to save money on your insurance policy. Drivers will likely qualify for at least one discount from the full range most auto insurers offer. Knowing how to take advantage of discount opportunities can make a difference in the cost of your insurance premiums. So when you’re shopping around for auto insurance, check out the discounts you can qualify for.

ARTICLE GUIDE

Is Geico a Good Company to Get a Discount?

GEICO offers one of the largest and most varied lists of discounts for drivers. Because Geico partners with so many colleges, employers, and organizations, it’s more likely to offer even more discounts. Thus, each driver has a good chance of qualifying for at least one of the company’s discounts.

GEICO stands out for offering the lowest rates for many types of drivers. GEICO is not only affordable but offers excellent customer service rated A+ by the Better Business Bureau (BBB), and AM Best rated its financial strength an A++.

If you’re looking for an insurance company that meets your insurance needs while also fitting your budget, GEICO is definitely worth considering. Compare prices and find the best rates for you. You only need to request a quote below and provide complete and accurate information; Generally, discounts for which you are eligible will be applied automatically. Continue reading our article to learn more about GEICO auto insurance discounts.

Unique Car Insurance Discounts

Along with the standard discounts, GEICO car insurance has some outstanding discounts that are exclusive to the company. A case in point is that Geico is the only reputable company to offer an auto insurance discount for federal employees, like Eagle discount. Other outstanding discounts are those for group affiliation for members of corporate and alumni groups.

GEICO Car Insurance Discounts: Driver’s Education and Affiliation

Drivers can qualify for more than one discount at a time with the same insurer. This includes discounts for your occupation or membership, the type of car you drive, your driving habits, and more. Let’s check the discounts Geico offers according to driver’s education and affiliation:

| Type of Discount | Description |

|---|---|

| Good student discount | Full-time students with a GPA of 3.5 or above can take advantage of GEICO’s Good Student Discount. This discount benefits eligible drivers with up to 15% off their premium. |

| Distant student discount | Drivers under the age of 25 who are in college more than 100 miles from home may qualify for a discount. |

| Defensive driver discount | Those senior drivers who take a defensive driving class can benefit from a discount for three years. |

| Federal program Eagle Discount (Federal employee discount)* | Active or retired federal government employees can receive a 12% discount on their premiums. |

| Memberships* | If you are a member of one or more of GEICO’s five hundred affiliated organizations, you may be eligible for a discount on your insurance premium. You can obtain a complete list of affiliated organizations from a GEICO insurance representative. |

| Organizations and Alumni | Discounts are available if you graduate or attend an eligible school or affiliated organization. You can obtain a complete list of affiliated organizations from a GEICO insurance representative. |

| Military Discount | 15% discount for military members, whether active or retired. |

| Emergency Deployment Discount | So that military members aren’t forced to face a lapse in auto coverage, Geico offers a 25% discount on rates during deployments. |

*Membership and Eagle discounts cannot be combined

GEICO Car Insurance Discounts: Vehicle Equipment

The type of vehicle you drive is a huge factor in determining the cost of your insurance rates, and it can also help you save money through auto insurance discounts. Fortunately, GEICO will automatically verify most discounts for your car during your application. In the application process, you will need to be specific and clear about the safety features of your vehicle.

Let’s see what the discounts that are associated with the characteristics of your vehicle are:

| Type of Discount | Description |

|---|---|

| Anti-lock brakes Discount | You can save 5% on your bill if your car has anti-lock brakes. Anti-lock brakes are an essential safety feature that decreases the chance of accidents by helping to restore traction to your tires in an emergency. |

| Air Bag Discount | Just having a vehicle with airbags installed can save up to 23% on your medical payments coverage or personal injury protection insurance. |

| Seat Belt Use Discount | Similar to the air bag discount, wearing your seat belts every time you drive will make it easy to get a discount on your medical payments insurance and personal injury protection coverage. |

| Anti-theft System Discount | If your car has anti-theft devices, your comprehensive coverage policy will receive a 23% discount. |

| Daytime Running Lights Discount | Driving a vehicle with daytime running lights installed, you can get a small 3% discount. |

| New Vehicle Discount | If you insure a car that is three years old or less, you can get a 15% discount on your premium. |

| Special Vehicle Discount | Policyholders with non-standard cars, such as farm or utility vehicles, may be able to get special discounts from GEICO. |

GEICO Car Insurance Discounts: Customer Loyalty

You don’t have to be a special driver to get auto insurance discounts from GEICO. Your individual characteristics as a customer can also get you discounted rates.

| Type of Discount | Description |

|---|---|

| Multi-Car Discount | If you insure more than one vehicle on your GEICO auto insurance policy, you may qualify for up to a 25% multi-car discount. |

| Multi-Policy Discount | Suppose you get homeowners insurance, motorcycle insurance, life insurance, or other types of coverage that Geico offers in addition to your auto insurance. In that case, you may also qualify for a multi-policy discount. |

| Continuous Coverage | If you have maintained the last three years without interruption in your insurance with GEICO, you will be able to obtain a continuous coverage discount. |

| Early Signing Discount | If you pay for your new insurance policy at least one week before activation, you can get a discount. |

| Paid-in-full Discount | If you pay your policy in full instead of making monthly payments, you’ll qualify for a discount. |

GEICO Car Insurance Discounts: Driving Habits

Good behavior behind the wheel can get you classified as a safe driver. See below the discounts offered by GEICO based on driving habits:

| Type of Discount | Description |

|---|---|

| Low Mileage Discount | GEICO does not list Low Mileage on its discount list; however, those who drive about 7,500 miles a year pay a 27% lower premium than those who double that number of miles. |

| Accident-free discount | If you are accident-free for five years or more, you can save up to 22% on your rate. |

Usage-Based Auto Insurance Discounts

Most major auto insurance companies offer some form of discount based on usage, and GEICO is no exception. Good drivers can take advantage of these usage-based programs to save more on car insurance. These programs are generally not available in all states.

| Type of Discount | Description |

|---|---|

| GEICO DriveEasy Discount | If you’re a safe driver, you can sign up for GEICO’s DriveEasy program and get a safe driver discount. With this application, the company monitors the driver’s driving habits and rewards good driving behavior. |

GEICO DriveEasy Program

DriveEasy program is GEICO’s usage-based program available in 34 states. How does it work? Like all other usage-based programs, DriveEasy tracks your driving habits in real-time, and it does so through a mobile app. Once you sign up, a discount is offered, which is then replaced with a discount based on your driving habits when your auto insurance policy renews.

Let’s take a look at the components that DriveEasy evaluates to award the driver’s score:

- Distracted Driving: Active use of the phone and portable phone calls when driving over six miles per hour may be considered distracted driving. Please note that even if someone other than the driver is using the phone, GEICO may consider this as distracted driving since it cannot detect who is using your phone.

- Hard Braking: Calculates your rate of deceleration while driving.

- Cornering: Monitors the speed at which the driver turns corners.

- Smoothness: Calculated by how you control your speeds. Frequent changes in speed and abrupt stops will impact your score.

- Smoothness: Monitors for abrupt stops and frequent speed changes.

- Road Type: GEICO evaluates the type of road you regularly drive on.

- Distance Driven: Determine the average number of miles you drive regularly.

- Time of Day: There are certain times when it is riskier to drive, such as early morning on weekends. The application evaluates if the driver usually drives at these risky hours and adjusts your score accordingly.

- Weather: Under snow or rain, visibility is more difficult, and therefore driving conditions are riskier. If DriveEasy detects that you often drive in these weather conditions, it will factor this into your score.

One advantage for those who tend to drive lightly and carefully is that they will be able to get the best auto insurance discounts based on usage. On the other hand, if you frequently drive without following good driving habits while enrolled in the DriveEasy program, you may not get discounts or be penalized with a smaller discount.

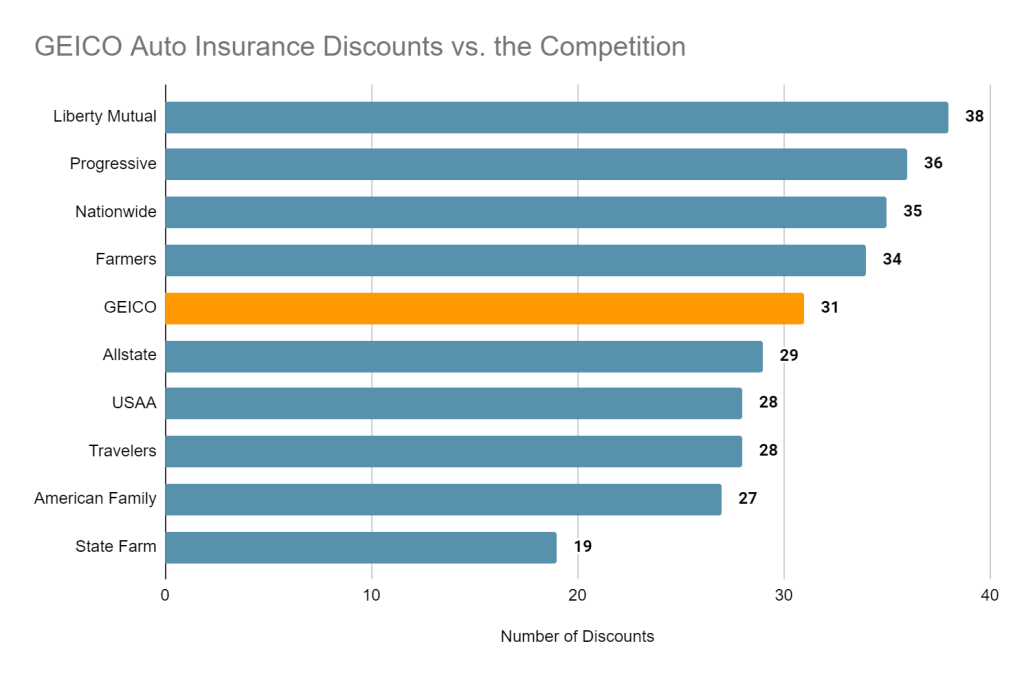

Comparing GEICO Auto Insurance Discounts vs. the Competition

One of the ways you can compare companies is to learn how many discounts they offer. GEICO is one of the insurance companies with the longest discount lists. Many other insurers offer a number of discounts that help their clients save money, which is a win-win strategy. Below we show a graph with the number of the discounts provided by the largest companies:

Based on the information above, major insurance companies offer many discounts, some even more than GEICO. Although GEICO ranks fifth among the companies that rank the most discounts, keep in mind that this does not mean that it is in the same place among the companies that offer the lowest prices. Allstate, for example, provides a wide range of discounts yet has the highest average rate among all insurers in our sample.

Although discounts can help you save, they don’t significantly determine the cost of your insurance. Companies look at factors like your credit score, age, location, driving history, and many other factors to determine your rates. However, the unique characteristics of the driver will be the main factor that determines the cost of your car insurance.

What’s the Bottom Line?

GEICO offers a hefty list of discounts and is also known for offering very cheap car insurance rates. However, Each GEICO customer or prospective customer should take the time to review the full list of discounts and determine if they have received every possible discount.

Also, keep in mind that although discounts are an easy advantage to take advantage of, they are not the most important when choosing the best insurance company for you. If a provider other than GEICO doesn’t offer discounts but better auto insurance rates that are a better fit for your particular insurance needs, you’re better off going with them. The final price of your auto insurance premium is the most important thing to consider.

Also, keep in mind that many discounts only apply to a small portion of your auto insurance premium. Therefore, although savings are always welcome, they can be insignificant. In addition, you should check to see if the discount you think you qualify for is available in the state where you reside. Anyway, get a quote from GEICO and see if the discounted rates fit your budget.

Lastly, while GEICO gets excellent reviews and ratings for its financial strength and customer service, it’s always a good practice to shop around. Comparing rates is the best way to make sure you get the best insurance. Just enter your zip code below and start your quote application right now!

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption