Cheap Liability Car Insurance In PA

Discover the best, affordable liability car insurance options in Pennsylvania. Compare quotes, and meet PA’s legal requirements without breaking the bank.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

With rates on the rise, many drivers are looking for cheap liability car insurance in PA. For safe drivers, a liability-only policy in Pennsylvania can be as low as $30 a month, or 1 dollar a day coverage.

If you have an older vehicle that you don’t drive much, a low-cost state minimum liability-only police in PA can be a smart move. You can save hundreds each year and stay legally covered.

ARTICLE GUIDE

What is Liability-Only Car Insurance in Pennsylvania?

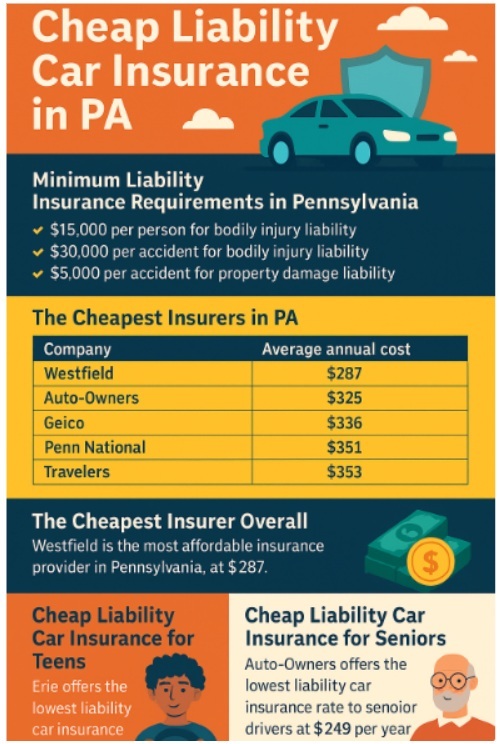

This type of policy pays for damage and injuries you cause to others, not damage to your own car. It’s ideal for drivers with older vehicles or those on a budget. Pennsylvania requires all drivers to carry minimum liability coverage, which includes:

- $15,000 for bodily injury per person

- $30,000 for bodily injury per accident

- $5,000 for property damage

- $5,000 in medical benefits (PIP)

On average, Pennsylvania drivers pay about $1,339 per year for full coverage, while liability-only policies cost as little as $228 to $519 annually, depending on a driver’s risk profile.

Liability insurance protects you financially if you’re at fault in an accident, but this type of coverage does not include:

- Collision coverage (your car’s damage in an accident)

- Comprehensive coverage (theft, weather, vandalism)

This minimal coverage meets legal requirements but offers no protection for your vehicle. So, if your vehicle is worth more than $8,000, you should probably get collision coverage and maybe even comprehensive.

The Cheapest Liability-Only Car Insurers in PA

Here are the top five insurers offering the cheapest minimum liability coverage in Pennsylvania:

| Insurer | Approx. Monthly Cost | Annual Cost |

|---|---|---|

| Westfield | $19 – $22 | $228 – $264 |

| Auto-Owners | ~$25 | ~$305 |

| Travelers | ~$28 | ~$338 |

| Erie | ~$31 | ~$376 |

| Nationwide | ~$40 | ~$478 |

These insurers consistently offer the cheapest liability car insurance in Pennsylvania. They also have great customer service and claim support.

The Cheapest Auto Insurance Company in PA

Westfield Insurance stands out as the most affordable insurer in Pennsylvania, with minimum liability policies starting at just $19 a month, which is super cheap. It offers excellent value for budget-conscious drivers, especially those with clean records and good credit scores. Westfield is especially recommended for:

- Drivers with older or paid-off cars

- Drivers opting for limited tort

- Low-mileage drivers

Cheap Liability Car Insurance for Teen Drivers in PA

Teen drivers face significantly higher insurance costs due to a lack of experience. In Pennsylvania:

- Adding a teen driver to an existing policy can increase premiums by up to $2,000 a year.

- An individual liability-only policy for a teen can cost $220 to over $300 a month.

Best Insurers for Teens:

- Progressive

- GEICO

- State Farm

- Erie Insurance

Quick Tips To Save Even More:

- Add the teen to a parent’s policy

- Use “good student” discounts

- Enroll in telematics or driver monitoring programs

- Compare at least 3 quotes

Cheap Liability Car Insurance for Seniors in PA

Seniors typically pay lower rates than teens but may see rate increases after age 75.

Average liability rates for drivers 60+ in PA:

- Travelers: ~$263/year

- Erie: ~$364/year

- GEICO: ~$385/year

Best discounts for seniors:

- Mature driver courses (up to 10% savings)

- Multi-policy bundling

- Low-mileage usage

Travelers is often the most affordable for seniors, offering solid coverage with personalized service.

Factors That Affect Your Liability Premium in PA

Your premium depends on many variables, including:

- Age: Teens and seniors pay more; the lowest rates are for drivers aged 35-55

- Driving history: Accidents and violations increase rates

- Credit score: Poor credit can double your premium

- ZIP code: Urban areas cost more than rural areas

- Vehicle type: Expensive or sporty cars cost more to insure

- Mileage: Higher mileage = higher premiums

- Tort selection: Limited tort is ~15% cheaper than full tort

- Coverage limits: Higher limits increase cost but offer better protection

Smart Tips to Lower Your Liability-Only Insurance Cost

Here’s how to reduce your premium:

- Opt for Limited Tort coverage

- Choose only the state minimums

- Maintain a clean driving record

- Improve your credit score

- Bundle policies (home + auto)

- Sign up for usage-based insurance

- Complete a defensive driving course

- Shop and compare quotes every 6-12 months

When Liability-Only Coverage May Not Be Enough

While liability-only is affordable, it may leave you financially exposed. Consider full coverage if:

- Your car is worth more than $4,000

- You have a loan or lease

- You drive frequently in urban areas

- You can’t afford to replace your vehicle out of pocket

In those cases, a full coverage policy including collision, comprehensive, and uninsured motorist coverage may be smarter.

Step-by-Step Guide to Securing Cheap Liability Only Coverage in Pennsylvania

- Assess your needs: Value of car, budget, driving habits

- Gather your info: Driver’s license, VIN, mileage, driving history

- Choose coverage: Minimum vs. higher limits

- Select tort option: Limited vs. full tort

- Compare quotes: Use comparison tools or call agents

- Ask for discounts: Student, senior, safe driver, multi-policy

- Review and purchase: Read the policy carefully before buying

FAQs About Liability Car Insurance in PA

A: It can reduce your premium by up to 15%, but it limits your right to sue for pain and suffering.

A: Yes. In Pennsylvania, insurers are allowed to use credit-based insurance scores.

A: Yes, as long as it meets PA’s minimum requirements.

A: Yes. Expect your rates to double or even triple.

A: Every 6-12 months or after a major life event (moving, new car, marriage).

The Final Word On Cheap Liability Car Insurance In PA

Securing cheap Liability-only auto insurance in Pennsylvania is possible if you have a clean driving record and shop around for the lowest rates. If you have an older car or limited driving needs, a liability policy from an affordable PA insurer like Westfield, Auto-Owners, or Travelers can save you hundreds annually. Teens and seniors should explore tailored options to cut costs as much as they can.

Always compare at least five quotes before buying a policy. Remember, your cheapest option is only a good deal if it provides the protection and service you need. Now that you know how to get cheap liability car insurance in PA, it’s time to compare quotes. Fill out a quick application online in about five minutes and compare up to 10 Pennsylvania rate quotes. Save more money today on quality Pennsylvania auto insurance.

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption