Cheap Car Insurance In NJ for Bad Drivers

Find cheap car insurance in New Jersey for bad drivers—even with DUIs, speeding tickets, or accidents.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

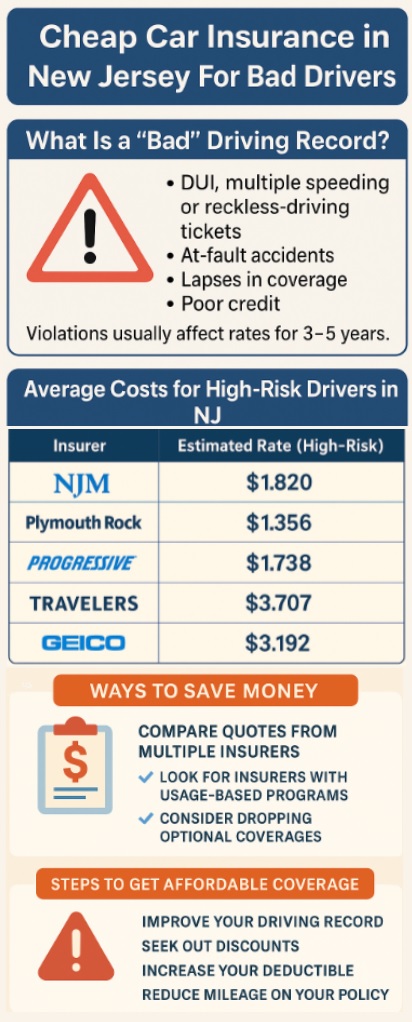

Even if your driving record is not perfect, you can still get cheap car insurance in New Jersey for bad drivers. New Jersey classifies drivers as high-risk if they have serious violations on their record. These may include a DUI, multiple speeding or reckless-driving tickets, at-fault accidents, lapses in coverage, or poor credit history. Notably, DUIs stay on record for up to 10 years, while typical violations can affect your auto insurance rates for 3 to 5 years.

Drivers with any of these infractions face significantly higher insurance costs, often double or triple compared to clean drivers. Nationwide, the average high-risk driver in NJ pays about $3,399 annually, but some insurers like NJM can cut that nearly in half, to around $1,820. That’s why understanding your current status and comparing quotes is crucial.

ARTICLE GUIDE

The 5 Best Insurers for High-Risk Drivers in New Jersey

Selecting the right insurer can save you thousands, even with a blemished record. Here are the top contenders:

NJM (New Jersey Manufacturers)

As the only NJ-based carrier specializing in local drivers, NJM consistently has the lowest premiums for high-risk individuals.

- Offers full coverage insurance starting around $1,820/year, compared to the statewide high-risk average of $3,399.

- DUI drivers pay approximately $1,732/year, significantly lower than most competitors.

- Earns top marks in customer satisfaction and has a strong dividend return record.

Plymouth Rock Assurance

This insurer stands out for its competitive pricing on both minimum and full coverage:

- Minimum coverage options start at $51/month ($612/year), and full coverage is available as low as $113/month ($1,356/year).

- Performs especially well for drivers with tickets and fewer violations.

GEICO

A favorite for both budget-conscious and higher-risk drivers:

- Liability-only coverage runs around $1,563/year clean, increasing modestly even after violations.

- Teen and senior drivers benefit from special rate plans.

Selective & Travelers

These insurers offer stability and moderate rate increases for tickets or minor violations:

- Selective shows no premium increase for a single speeding ticket.

- Travelers Insurance caps increases at about 24% after similar infractions.

Non-Standard and State Pool Options

For drivers standard insurers reject, options include:

- SafeAuto, The General, and other SR-22 carriers—readily issue policies but at a premium.

- NJ PAIP (assigned-risk pool) offers basic state-backed coverage with no credit checks, often as a last resort.

Handling Rate Increases After Violations

Each insurer calculates risk differently, so price changes after infractions vary widely:

| Violation | NJM | GEICO | Selective | Travelers | Plymouth Rock |

|---|---|---|---|---|---|

| Speeding Ticket | +14% | 0% | 0% | +24% | +17% |

| At-Fault Accident | +7% | — | +55% | +51% | +45% |

| DUI (Annual Cost) | ~$1,732 | ~$3,171 | — | — | ~$2,141 |

These comparisons show NJM consistently applies the smallest increases, while GEICO reliably maintains flat rates for minor infractions, then raises steeply for major violations.

Best Insurance Companies for Seniors with Bad Driving Records

Insuring older drivers often means balancing age-related discounts with perceived risk. Here’s how top insurers serve seniors in NJ:

- GEICO offers compelling rates:

- Liability: roughly $86/month clean, rising to ~$112/month with a ticket and $208/month with a DUI.

- Full coverage: about $188/month, competitive even after violations.

- Liability: roughly $86/month clean, rising to ~$112/month with a ticket and $208/month with a DUI.

- State Farm is strong for seniors with serious violations:

- DUI full coverage sits at around $166/month, more affordable than many other insurers.

- DUI full coverage sits at around $166/month, more affordable than many other insurers.

- Nationwide and Travelers offer substantial discounts for mature drivers completing AARP- or AAA-endorsed safe-driving courses.

- Bundle auto and home insurance for lower rates.

- Enroll in mature-driver courses—up to a 22% annual discount is common.

Best Insurance for Teens with Bad Records

Teen drivers are already costly to insure; adding infractions worsens the premium burden. Here’s what parents and teens need to know:

- GEICO leads on value:

- Liability-only at $953/year, even after accidents.

- Full coverage starts at around $2,474/year.

- After a minor accident, liability rates increase to just $1,085/year, still the best available.

- Liability-only at $953/year, even after accidents.

- NJM trails but is the next best option:

- Liability for teens averages $2,446/year, with full coverage reaching $4,096/year when accident-free.

- Liability for teens averages $2,446/year, with full coverage reaching $4,096/year when accident-free.

- Add teens to a parent’s GEICO policy to save compared to standalone plans.

- Encourage good grades and disciplined driving habits as some insurers offer student discounts.

Practical Strategies for Lowering High-Risk Insurance Costs

Even with a bad record, you can substantially lower your car insurance bill in NJ through smart choices:

- Regularly compare quotes – every 6–12 months.

- Raise deductibles to $1,000 to slash premiums by 10–20%.

- Take defensive driving courses, especially for mature drivers.

- Build credit – even modest credit boosts can translate into significant savings.

- Bundle policies to apply home and auto discounts.

- Use usage-based programs (like GEICO Drive Safe & Save) or pay-per-mile options if you drive infrequently.

- Maximize claim-free bonuses, such as NJM’s dividend program.

These strategies compound to offer real, measurable savings—often in the hundreds annually.

Should You Choose a Standard Insurer, Non-Standard Carrier, or State Pool?

- Standard carriers like NJM, GEICO, Travelers, and Plymouth Rock are your best bet for affordability and quality service.

- Non-standard insurers, while more accessible, typically charge higher premiums and offer limited perks.

- NJ PAIP should be your fallback, state-backed coverage for those denied by private insurers.

The Final Word On Cheap Car Insurance In New Jersey For Bad Drivers

- NJM is the top choice for high-risk drivers overall in New Jersey.

- Plymouth Rock provides outstanding value among minimum and full coverage plans.

- GEICO is ideal for teens and seniors, even with bad records.

- Selective and Travelers offer steady, moderate pricing adjustments.

- Non-standard carriers and the NJ PAIP exist as safety nets but at premium prices.

With focused research on the best and cheapest auto insurance in NJ, you can get good coverage without overpaying. By targeting the right insurers and leveraging smart cost-saving strategies, you can get cheap car insurance in New Jersey even if you’re a bad driver.

Now that you know how to get cheaper auto insurance in New Jersey, whether you’re a safe driver or have multiple violations, it’s time to save money. Compare up to 10 quotes in about five minutes and save hundreds with direct rates.

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption