How Much is Car Insurance for 18 Year Old Drivers

The cost of car insurance for 18-year-olds is high. This article provide tips for obtaining the cheapest car insurance for 18 year old

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

Car insurance for 18-year-old drivers can be expensive, with rates typically higher than those for drivers in other age groups. This is largely because 18-year-olds are considered high-risk drivers by insurance companies, given their lack of experience behind the wheel. However, with some effort and research, 18-year-olds can find affordable car insurance options that meet their needs. In this article, we’ll explore the factors that impact car insurance rates for 18-year-old drivers, provide tips for finding the best insurance coverage at the lowest cost, and highlight some of the cheapest car insurance companies for 18-year-olds.

ARTICLE GUIDE

What is the Average Cost of Car Insurance for an 18-Year-Old Driver?

The cost of car insurance for 18-year-old drivers can be quite high. According to our research, the average cost of car insurance for an 18-year-old driver is $266 per month for the minimum required coverage. This amount is significantly higher than the national average for drivers of all ages, which is $194 per month.

If an 18-year-old driver opts for full-coverage car insurance instead of just the minimum required coverage, the average cost increases to $543 per month. It’s worth noting that the cost of car insurance can vary depending on factors such as the driver’s location, driving record, gender, and the type of car being insured.

What is the Cost of Adding an 18-Year-Old to a Car Insurance Policy?

On average, it costs $2,250 per year to add an 18-year-old driver to a parent’s car insurance policy. While this may seem expensive, it is often much cheaper than if the 18-year-old and their parent were to purchase separate car insurance policies. Research has found that when an 18-year-old and their 50-year-old parent purchase separate auto insurance policies, they pay a total of $6,277 per year on average. However, when the same 18-year-old and 50-year-old parents purchase a car insurance policy that covers both of them, they pay an average of $3,577 per year. This is a savings of $2,700 per year. Therefore, if an 18-year-old has a parent who can add them to their auto insurance policy, it is often the easiest and most cost-effective way to obtain coverage.

Is there a Decrease in Car Insurance Rates at 18 Years Old?

Car insurance rates typically do not go down at age 18, as young drivers are considered high-risk by insurance companies due to their lack of driving experience. However, if you have been driving for a couple of years and have a clean driving record, your rates may start to decrease slightly.

Most drivers see a more noticeable drop in their car insurance rates at age 20 and an even bigger drop at age 25. This is because as you gain more experience and demonstrate responsible driving behavior, you become less of a risk to insurance companies. However, it’s important to keep in mind that many factors can affect car insurance rates, so individual results may vary.

Does Gender Affect Auto Insurance Rates for 18-Year-Olds?

Yes, gender can affect auto insurance rates for 18-year-olds.

Young male drivers typically pay more for car insurance than young female drivers. This is because, statistically, male drivers are more likely to engage in risky driving behaviors and get into accidents compared to female drivers, which can result in higher insurance rates for males.

As a result, an 18-year-old male driver can expect to pay more than the average cost of $266 per month for minimum required coverage, while an 18-year-old female driver may pay less than that amount. However, this gap is narrowing as more states in the United States are adopting gender-neutral insurance laws.

Young drivers need to shop around and compare auto insurance rates for 18-year-olds from different providers to find the best coverage and price for their individual needs. By doing so, they can ensure they have the necessary protection while on the road without breaking the bank.

Which Car Insurance Companies Offer the Lowest Rates for 18-Year-Old Drivers?

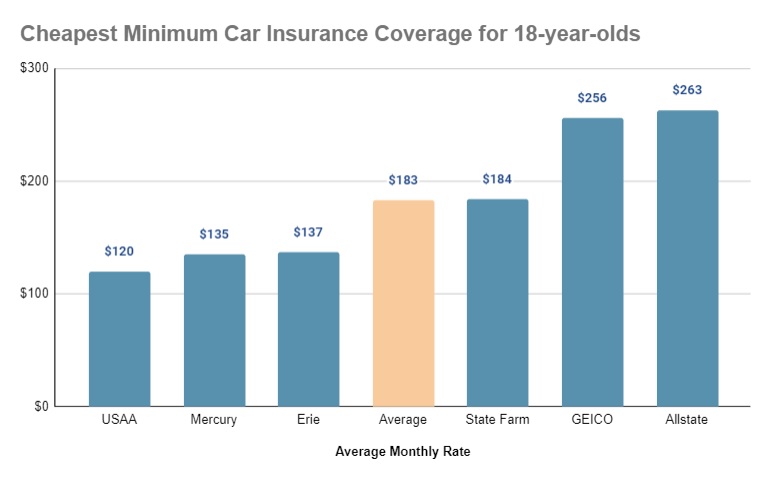

Several insurance companies offer affordable rates for 18-year-old drivers. State Farm is often known as the company that offers the cheapest car insurance for 18 year old drivers, with an average rate of $184 per month. Mercury and Erie are also popular options, with average monthly rates of $135 and $137, respectively, for minimum-coverage car insurance in the states they serve. USAA is a good choice for 18-year-olds who are military members or closely related to one, offering minimum-coverage car insurance for $120 per month on average. GEICO and Allstate also offer relatively cheap insurance for 18 year olds, with average monthly rates of $256 and $263, respectively, for minimum-coverage car insurance. For full-coverage policies, Farm Bureau and Erie are often the cheapest options, with average monthly rates of $156 and $267, respectively.

What are the Most Affordable Full-Coverage Insurance Rates for 18-Year-Old Drivers?

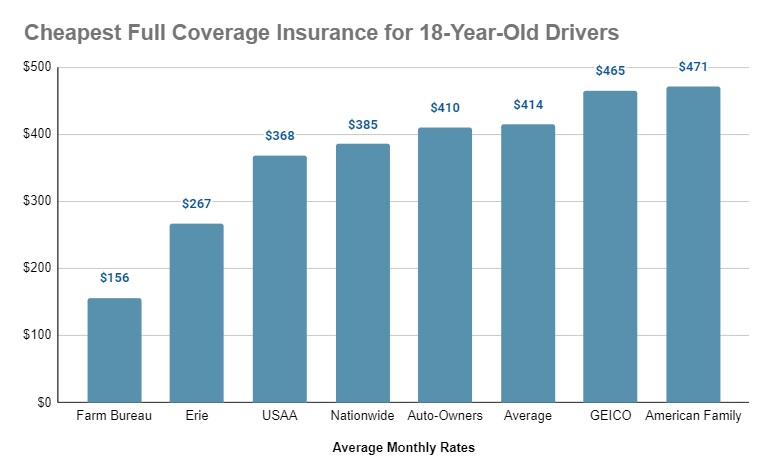

According to research, Farm Bureau and Erie are among the cheapest car insurance companies for 18-year-old drivers who want to purchase a full-coverage policy. Farm Bureau offers an average rate of $156 per month, while Erie’s average monthly rate is $267. However, rates can vary based on factors such as location, driving history, and the type of vehicle being insured. 18-year-old drivers need to shop around and compare quotes from multiple insurance companies to find the best and most affordable coverage options. Below, you can check some of the rates offered by the main companies:

Best Auto Insurance Discounts for 18-Year-Olds

As an 18-year-old driver, auto insurance rates can be expensive due to a lack of driving experience and higher risk factors associated with younger drivers. However, there are several auto insurance discounts that 18-year-olds can take advantage of to lower their insurance costs. Here are some of the best auto insurance discounts for 18-year-olds:

- Good Student Discount: Many insurance companies offer a discount for young drivers who maintain good grades in school. To qualify for this discount, you must typically have a B average or higher. This discount can range from 10% to 25% off your premium.

- Defensive Driving Discount: Completing a defensive driving course can also help you qualify for an auto insurance discount. This type, of course, teaches you how to drive defensively and safely and can help you become a more responsible driver. Some insurance companies offer discounts of up to 10% for completing a defensive driving course.

- Safe Driving Discount: Maintaining a clean driving record is one of the best ways to qualify for a lower auto insurance premium. Avoiding accidents, traffic violations, and other infractions that can raise your premium is crucial in obtaining this discount.

- Multi-Car Discount: If your family has multiple cars insured under the same policy, you may qualify for a multi-car discount. This discount can help lower the overall cost of insurance for all drivers on the policy, including you as an 18-year-old driver.

- Pay-As-You-Go Discount: Some insurance companies offer usage-based insurance policies where the premium is based on the number of miles driven. This can be a great option for young drivers who don’t drive as often, as it can result in lower insurance premiums.

It’s important to shop around and compare policies from different providers to find the best discounts and overall coverage for your needs. Remember, the key to getting the best auto insurance rate as an 18-year-old is to prove to the insurance company that you are a responsible driver.

Getting Cheap Car Insurance for an 18-Year-Old

Although car insurance can be expensive for 18-year-olds, there are several things you can do to lower your rates and save money on coverage. Here are some tips for getting cheap car insurance for 18-year-old drivers:

- Drive an older or cheaper vehicle: Older cars or cars with lower values are typically less expensive to insure.

- Get minimum coverage car insurance: If you have an older vehicle, you may only need to purchase minimum-coverage car insurance, which is less expensive than full-coverage insurance.

- Stay on your parents’ car insurance policy: If your parents have a car insurance policy, you may be able to stay on it and pay a lower rate than you would pay for your own policy.

- Shop around and compare quotes: It’s important to shop around and compare direct quotes from several insurance companies to find the best rates.

- Look for discounts: Many insurance companies offer discounts that can help lower your rates. For example, you may be eligible for a good student discount if you maintain a certain GPA or a defensive driving discount if you complete an accredited defensive driving course.

Conclusion

In conclusion, car insurance for an 18 year old might be quite expensive due to various factors such as inexperience, high-risk behavior, and the type of car they drive. However, there are several ways to lower the cost of car insurance, such as maintaining a clean driving record, choosing a safe and reliable car, and taking advantage of discounts. It’s important for these young drivers to understand the importance of car insurance and to take the necessary steps to ensure they are adequately covered while on the road. By doing so, they can protect themselves and others and enjoy the freedom and independence that comes with driving.

By understanding the types of coverage available, the factors that affect insurance rates, ways to lower insurance costs, and tips for finding the best car insurance policy, 18-year-olds can make informed decisions and ensure they have the coverage they need at a price they can afford.

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption