Buy Now Pay Later Car Insurance Plans

Buy Now Pay Later Car Insurance policy is the best way to save money. Get the Lowest Rates Now!

FREE Auto Insurance Comparison

Compare Quotes and Save!

Secured with SHA-256 Encryption

- You can buy now pay later car insurance, which will get you legally insured without making a significant down payment.

- If you have a short-term cash flow problem, this car insurance agreement is favorable.

- You can pay your policy partially or totally any time you want.

- It may seem that you have a month of entirely free coverage, but you will have to pay the full cost of the policy.

- It happens that these insurance policies without a down payment are generally much more expensive than conventional ones.

- Applying for this plan does not necessarily mean it will be granted.

- Some insurance companies will allow you to make your monthly payments online through credit or debit cards.

Not everyone can pay their insurance premium at once to cover their vehicle. This is because they don’t have enough money to do it this way. Does it sound like your current situation? Well, know that there are always options to choose from. Fortunately, you can buy now pay later car insurance, which will get you legally insured without making a significant down payment.

But do not worry; if you want to get auto insurance with zero down payment, you can do it. If you are in a short-term cash flow problem, this car insurance deal is favorable. You must use your car anyway, for example, if you need to look for a new job. Now your search is over. We can help you get car insurance now pay later.You may not feel very confident due to your bad experience with insurance companies that have usually made you pay a lot of money down.

To compare about 10 quotes quickly, enter your zip code in our quotes form and click “Get Quote”.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

ARTICLE GUIDE

What’s Buy Now Pay Later Car Insurance?

Buy now pay later car insurance is a modern financial arrangement that allows policyholders to secure their auto insurance coverage immediately but defer the premium payment to a later date. This payment option offers individuals the flexibility to spread out the cost of their insurance over a period, typically in installments, instead of paying the entire premium upfront. It can be particularly helpful for those facing budget constraints or prefer to manage their expenses more evenly.

However, it’s important to note that while this approach can provide short-term relief, policyholders should carefully consider the terms and conditions of such agreements, as they may entail interest charges or additional fees. It’s essential to weigh the benefits of immediate coverage against the long-term financial implications before opting for a buy now pay later car insurance plan.

Can I Really Buy Now Pay Later Car Insurance?

Many people feel overwhelmed, and have difficulty paying for their car insurance coverage with such high rates. Fortunately, you can buy now pay later car insurance. This way, you can legally drive on the road. All these offers can be useful for you. You will not have to worry in the short term because you insure the car now and pay for car insurance later.

For example, if your car insurance policy costs $1200 per year, which equals $100 per month, you can pay later and save $100 now. Then you will be well covered without paying anything for the first month and will drive legally on the road. Of course, you should qualify for this type of plan. In the next eleven months after the first month without paying anything, you will pay the full price of your policy: $1200.

Your policy can be paid partially or totally at any time you want. At first glance, it may seem that you have a month of entirely free coverage, but later, you will have to pay the full cost of the policy. Anyway, for those who cannot buy auto insurance with an initial deposit, buying car insurance now pay later is a wonderful option.

Applying for this plan does not necessarily mean it will be granted. It depends on many factors.

Enter your zip code, and you will be on your way to finding car insurance now pay later. You just have to provide basic information, and that’s it.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

When Buy Now Pay Later Car Insurance Is A Good Plan?

If you have changed jobs and still have almost a month left for your first paycheck, it would be advantageous to buy car insurance now pay later. Being a responsible driver, car insurance companies could offer you a free coverage plan for the first month and pay later. See below how this policy can also help you:

You emptied your accounts to buy a new car, the one you were looking forward to for so long. Getting auto insurance was not among your priorities; you just thought about your new vehicle. After many years of saving, almost nothing is left in the bank once you buy your desired car at the dealership. You can then apply for car insurance now pay later to go home, driving the vehicle of your dreams. It will be possible to save money on your auto insurance since you have one month of coverage without paying anything until the next month. In this scenario, this is a highly favorable deal.

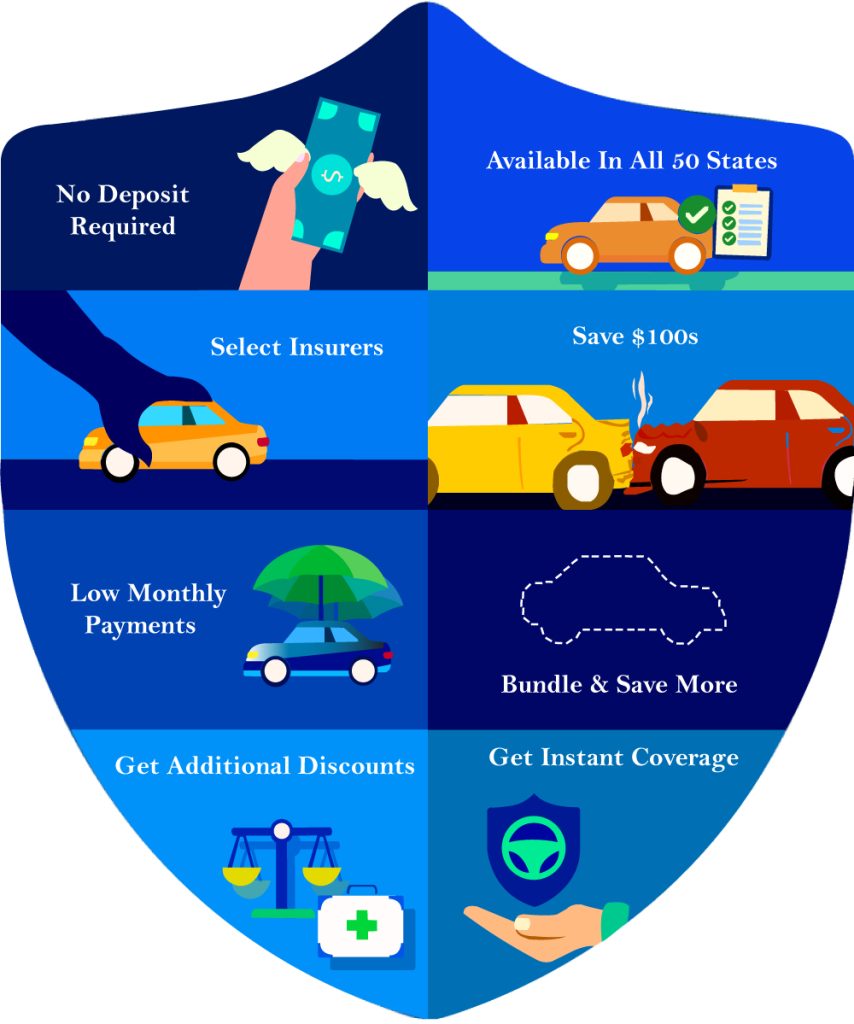

Advantages of Buy Now Pay Later Car Insurance

Saving money when acquiring car insurance is the main reason to get now pay later car insurance. If you cannot afford to make an initial deposit, then buy now pay later car insurance may be the best option.

Driving daily to work is the typical scenario of thousands of people in the United States who need coverage. The money you didn't pay the first month, you could use it for gasoline and other necessities.

This is why insurers offer these deals so that you can make small payments every month. For example, if your monthly premium is $100, not having to pay anything the first month, with only $100, you could pay the first two months of coverage. If your finances are in decline today, this plan could be very profitable for you.

Another additional convenience is that some insurance companies will allow you to make monthly payments online through credit or debit cards. Also, you could save a few hundred dollars by getting the available discounts.

Let the companies fight for you. Get a Quote!

Just enter your zip below

Cons of Buy Now Pay Later Car Insurance Plans

Before buying this type of plan, you must be sure that this is exactly what suits you. Why do we say this? The answer is quite simple.

For insurance companies, customers who do not make the down payment are sometimes riskier than those who do. This is because many people will buy a car insurance policy without an initial deposit and cancel it when the free term expires.

So, it happens that these insurance policies without down payment are generally much more expensive than conventional ones. For all those going through a complicated financial situation, this could make them feel even worse. In fact, this is almost the only drawback of acquiring this type of insurance policy.

For example, you bought a policy for $1500 a year and did not have to make a payment. In this situation, you didn’t spend any money initially, but the price was split in monthly installments of $125. However, with a down payment, your premium would have been $1300 yearly for the same coverage. Being able to save $200 a year is significant when the financial situation is not the best.

Should You Get Car Insurance Now Pay Later?

If you are in a bad financial situation, borrowing money from a family member or friend would be advisable to make the initial deposit. In the long run, you will save more money this way. If you pay your policy in full, including the down payment, you may also receive some benefits and discounts from your insurer. Only as a last resort, after having exhausted all the options, you should get insurance coverage without making a down payment.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

What States Allow you to Buy Now Pay Later Car Insurance?

It is wise to have auto insurance, which is mandatory in most of the 50 states of the United States. Your entire responsibility will always be to drive an insured vehicle, even if you have declared bankruptcy. The consequences of driving an uninsured vehicle can be severe for you. For example, your salary could be garnished to pay for damages you caused in an accident. If you are one of those people with low funds, the good news is that you can buy now pay later car insurance.

If you do some research, you will know that not all states offer these insurance plans. It is good that you know the states that allow it.

Compare now several quotes available in the market. Discover the agencies that offer the best deals in your state.

Insurers That Offer Buy Now Pay Later Car Insurance

Indeed, many insurers prefer clients that do not represent any risk to the company. Fortunately, several insurance companies offer affordable plans for clients who need car insurance now pay later.

Among the companies that sell buy now pay later car insurance policies are:

- Allstate

- Geico

- Esurance

- Farmers

- Progressive

- State Farm

- Nationwide

- Kemper

- Safe Auto Insurance

Let the companies fight for you. Get a Quote!

Just enter your zip below

Purchasing Cheap Car Insurance Plans

If you are looking for the cheapest car insurance that allows you to buy now and pay later, you may not know exactly where to search. You have probably seen several online or TV ads remarking on how to buy now pay later car insurance. When you see this kind of insurance, you might think it is not real. To buy now pay later car insurance, the first step in the process is to apply for it. If you have done some research, you have probably already found an insurance provider that offers this type of coverage.

Usually, your first monthly payment could be used as a deposit for your insurance policy. This could seem like you are getting car insurance now pay later, but you will be paying a deposit instead. It is only masked as a first-month installment.

This is the reason why you should always read in-depth your car insurance policy contract. Before buying your car insurance policy, you should read the agreement, especially the fine print. You should be up to date in case of any hidden payment because these charges could increase your policy’s price and make it more expensive.

Factors That Have An Impact On The Cost Of Your Premiums

Some insurance providers may offer better prices to certain types of drivers. There are many factors that insurers consider when calculating your premiums. This also happens when getting auto insurance now pay later plans. Here are some of these aspects:

- Driving record – Your driving record represents 30% to 35%.

- Policy Options – Your policy options equate to around 10%.

- Credit Rating – It equates to around 5%.

- Vehicle’s make and model – This equals about 15%.

- Your age, marital status, and gender – These factors account for about 25%

- Other factors, such as occupation and zip code – They are equivalent to approximately 10%.

Let the companies fight for you. Get a Quote!

Just enter your zip below

Tips for Getting Cheap Car Insurance

It is possible to save money when buying your car insurance policy. Here are some tips that could help you pay lower premiums:

- Choose well the vehicle you drive

- Increase the amount of your deductible

- Drop coverage you don’t need

- Bundle your auto and home insurance in one policy

- It would help if you got all the possible discounts

- Consider all aspects that affect the price of your premiums.

- Compare car insurance quotes before deciding on a policy.

You can get car insurance estimates in just minutes by visiting many relevant comparison websites. It will take only five minutes or less; you can compare up to 10 quotes. Read below to know more about this.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Take Advantage of Online Discounts and Save More

Try to get as many discounts as possible to save more on your car insurance. There are several types of discounts and benefits you may have never heard of, and they can provide significant savings. Some of these discounts are:

- Safe Driver: Having a clean driving record can save you hundreds of dollars without fines or accidents for a certain number of years.

- Accident-Free: It offers lower rates for customers not involved in accidents in a certain period.

- Good Student: A GPA of 3.0 or more in high school can save you up to 15%.

- Good Credit: A good credit history (over 700) will be considered reliable by insurance companies and will grant you certain benefits.

- Active Military or Veteran: Discounts of up to 5% or even more are available for all active or retired military.

- Teacher Discount: The simple fact of being a school teacher will make it possible to get discounts on your auto insurance.

- Senior Citizen: The elderly (60 years or older) have certain privileges with many car insurance companies.

- Low Mileage: Getting up to a 10% discount on your monthly premiums is possible if you do not drive more than 800 miles monthly.

- High Deductible: Drivers who drive safely can save hundreds of dollars on their car insurance if they select a deductible over $1000.

- Safety and Security Features: If your vehicle has all the necessary safety standards for you and your passengers’ protection, you will receive discounts between 3% and 5%.

- Garaged-Parked: The simple act of parking your car in a completely secure garage will give you a 2% discount.

- Bundling Home and Auto Insurance: Insuring your car and your home together in one policy will bring you great benefits using your company’s insurance package.

- Multi-Vehicle: You will get discounts if you include more than one vehicle in your policy. This way, you will pay much less than if you insure the vehicles with independent policies.

- Policy Payment in Full: Make a single payment of your insurance policy, and your company will consider it by offering a discount on your total amount.

Buy Now Pay Later Car Insurance Online

Finding the best auto insurance with the exact coverage you need has always been more challenging than today. Every day, more people not only compare affordable car insurance rates online but also buy their policies. Shopping online is a perfect way to start looking for your auto insurance. Not all insurance providers offer the same discounts and deals. Policy prices generally vary from one insurer to another. One of the most effective ways to save money on auto insurance is to compare rates online.

When you have a limited budget and then need car insurance now pay later, you should compare five quotes or more. To start comparing, enter your zip code and then answer some easy questions like:

- Home address

- The number of your driving license

- Social Security Card (not required by all insurance providers)

- Your car’s make and model

- Miles traveled monthly

- Your driving history (your traffic violations and accidents should be included)

After bringing this data together, you can apply for auto insurance quotes on different websites. This will only take 4 or 5 minutes. You should enter your zip code, and you will be able to compare ten quotes in only 5 minutes or less. Compare quotes now, and you will be able to save a lot of money on your car insurance coverage.

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption