What Is a Good Auto Insurance Policy?

We all hear a lot of advertisements and opinions on what is a good auto insurance policy. However, car coverage is very personal, and you have to consider many factors that relate to your unique needs.

FREE Auto Insurance Comparison

Secured with SHA-256 Encryption

- There are many factors you have to consider which relate to your unique insurance needs.

- Just complying with state vehicle insurance requirements is only a limited policy coverage level for liability in a car accident.

- Liability insurance only pays for damages to other people’s vehicles and injuries suffered by others. So you need also to consider comprehensive and collision coverage if you want your own damages covered.

- Your policy will only provide coverage for insured events up to your policy limits. If accident damages exceed this number, then the injured parties can sue you for the rest.

- While you can’t predict every scenario, it’s essential to avoid being under-insured from any foreseeable situation which may expose you to personal liability.

We all hear a lot of advertisements and opinions on what makes a good auto insurance policy. However, there are many factors you have to consider which relate to your unique needs vs. what an actor on TV says. Car coverage is very personal. Without the right type of coverage, you could be exposed to high financial risk in a car accident or end up throwing money away in premiums every month.

ARTICLE GUIDE

How Much Auto Insurance Policy Do You Need?

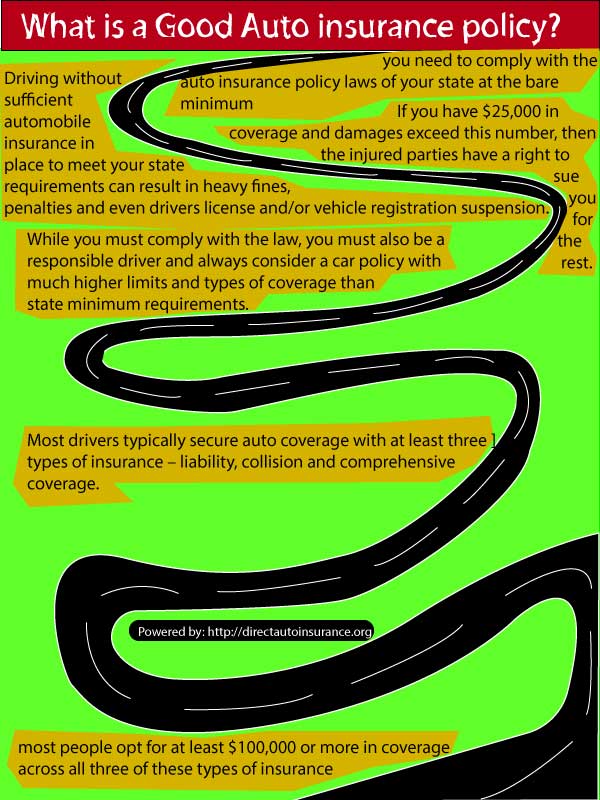

First of all, you need to comply with the auto insurance policy laws of your state at the bare minimum.

Driving without sufficient automobile insurance in place to meet your state requirements can result in hefty fines.

You could get penalties and even a driver’s license and vehicle registration suspension. In severe cases, you could also face jail time, especially in serious car accidents where injuries have occurred.

However, complying with state vehicle insurance requirements is just a limited level of policy coverage for liability in a car accident. Almost always does not protect you or your family in a car accident where you were at fault. Liability insurance only pays for damages to other people’s vehicles and injuries suffered by others. So you need also to consider comprehensive and collision coverage if you want your own damages covered.

Furthermore, the levels of coverage required by law are extremely insufficient that you may still be personally liable in a car accident. While you must comply with the law, you must also be a responsible driver.

You should always consider a car policy with much higher limits and types of coverage than state minimum requirements.

Let the companies fight for you. Get a Quote!

Just enter your zip below

What Is a Good Auto Insurance Policy?

Most drivers typically secure auto coverage with at least three types of insurance – liability, collision, and comprehensive coverage. Where you live, your financial situation, and how much your car is worth can all influence how much auto insurance policy you should buy. However, most people opt for at least $100,000 or more in coverage across all three of these types of insurance.

Can I Be Personally Liable In a Car Accident?

You can be personally liable for damages in a car accident from a number of ways. The most common reason is to be underinsured or uninsured simply, even with auto insurance. Your policy will only provide coverage for insured events up to your policy limits. If you have $25,000 in coverage and damages exceed this number, then the injured parties have a right to sue you for the rest.

A Lot of Different Costs

With the cost of medical care and vehicle repair costs rising every year, it’s important to secure coverage. Good coverage provides high enough limits to protect you in the event of an accident. While $100,000 in coverage may seem like a lot, it isn’t given the cost of surgery, follow up care, loss of wages, and other damages from an injured party can quickly exceed this. While you can’t predict every scenario, it’s essential to avoid being under-insured from any foreseeable situation which may expose you to personal liability.

FREE Auto Insurance Comparison

No matter how much car insurance you need, compare quotes direct from auto insurance providers nationwide

Secured with SHA-256 Encryption

Should I Buy Other Types of Auto Insurance Policy like Medical Payments Coverage?

There are many different types of car policy; however, liability, collision, and comprehensive are the most common. Drivers who have financed new vehicles should consider GAP insurance.

Consider the very affordable cost of other supplemental auto insurance policy options. The most affordable as medical payments coverage they can also be very worthwhile to have.

Many drivers opt to start a direct auto insurance comparison online; however, you need only to do this once you know what type of insurance you need. The attraction of finding cheap car insurance quotes online and the convenience of buying a policy in a few clicks can be very appealing. However, before doing anything, you need to speak with a licensed agent. Only a trusted professional can explain all your options. And relay an opinion on what type of policy would protect your unique needs. Once you have an expert opinion, however then its time to compare vehicle insurance quotes from multiple providers.

Let the companies fight for you. Get a Quote!

Compare Quotes From Top Rated Insurers. Good Drivers Can Get Good Discounts. See How Much You Can Save Now!

Secured with SHA-256 Encryption